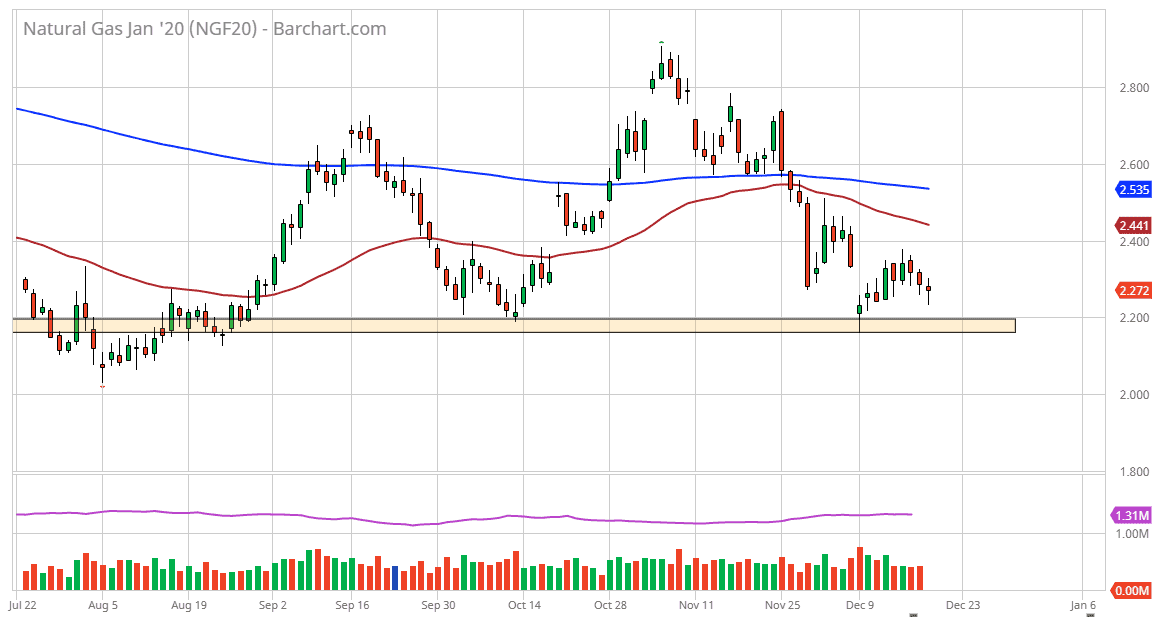

Natural gas markets initially fell during the trading session on Thursday, began a boost from a -110 million number instead of the anticipated -97. Because of this, it looks as if we are starting to see demand pick up for natural gas which makes sense considering the time of year. However, we have unfortunately seen 17% more drilling over the previous year, so it makes quite a bit of sense that we struggle overall.

The $2.20 level underneath is massive support and should continue to be of interest. That interest should translate into support as it has over the last couple of weeks. In fact, now that we have filled the gap to the upside it’s possible that if we make a fresh, new high it’s likely that we could go to the 50 day EMA followed by the 200 day EMA. Once we get above the $2.40 level, the market will move in $0.10 increments higher. However, if we were to break down below the $2.20 level it would be rather catastrophic for natural gas as he will have been a “wasted winter” for suppliers. This would be particularly unnerving for the industry considering that there is only another month or two of cold weather that will be traded in the futures market, the time is running out for that massive spike in order to claim profits.

That being said, it is more than likely going to be a scenario where we rally, but it’s only possible if we get a cold snap. We are starting to see colder temperatures in the United States, so here soon we should see a bit of a pop. I think at this point it might be difficult to break above the $3.00 level, which is a huge psychological barrier. If we do get above, there then the spike could really take off, but we have fallen the such extraordinarily low levels that it would take quite a bit to make that happen. Once we get into the spring contracts, it’s likely that we will see massive selling yet again. We get a short-term buying opportunity, and then we can start shorting again at higher levels and signs of exhaustion. In the short term though, I do prefer the rally, but I would be very cautious about position size or possibly use CFD markets in order to take advantage of what’s about to happen.