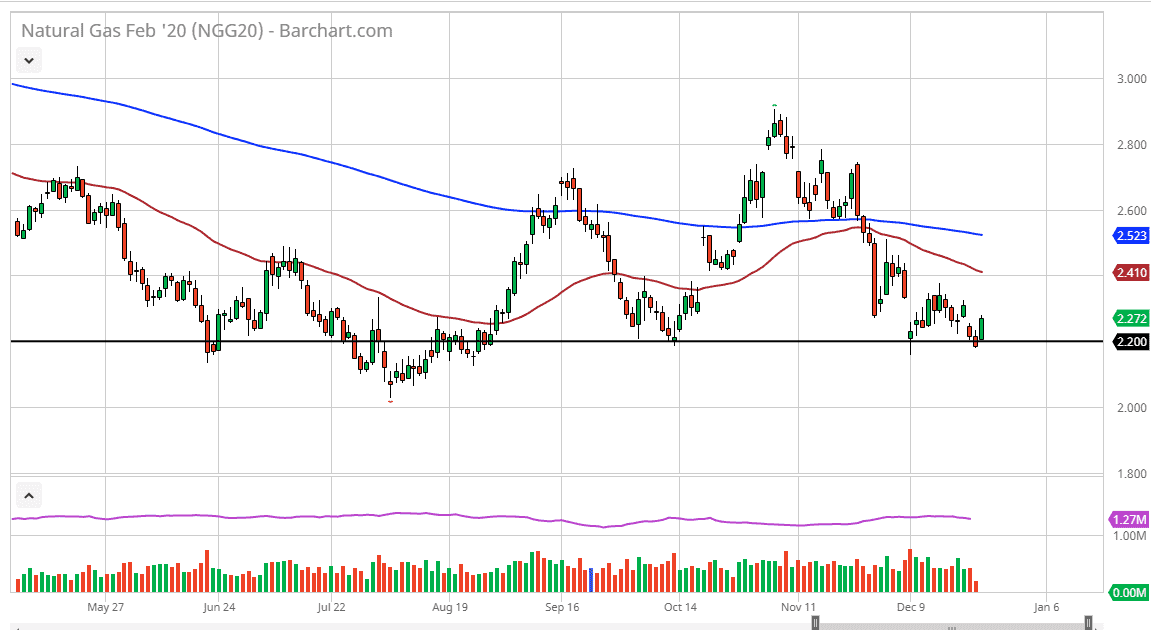

Natural gas markets rallied significantly during the trading session on Thursday, using the $2.20 level as a springboard. This is an area that has been supportive more than once, as denoted by the line on the chart. Ultimately though, I think that this is a short-term rally but I’m not afraid to take advantage of it based upon the size of the candlestick. We have filled the gap from a couple of days ago, and if we can break above the highs of the trading session on Thursday, that I would be looking for a move towards the $2.40 level will be targeted.

At this point, the $2.20 level should continue to attract a lot of buying pressure, and as a result I believe that the market will continue to bounce from here in the short term. Whether or not we can break above the 50 day EMA is a completely different question, but at this point if we were to break above there then you would have to deal with the 200 day EMA above. I think that it is only a matter of time before we would find sellers at that point. Ultimately, if we can get a move above there it could change a lot of things, but I think the “winter pop” that I expect every year will be a little muted at this point. The Americans have drilled another 17% as compared to the previous year as far as supply is concerned, so it is going to be difficult to break through all of that supply. I think at this point we will get the occasional short-term bounce but at the first signs of exhaustion on the daily chart, I’d be more than willing to start shorting again. This will be especially true as we are closer to springtime, as major shifts and whether will send this market right back down. Ultimately, I think that the marketplace will continue to favor the downside longer-term, but we may get the winter storm that sends this market higher in a short-term opportunity. The real trade is probably going to be crushing any signs of strength next year as natural gas suppliers are going to be absolutely decimated with these extraordinarily low prices. In fact, the real trade is probably shorting some of these companies in the stock markets, but natural gas is to be faded on rallies.