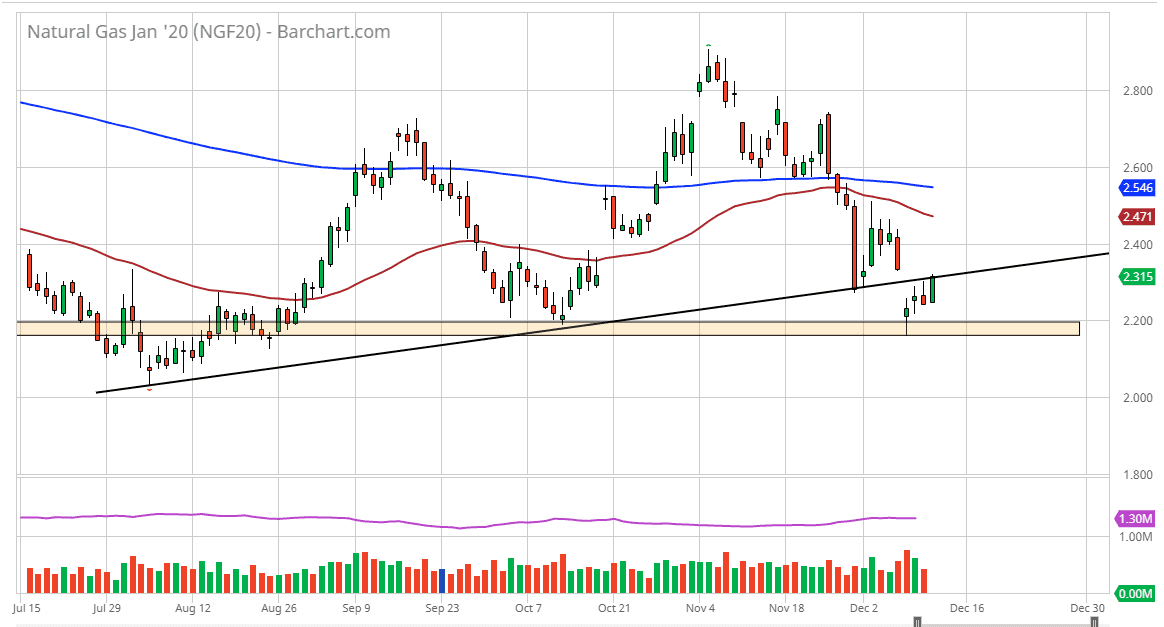

Natural gas markets rally during the trading session on Thursday, filling the gap from the beginning of the week. It is at this point that the real work begins for those trying to push natural gas higher. Keep in mind that this is an extraordinarily sensitive market when it comes to whether reports, and we had recently received word that temperatures are expected to be warmer and December, and that of course works against the value of natural gas as it suggests that demand is going to fall. However, temperatures have been exactly warmed up and unless something changes drastically it’s very likely that demand will start to pick up again rather soon.

The inventory number came out during the trading session on Thursday, at -71 instead of -73 billion, but at this point the slight miss to the downside doesn’t necessarily suggest that things are going to fall apart, just that they are as expected. That being said, breaking above the top of the gap in clearing the $2.40 level would be a very bullish sign. At that point I would anticipate that the market could continue to go much higher, perhaps reaching towards the $2.60 level. While I know that the trading of natural gas has been miserable for this winter, the reality is that it’s almost impossible to short the market this time of year. Quite frankly, all it’s going to take is some type of cold weather report to send this market right back up into the air.

The hammer from the Monday session that sits at the $2.20 should be considered a significant candlestick, and therefore if we were to break down below it it’s likely that we could fall apart from there. That being said, the candlestick during the trading session on Thursday was very strong, and it looks likely that we could get a little bit of follow-through. Having said that, the $2.40 level would need to be cleared in order to gain a little bit of confidence. If we did break down below the candlestick from the Monday session, then it opens up the door down to the $2.00 level which of course will attract a lot of attention not only because it is such an extreme low, but it is a large, Round, psychologically important figure. With that in mind, we have a couple of levels worth paying attention to now.