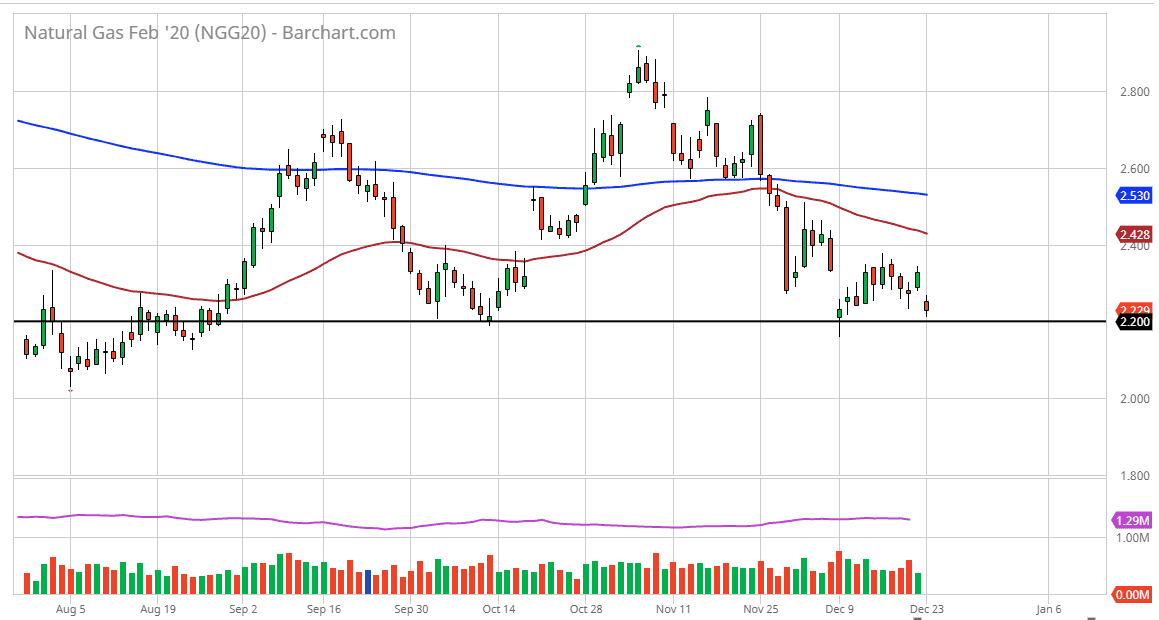

Natural Gas gapped lower to kick off the trading week on Monday, as we again have seen a lot of bearish pressure into this marketplace. While I still expect some type of spike higher during the winter, it is obvious that even with bullish storage numbers last week, natural gas simply cannot pick itself up at this point. In fact, I suspect that this is going to be a horrific 2020 for natural gas suppliers, as the drilling of natural gas in the United States had been 17% more than the previous year.

Having said that, we are sitting right on top of an area that has been very supportive more than once, in the form of the $2.20 level. I believe that this level will continue to offer support, but I think that eventually they may break through it. Even if the market doesn’t, I look now at a spike in price as a selling opportunity and will skip trying to catch that this winter. Most years, this ends up being one of the best trade to the year but it just hasn’t been there. Because of this, next year is going to be very difficult, as the market has not chewed through enough of the supply through the winter. That is a horrific signs I think it’s only a matter of time before we start shorting this market anytime it rallies. Even if we get the massive spike that is typical of the wintertime, I will probably sit on the sidelines and simply wait for an opportunity to short.

The real trade might be in shorting natural gas related companies in the stock markets, as they are going to get crushed because they cannot produce profits at these extraordinarily low levels. Ultimately, the natural gas sector is going to get throttled in general, and if we start to get an economic slowdown, once we get into the spring time it’s going to be even worse so at this point natural gas markets will probably continue to see very bearish action, and of course risk aversion when it comes to trying to pick up natural gas. We need to see the supply to through and a lot of drillers stop producing in order to go higher for any significant move. At this point, that does not look likely anytime soon.