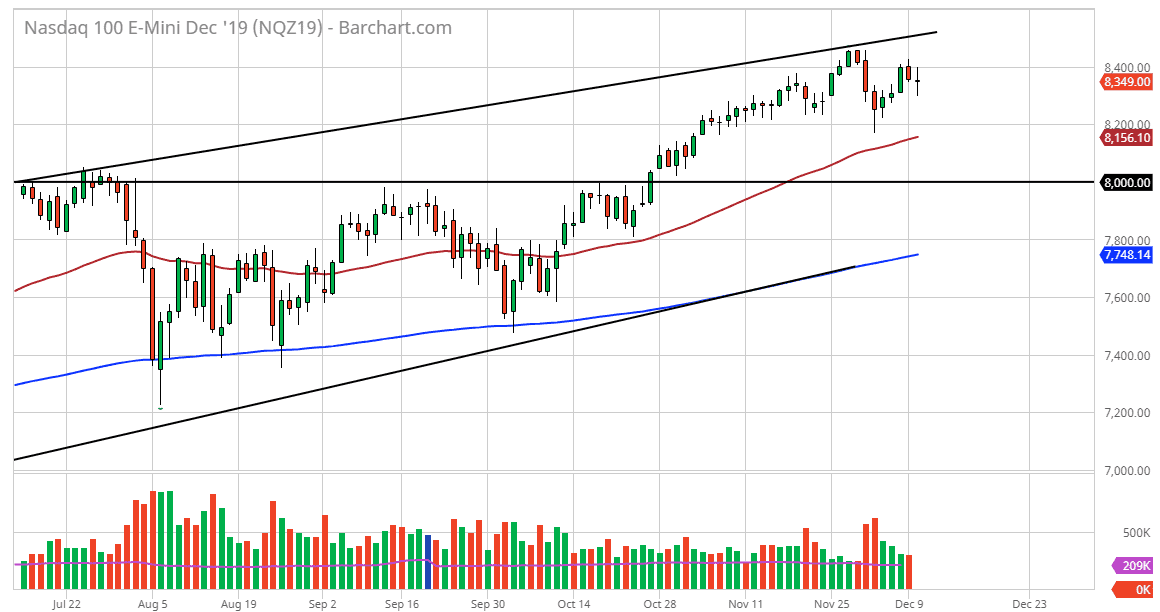

The NASDAQ 100 gapped lower to kick off the trading session, although just barely. At this point, the market then went back and forth during the day, simply chopping around. At this point, the makes quite a bit of sense considering that the December 15 deadline is rapidly approaching. It is on December 15 that we could see more tariffs slapped upon the Chinese by the Americans, and quite frankly the later we get in this week that we go without some type of sign that the Americans are going to delay the tariffs, the more likely we are going to see a little bit of selling. That being said though, it should offer plenty of buying opportunities. After all, the 50 day EMA underneath should be supportive, looking at the 8200 level as a potential short-term floor.

That being said, the 8500 level above is massive resistance, so breaking above there would be a very bullish sign. I have a hard time believing that happens between now and the weekend without some sign that tariffs are going to be delayed. Having said that, I have no interest in shorting this market and I think that if you are patient enough you could look at the market as being able to be purchased for a value play after some type of knee-jerk reaction to the downside. The 8000 level should offer quite a bit of support as well, and that of course the 200 day EMA sits just below the 7800 level, and that of course should offer support as well. In other words, no matter what happens I am a buyer at this point. This doesn’t mean that I would be simply jumping right in right away to get long, but I do like the idea of looking for value underneath. We are a little bit stretched at this point and with so much uncertainty it makes sense that the “weak hands” could get flush out rather quickly. Quite frankly, we are in an uptrend and we have seen tariffs levied before. Every time that’s happened, there’s been an initial knee-jerk reaction to the downside, followed by bigger players coming in and picking up equities “on the cheap.” There is absolutely nothing on this chart that suggests that can’t happen again. I like the idea of going long of this market, but I want to see a little bit of value first. Based upon the ascending triangle that I have been pointing out for some time, we have a target of 8800.