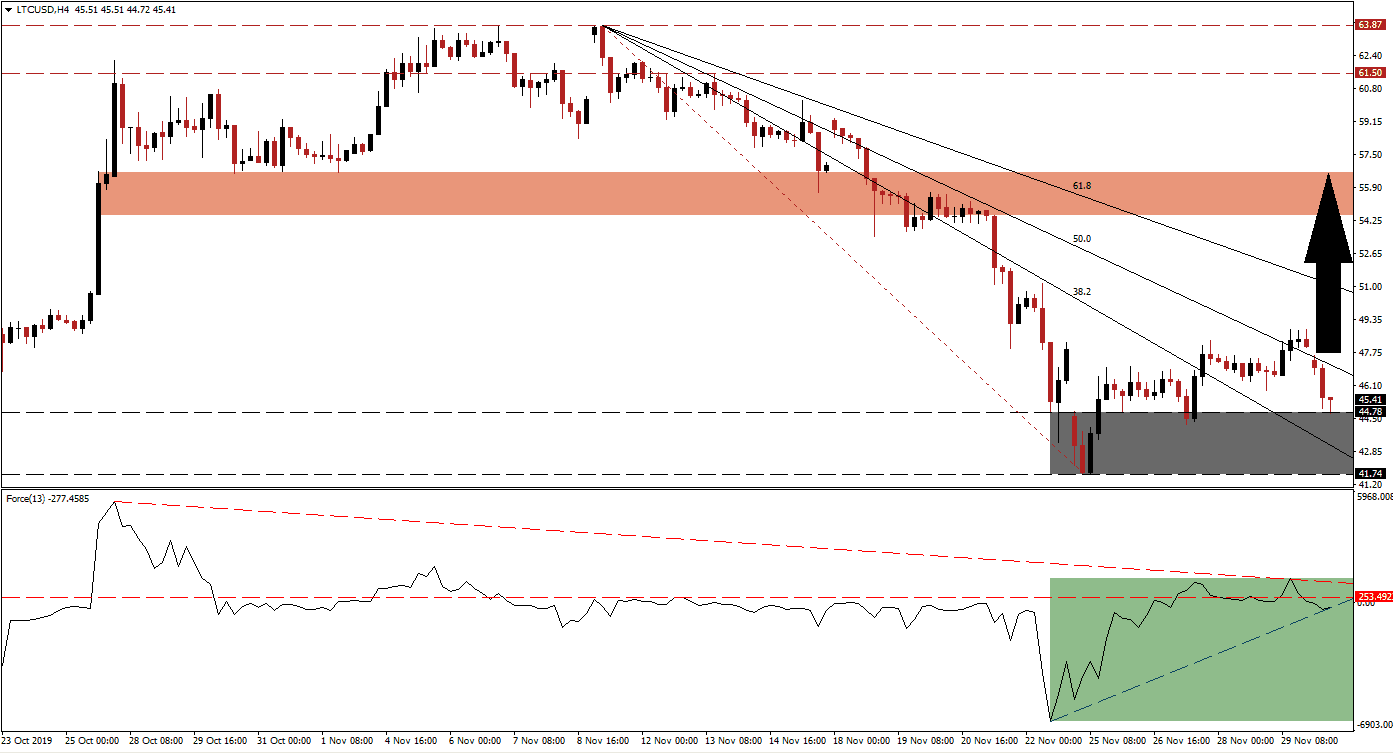

Volatility in the cryptocurrency market remains elevated and while a broadly bearish bias has been established, the LTC/USD may be on the verge of another push to the upside. Following the breakout above its support zone, this cryptocurrency pair briefly eclipsed its descending 50.0 Fibonacci Retracement Fan Resistance Level. Price action was then pressured into a reversal and has now approached the top range of its support zone. Such a move is normal and often represents a good buying opportunity as the breakout is likely to accelerate. An advance into its next short-term resistance zone will keep the long-term downtrend intact.

The Force Index, a next-generation technical indicator, was rejected by its descending resistance level as marked by the green rectangle; this additionally led to a breakdown below its horizontal support level, turning it into resistance. The Force Index remains in negative conditions, suggesting bears remain in charge of price action. This technical indicator is now expected to attempt a double breakout, supported by its ascending support level, and lead the LTC/USD to the upside. You can learn more about the Force Index here.

One development to monitor is the crash in the Litecoin hashrate which reached an all-time high in July 2019 of 523 Th/s. Over the past four months, the hashrate plunged to a low of 149 TH/s, making Litecoin vulnerable to a 51% Attack. This refers to one entity in control of over 51% of hashpower, giving them control of price action. The hashrate started to collapse following August’s halving event that cut rewards for miners, and the LTC/USD has contracted ever since. The support zone, located between 41.74 and 44.78 as marked by the grey rectangle, may initiate a short-covering rally and move this cryptocurrency pair out of extreme oversold condition.

Upside potential is expected to remain limited to its short-term resistance zone located between 54.50 and 56.61 as marked by the red rectangle. Cryptocurrency traders are advised to monitor the intra-day high of 48.89 which marks the peak of the current breakout. A sustained push above this level will equally place price action above its 50.0 Fibonacci Retracement Fan Resistance Level from where more upside is possible. The long-term downtrend is not expected to be broken in the LTC/USD, unless a fundamental catalyst such as an increase in the hashrate, will emerge.

LTC/USD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 45.25

Take Profit @ 56.50

Stop Loss @ 41.75

Upside Potential: 1,125 pips

Downside Risk: 350 pips

Risk/Reward Ratio: 3.21

In case of a breakdown in the Force Index below its ascending support level, the LTC/USD could attempt a breakdown below its support zone. This cryptocurrency pair will face its next support zone between 36.79 and 33.63 which includes a previous price gap to the upside and one to the downside. A move into this zone should be viewed as an excellent long-term buying opportunity.

LTC/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 40.25

Take Profit @ 33.75

Stop Loss @ 43.25

Downside Potential: 650 pips

Upside Risk: 300 pips

Risk/Reward Ratio: 2.17