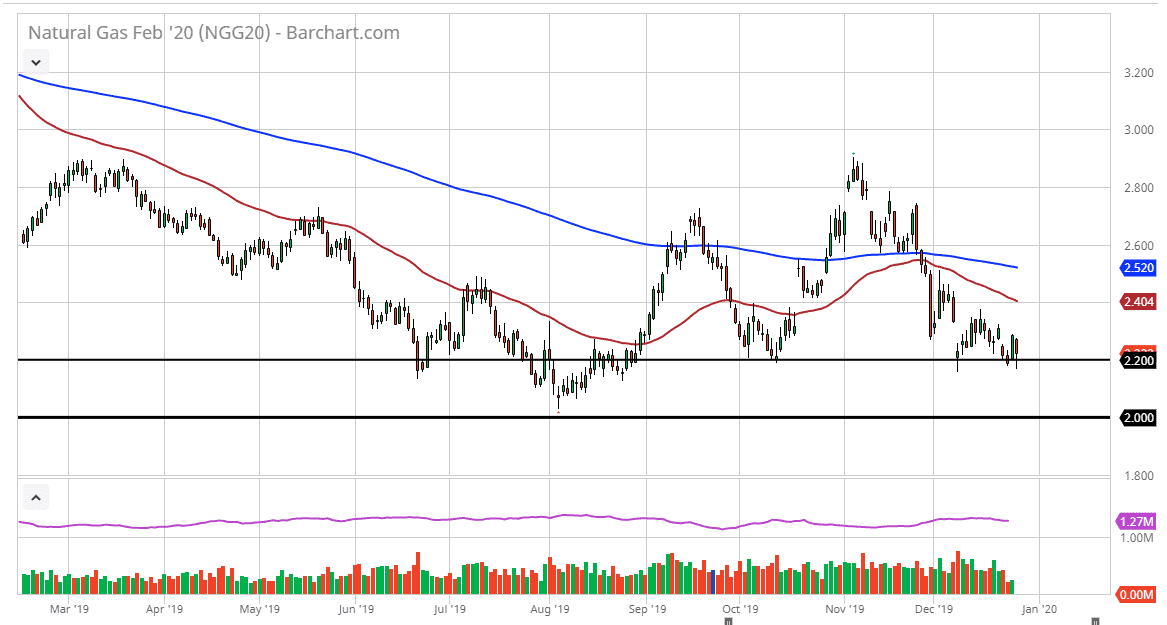

Natural gas markets initially fell during the trading session on Friday to pierce the $2.20 level. That of course is yet another bearish move, but we also have seen quite a few buyers down near that area as we got a stronger than anticipated Natural Gas Storage figure, coming in at -121 billion, as opposed to -116 billion. Ultimately, this is a market that is oversupplied though, so I think a short-term technical bounce is probably as good as it’s going to be.

Looking at this chart, the 50 day EMA is currently trading at the $2.40 level, and that would be about as far as I think this market can go in the short term. Overall, I think that the market participants will continue to fade rallies though but looking at this chart we have clearly failed to have a “high demand season” in comparison to previous winters in North America. Because of this, there are going to be a lot of questions to deal with next year, but in the short term I do think that we are a bit oversold. At this point, I think there is an opportunity to take short-term long positions, but I would be very leery about hanging onto any bullish moves. At this point I think that the $2.80 level is going to offer resistance and most certainly the $3.00 level will on any type of major spike higher.

To the downside, if we were to break down below the lows of not only Friday, but the gap lower from a couple of weeks go on that Monday candle, then we could go down to the $2.00 level given enough time. That is a large, round, psychologically significant and major support level, so therefore I don’t know that we break down below there and certainly if we did it would be a catastrophic turn of events for natural gas. I doubt that happens, because quite frankly at that point most companies will start to lose a lot of money that are involved. All things being equal, this is a market that is oversold but quite frankly the fact that the Americans have drilled 17% more this past year than the year before continues to cause quite a bit of problems and therefore it’s likely to fail every time it tries to rally anytime soon.