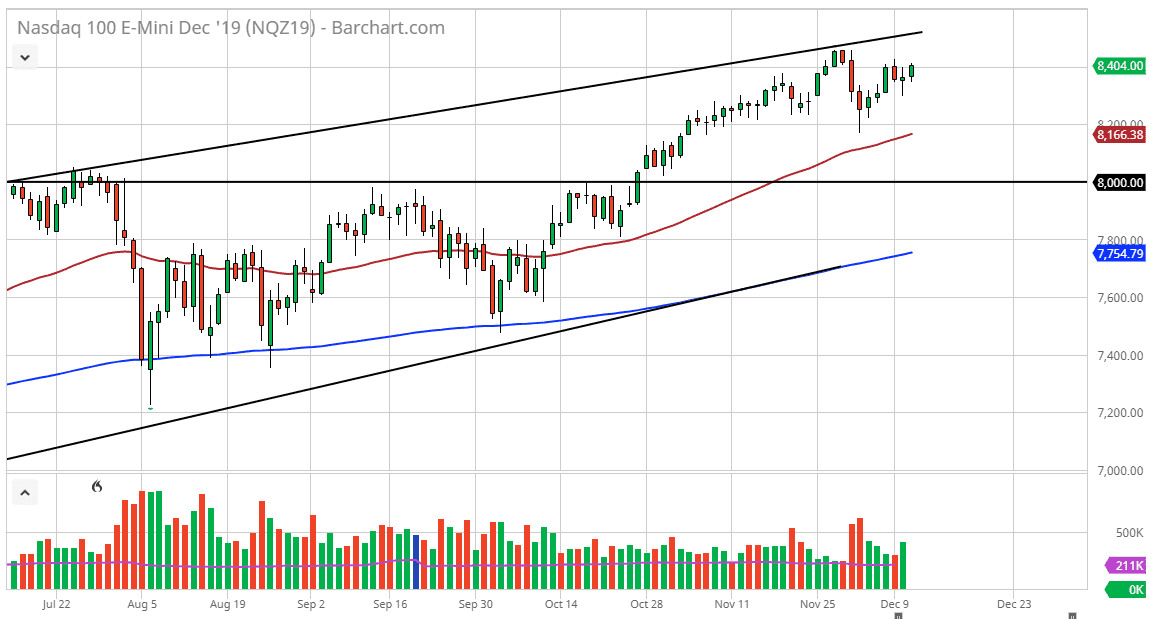

The NASDAQ 100 initially pulled back a bit during the trading session on Wednesday but found enough buyers to turn things around and go reaching towards the 8400 level. This is a contract that has seen a lot of bullish pressure as of late, and after pulling back the way it has it looks as if we are ready to retake the highs again. This will be especially true if the US and China can come together in some type of an agreement or at the very least the US decides to delay tariffs against the Chinese.

We could get a bit of skittering between now and then, as the deadline is December 15 but ultimately this is a market that will continue to see a lot of back and forth. It is in an uptrend though and that can’t be ignored. Because of this, the market is very likely to continue to offer value every time it drops, and the 50 day EMA is the major short-term support level here, followed by the 8000 level.

Remember, the 8000 level being broken was the top of an ascending triangle that measures for a move to the 8800 level. With this, I like the idea of buying dips, and I do believe that we go another 400 points to the upside. I like the idea of adding slowly, and then building upon it. Overall, the market is probably and somewhat of a “holding pattern”, and that should offer an opportunity to build up a position but if we do take off to the upside, perhaps on an announcement of the tariffs being delayed it into the weekend, then the market is going to shoot straight up in the air. It will be interesting to see how this plays out but right now it certainly looks as if we are trying to do just that. Do not look at pullbacks as selling opportunities because you could have a “rip your face off rally” at any moment. We have seen this look before, and it seems to always be followed by the next leg higher. 8800 is my target, and I think at this point we may very well get there between now and the end of the year, especially if things improve between the Americans and the Chinese. Corporate earnings are still good, and that continues to be a driver as well.