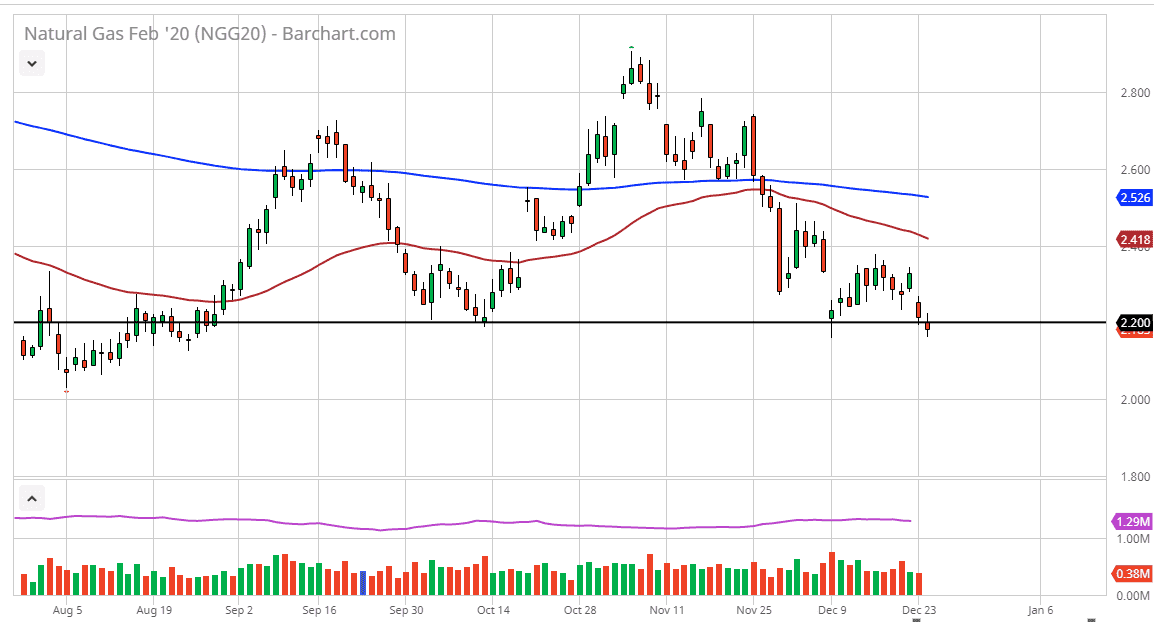

Natural gas markets initially tried to recover from the gap lower on Tuesday, and even broke above the top of the gap but fell apart and sliced through the $2.20 level. By doing so, the market has now broken below the $2.20 level, although not the most recent lows. At this point, it’s likely that the market will probably continue to go lower, perhaps reaching down to the $2.00 level. Ultimately, the market could reach towards the gap above, but I think at this point it’s likely that the gap being broken from a couple of candles ago should send this market looking towards the $2.40 level, and the 50 day EMA. There might be a short-term opportunity for buying natural gas but at this point the natural gas markets have been a complete disaster this winter.

Ultimately, what is the real concern of this market is that the market could not chew through the massive amount of oversupply that the Americans had put into the marketplace this year. The 17% gain of extraction from the previous year simply cannot be worked through quick enough. Currently, the market is very likely to continue to see a lot of selling pressures, especially after short-term rallies. Yes, I still believe that there is a significant spike just waiting to happen for the winter and due to a change in the weather, but I think that will be short-lived. While during past years I have taken advantage of this winter spike, this year has simply not been able to lift the market, and at this point in time the real trade is probably going to be based around shorting natural gas suppliers and drillers next year as the prophet has been sucked right out of this market.

Conversely, which going to be interesting is that the market will probably spike much higher given enough time, but that will only be after drillers finally stop producing natural gas because it just doesn’t pay enough. If that’s going to be the case, we will eventually have a tradable market but right now it’s simply a matter of fading rallies as they occur. If we break down below the lows of the session that formed the hammer from two weeks ago, then we could probably go down to the $2.00 level. I would have to believe that there is a lot of support at that large, round, psychologically significant figure though.