Bitcoin is leading most of its peers to the downside, and Litecoin experienced another drop to the downside. The bearish trend in the cryptocurrency market is likely to extend, but Litecoin is arriving at a critical junction that may determine its future, while it may be suffering from a dust attack. A dust attack refers to sending a micropayment to addresses across the network. Attackers will then monitor them and attempt to identify the person or company owning them. The LTC/USD stabilized inside its support zone with an increase in bullish momentum.

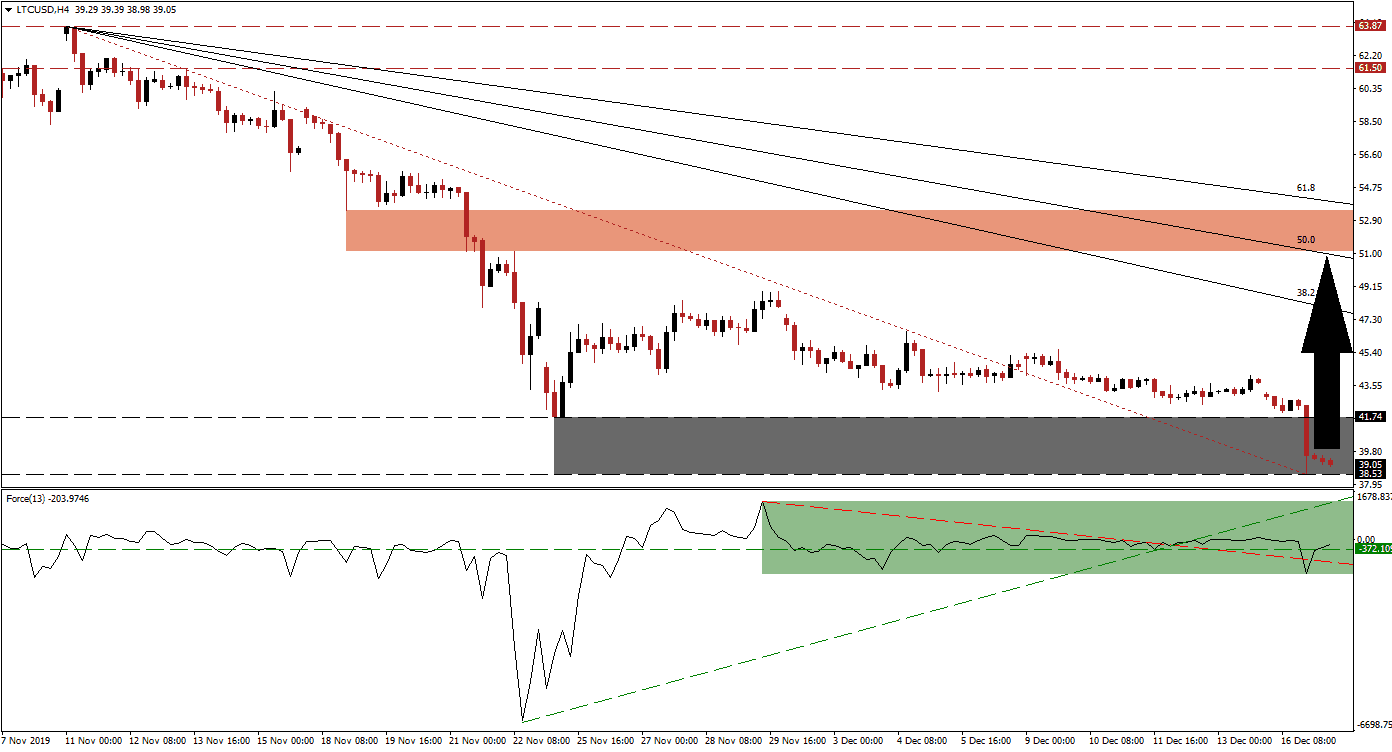

The Force Index, a next-generation technical indicator, plunged with price action before recovering to the upside. The Force Index briefly dipped below its descending resistance level before bullish momentum returned, pushing it back above its horizontal resistance level and turning it into support, as marked by the green rectangle. This technical indicator remains in negative conditions with bears in charge of the LTC/USD, but upside momentum is favored to push it back into positive territory and close the gap to its ascending support level.

One development suggesting a dust attack, initially traced back to August 20th 2019 or ten days after the Litecoin network came under attack, is the systematic spike in active Litecoin addresses every seven days. Litecoin is in the development process of MimbleWimble, a network upgrade intended to enhance privacy and address security flaws. This may push Litecoin into the privacy coin sector, followed by the delisting of several exchanges that ban privacy coins in an attempt to please regulators. Technical developments in the LTC/USD favor a breakout and short-covering rally off of a critical support zone, which is located between 38.53 and 41.74, as marked by the grey rectangle.

While more downside cannot be ruled out, especially if an ongoing dust attack is confirmed, the magnitude of the sell-off made this cryptocurrency pair vulnerable to a counter-trend advance. Another bullish development emerged after the LTC/USD moved above its Fibonacci Retracement Fan trendline; a breakout is anticipated to close the gap between price action and its descending 38.2 Fibonacci Retracement Fan Resistance Level. The anticipated advance will face a significant resistance at its 50.0 Fibonacci Retracement Fan Resistance Level; situated just below its short-term resistance level located between 51.14 and 53.46, as marked by the red rectangle. You can learn more about a breakout here.

LTC/USD Technical Trading Set-Up - Counter-Trend Breakout Scenario

Long Entry @ 39.00

Take Profit @ 51.00

Stop Loss @ 36.75

Upside Potential: 1,200 pips

Downside Risk: 225 pips

Risk/Reward Ratio: 5.33

In the event of a breakdown in the Force Index below its horizontal support level as well as its descending resistance level, the LTC/USD may attempt to extend its sell-off. The next major support zone awaits price action between 29.99 and 32.85; this would represent an outstanding long-term buying opportunity given the fundamental developments in this cryptocurrency pair.

LTC/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 36.00

Take Profit @ 30.00

Stop Loss @ 39.00

Downside Potential: 600 pips

Upside Risk: 300 pips

Risk/Reward Ratio: 2.00