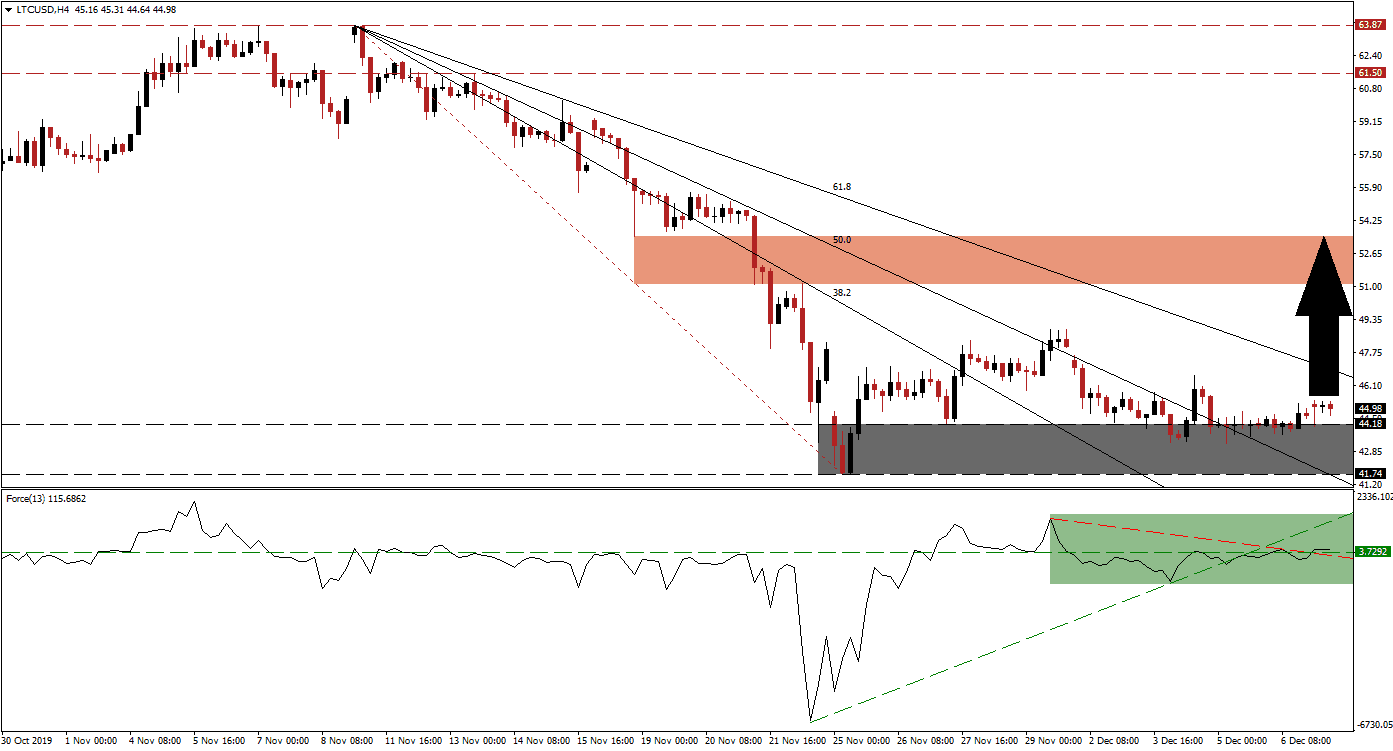

Litecoin is facing a minor existential crisis after the hashrate crashed to a 2019 low, following price action in the LTC/USD to the downside after the 2019 halving event. This has severely limited the profitability of miners, especially smaller ones that utilize outdated machines. This cryptocurrency pair may additionally be testing the so-called shut-off price for Litecoin, the level at which mining is no longer profitable. Price action is hovering just above its support zone, with the Fibonacci Retracement Fan sequence applying downside pressure. You can learn more about a support zone here.

The Force Index, a next-generation technical indicator, started to recover after price action dropped into its support zone. The build-up in bullish momentum carried the Force Index above its horizontal resistance level, converting it back into support. While this technical indicator remains below its ascending support level, it was able to eclipse its descending resistance level as marked by the green rectangle. Another bullish development emerged after the Force Index moved back into positive territory, placing bulls in charge of the LTC/USD.

After price action initially recovered from its support zone, located between 41.74 and 44.18 as marked by the grey rectangle, the 50.0 Fibonacci Retracement Fan Resistance Level rejected an extension of the breakout. The following reversal in the LTC/USD into its support zone resulted in a higher low, an additional bullish development. With the descending 61.8 Fibonacci Retracement Fan Resistance Level closing in on this cryptocurrency pair, a breakout is favored to ignite a short-covering rally. This will clear price action to accelerate into its next short-term resistance zone. You can learn more about a short-covering rally here.

One key level to monitor remains the intra-day high of 46.62, the peak of a failed breakout attempt that was reversed; a sustained move past this level is likely to result in the addition of new net buy orders. A fundamental bullish driver for Litecoin is the mechanism that lowers the mining difficulty once the hashrate drops, enticing miners to come back online. As the price of the LTC/USD dropped, dragging the hashrate to a 2019 low, the mining difficulty dropped to a 2019 low as well. This cryptocurrency pair is ripe for a breakout and short-term advance into its resistance zone located between 51.14 and 53.46, as marked by the red rectangle.

LTC/USD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 44.85

Take Profit @ 53.45

Stop Loss @ 43.20

Upside Potential: 860 pips

Downside Risk: 165 pips

Risk/Reward Ratio: 5.21

In the event of a breakdown in the Force Index below its descending resistance level, which currently acts as temporary support, the LTC/USD could attempt a breakdown below its support zone. Give the dominant fundamental scenario, enforced by technical developments, the downside remains limited to its next support zone. Price action will face this zone between 36.79 and 33.63; this covers a previous price gap to the upside as well as to the downside and represents a sound long-term buying opportunity.

LTC/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 41.50

Take Profit @ 35.00

Stop Loss @ 44.00

Downside Potential: 650 pips

Upside Risk: 250 pips

Risk/Reward Ratio: 2.60