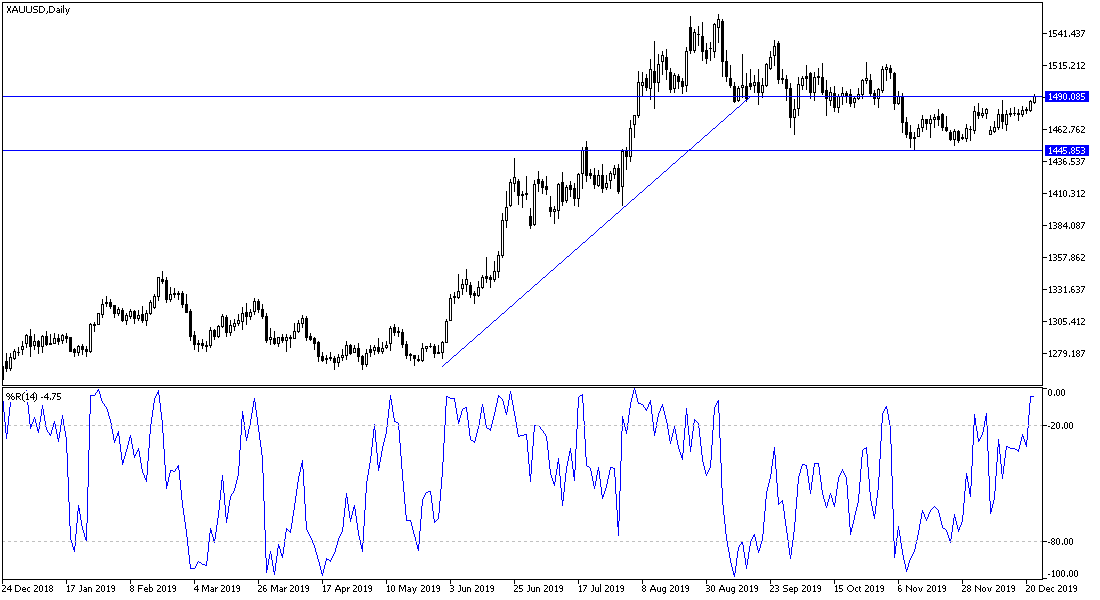

As we expected before, the stability of gold prices for a long time and for several sessions foreshadows a forthcoming price explosion, which happened as the yellow metal rose to the $1492 resistance, its highest for more than a month and a half, after its stability for a long time between $1471 support and $1483. Gold got the push from weaker than expected economic data results, which weakened the US dollar, which is connected inversely to gold, along with renewed investor fears of a Hard Brexit, and that it may be without a deal with the European Union after British Prime Minister Boris Johnson threatened that he would seek not to extend the transitional period beyond 2020, to agree on trade relations with the European Union.

The features of the expected trade agreement between the United States of America and China and its official signature still haunt investors, amid fears of sudden steps from both sides of the global trade war that end recent hopes. The financial markets had hoped the agreement would be signed before the Christmas and New Years holidays to enter the year 2020 with optimism about the possibility of ending that war, which threatens to stagnate the global economy as a whole.

The longevity of that war began to appear on the results of economic releases from the United States and China alike. Yesterday, it was announced that US durable goods orders were down to their lowest levels in six months. As the main orders declined to -2.0%, while expectations were for a decline of only 0.2% from 0.5% previously. Core orders fell to 0.0%, and expectations were for a significant increase of 1.5%.

According to the technical analysis of gold: the general trend of the yellow metal is still upwards and a return to the test the $1500 psychological resistance will give the trend a new momentum to move and test higher peaks. At the present time, the closest resistance levels are at 1495, 1510 and 1525, respectively. The downward momentum of gold may increase again if it moves towards the support levels 1480, 1471 and 1465, respectively. I still prefer to buy gold from every bearish level.

Today's economic calendar is completely free of any important economic releases ahead of Christmas and New Year holidays.