The United States as seen a couple of major snowstorms over the last couple of days, and at this point it looks very likely to have a major effect on the natural gas markets. After all, the northeastern part of the United States is heated mainly by natural gas, and it is one of the largest consumers of that commodity in the world. Beyond that, we had some technical situations come into play that affected the market as well.

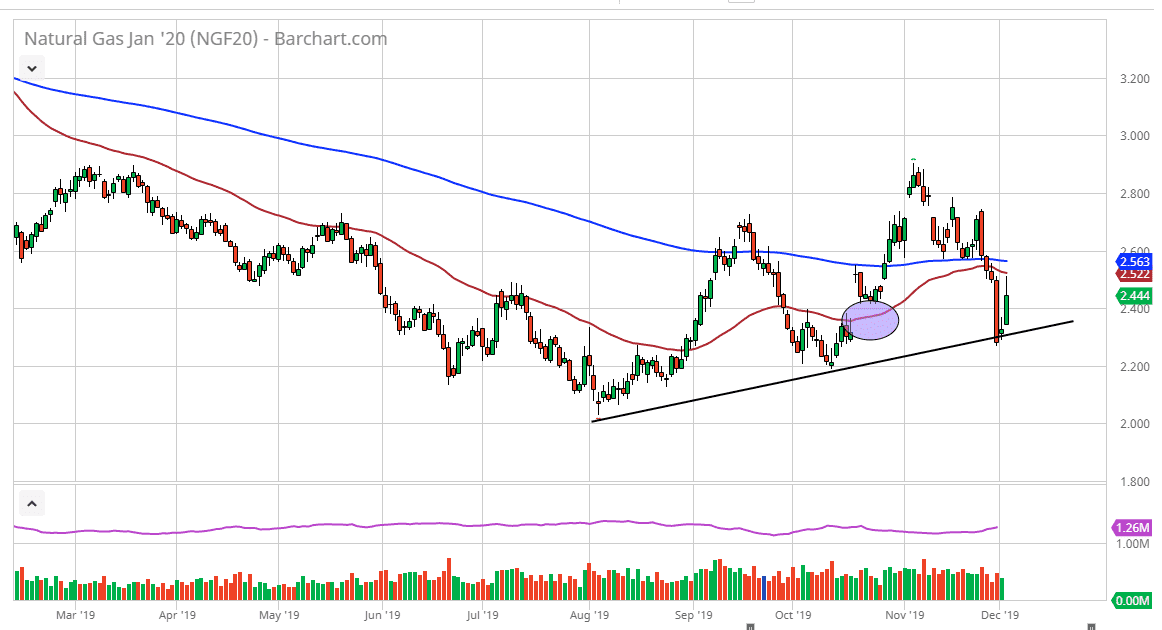

The market should continue to be technically driven as well, as we have just filled a gap on Friday, and now have bounce from there. By doing so, it looks very likely that we are going to continue to see buyers underneath and quite frankly this time a year is normally quite bullish. Overall, this is a market that should continue to find interest in the short term, as colder temperatures will undoubtedly drive up demand and decrease supply. That being said, we also have some resistive action just above at the moving averages, and we did in fact pull back from there. I do think that eventually we grind higher and short-term dips will offer buying opportunities after this action. This is a market move that should have been somewhat forecasted, but now if we can break above the moving averages just above, the 50 day and the 200 day EMA, then I think that we will go looking towards the $2.80 level and then eventually the $3.00 level.

That being said, we have a couple of weeks of very high bullish pressure from historical standpoint, so I anticipate buying for the next couple weeks before jumping in and selling natural gas sometime in the middle of January or so. With this, I am cautiously optimistic, but I would be willing to do more or less “smash and grab” type of trade where I’m in and out relatively quick to the upside. Given enough time, I do believe that we will break above the $3.00 level, and perhaps crying quite a bit higher. It’s only a matter of time before we get some type of massive temperature drop in the United States it drives up demand, as is the case most winters. Longer term though, I remain very skeptical on pricing when it comes natural gas, but this is the time a year where it gets a bit of a relief rally like clockwork.