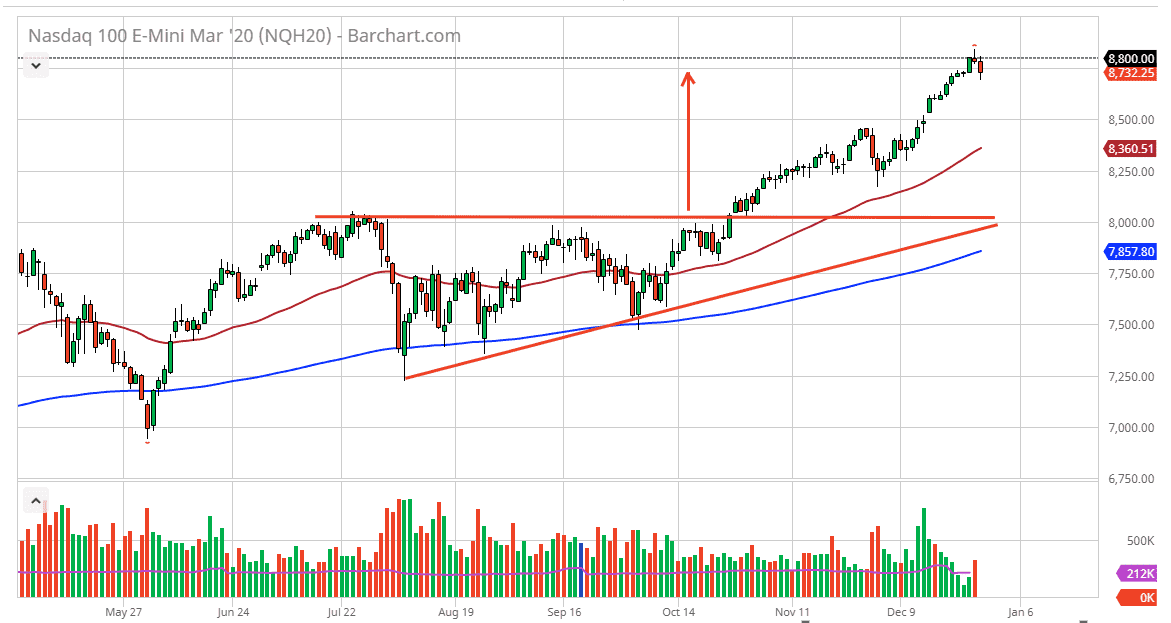

The NASDAQ 100 has broken down a bit during the trading session on Monday as traders have fulfilled the target based upon the ascending triangle underneath. We had broken above that ascending triangle, and the measured triangle should send the market towards the 8800 level, which of course we have. At this point, now that we have fulfilled that level, the market has decided to take profit as we are at the very end of the year. This makes quite a bit of sense, as the profit-taking will be heavily influenced by the end of the year. Remember, money managers will need to perform for their clients, and therefore booking profits at this late date maximizes the return that investor see.

Beyond that, volume is a little bit then and therefore it makes sense that the market would struggle to go higher at this point, and currently I believe that most people are focused more on New Year’s Day than any type of major trade. That being said, the market should offer plenty of opportunities and I think somewhere near the 8500 level we should see a lot of support. Beyond that, I believe that the 50 day EMA comes in as support, and we should continue to go higher. I like buying value, because quite frankly this is a market that has been in an extended uptrend, but we may have gotten a little bit ahead of ourselves in the last couple of weeks.

The 50 day EMA should offer plenty of support, and at this point it is starting to reach towards that previously mentioned 8500 level. Underneath there, the 8250 level underneath is support as well. At this point, the 200 day EMA would dictate the longer-term trend and we are quite far above there. I think that pullbacks are necessary in order to find value and I do think that a lot of traders will see plenty of value based upon a pullback as it will become “cheap.” Ultimately, if we break above the top of the shooting star from the Thursday session, then the market is likely to enter a bit of an impulsive stage, and obviously very bullish. Unlikely to happen, it is something that I need to pay attention to them, because obviously the market would be entering something impulsive and strong. All things been equal though, a pullback makes the most sense at something that I will be looking for.