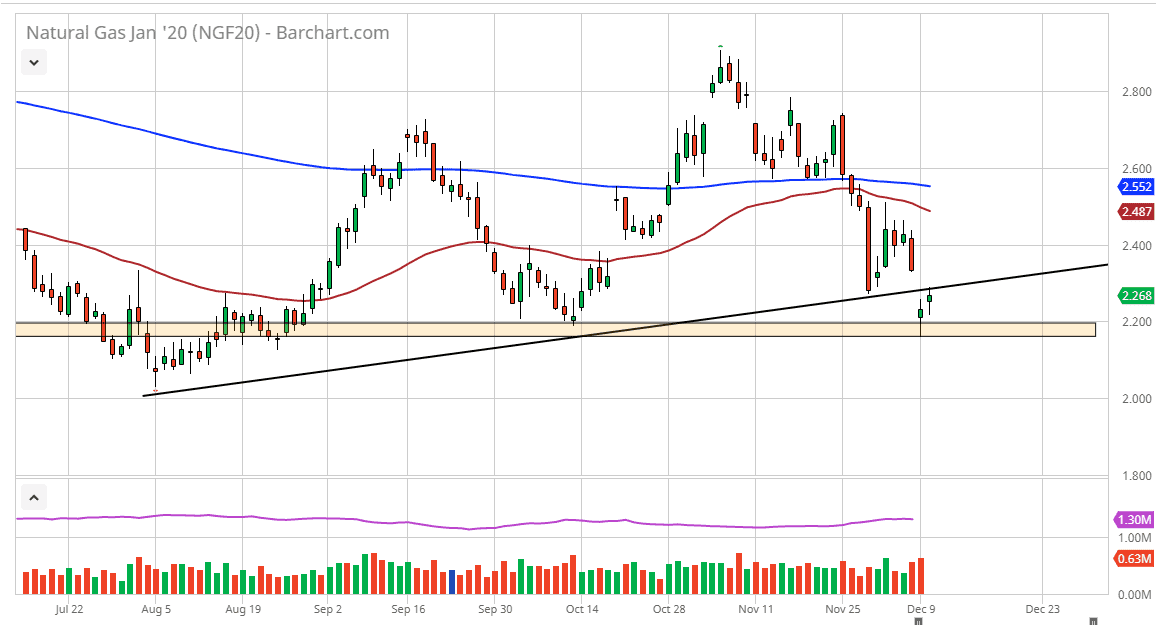

Natural gas markets have gapped higher to kick off the trading session on Tuesday as the selloff on Monday was a bit overdone. At this point, market participants then sold to fill that gap, and then turned around to form a bit of a hammer. However, there is a bigger gap from the Monday session that has yet to be filled, and that is more than likely going to be the next target. All things being equal, the $2.20 level underneath should offer plenty of support, as it is a large, round, psychologically significant figure in of course an area where we have seen support at previously.

Looking at this chart, if we can break above the $2.40 level it makes quite a bit of sense that we go higher from there. This is action that has been a bit negative due to the fact that the weather report suggests that the temperatures in December will be warmer than usual. If that’s going to be the case, then it’s likely that the natural gas markets will continue to face a bit of bearish pressure, but ultimately it’s only a matter of time before we see some type of cold weather in the forecast that will send this market higher. We are at extreme lows, and it’s likely that we will bounce given enough time.

Having said that, if we break down below the bottom of the candlestick from the Monday session, then it’s likely that we continue to go down to the $2.00 level, which of course is a large, round, psychologically significant figure. That level should offer a significant amount of support as well, so if we were to break down below there it would be catastrophic. All things being equal, I suspect it’s only a matter of time before the buyers return but having said that US natural gas drillers have increase production by 17% this year, and that of course has caused a bit of a supply glut. Ultimately, this is a market that should continue to be very rocky, but at the end of the day this is a market that is oversold, so it’s more than likely only a matter of time before we get that significant bounce. Small position sizing is the key here, because quite frankly it seems like the matter what happens, there’s always some type of headwind in this commodity.