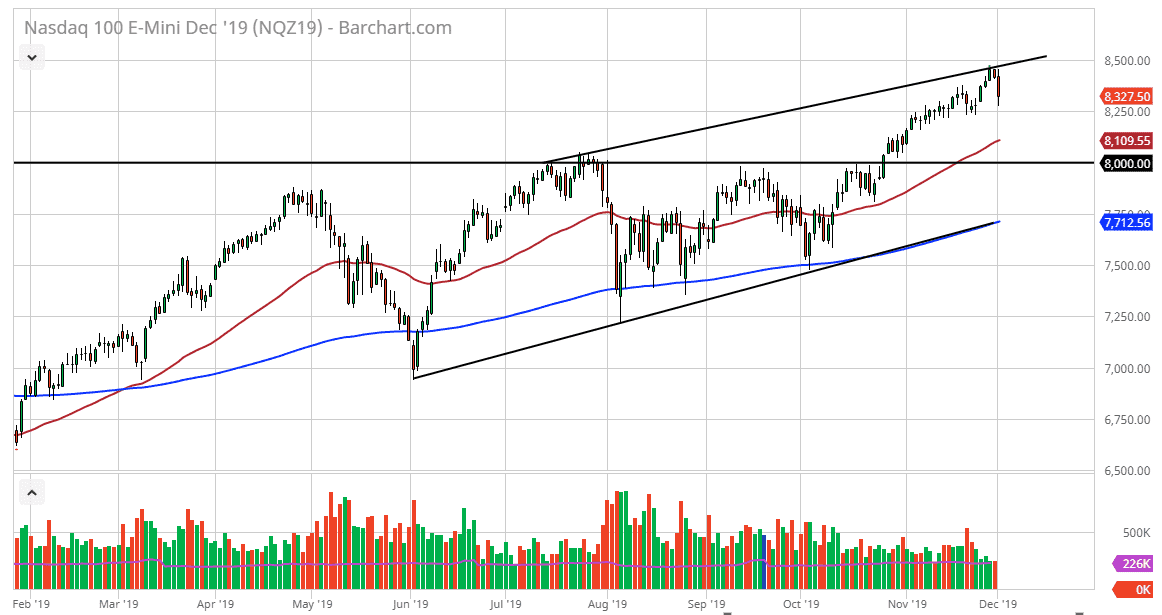

The NASDAQ 100 has initially tried to rally during the trading session on Monday, but fell as it reached the recent highs, and of course the top of the overall uptrend and channel. At this point, the market fell rather significantly during the trading session, as the ISM Manufacturing PMI numbers came out lower than anticipated. This was probably the excuse that was needed, as the market had gotten a bit overextended. That being said, the market also has seen a lot of support come into play just above the 8250 handle.

Looking at this chart, it’s obvious that we are in an uptrend, so at this point I think it makes a lot of sense that short-term pullback should be buying opportunities as the market has been in such a strong uptrend over the last several months. Even if we were to break down from here, it’s very likely that a market below the 8200 level probably brings in the 50 day EMA which is closer to the 8100 level, and then of course the structurally important 8000 level as it is a large, round, psychologically significant figure and of course the top of the previous ascending triangle. I certainly think that there would be plenty of buyers in that area.

Don’t forget that the so-called “Santa Claus rally” happens this time of year, as the markets continue to see traders come in and try to make up any shortfalls for the performance that they have brought forth through their clients over the year. At this point, the market is likely to see a lot of buyers coming back into the markets I don’t have any interest in shorting the NASDAQ 100, regardless of what’s going on. I recognize that the US/China trade situation continues to cause issues, but I think it’s only a matter of time before traders will beyond that as well. If we can get some type of “phase 1 deal” signed, that would be more than enough of a reason for the market to rally, and perhaps go well above the 8500 level. That being said, expect a lot of volatility but I do think that there will be plenty of buyers every time this market dips, just as we have seen for the last several months. Until something changes, you have to assume that it continues going on the same way.