Since the beginning of this week’s trading, gold prices have watched with caution the arrival of a wave of important economic data and events affecting sentiments of global financial markets and investors. Since gold is one of the most important safe havens, then in the event that more US tariffs are imposed on China’s imports, the agreement between the US and China fails at the present time, and the British election results does not meet market expectations, that would push gold price to start moving higher. Recent gains did not exceed the $1469 level before settling around $1463 at the time of writing.

Today, US inflation figures will be announced and an update from the Federal Reserve's monetary policy, along with an update on inflation and labor market expectations, which will give investors a clearer view of the future of the US Central Bank's monetary policy under Jerome Powell, who will deliver an important speech half an hour after the announcement of the US interest rate, which is stable around 1.75% amid confirmed expectations that the bank will not make any change to the rates.

And with US inflation numbers awaited, the average inflation forecast for the United States has increased over the next three years by 0.1% to 2.5%, and expectations for the next year rose slightly by 0.02%, to 2.4%, according to the latest Federal Reserve survey. Both indices rose from their lowest levels since 2013.

With tension over the failure of the trade agreement between the United States of America and China, Wall Street Journal reported that Congress is working on a bill banning the use of federal funds to buy Chinese buses and railways, which could hold talks for the Phase 1 of the trade agreement between the world's two largest economies.

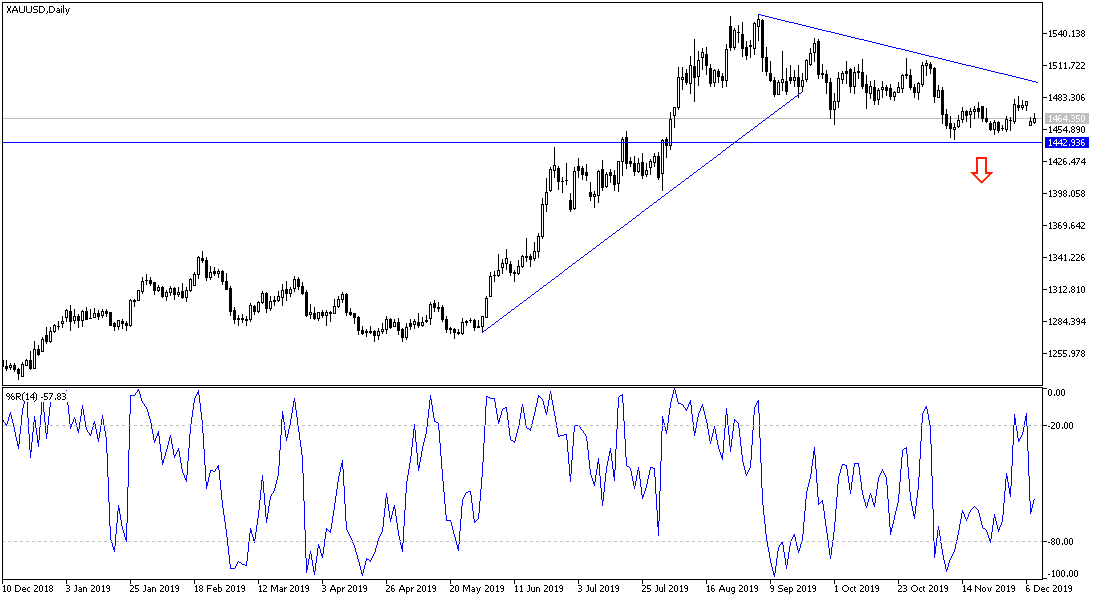

According to the technical analysis of gold today: Gold prices are still under the pressure of a downward correction and the current trend reversal will be strengthened if prices move towards 1458, 1445 and 1430 dollars, respectively. On the other hand, the bullish correction is in a wait mode until gold prices returns to the peaks of 1478 and 1485, and the $1500 psychological resistance. It must be borne in mind that gold may get strong backing from renewing global trade and geopolitical tensions, as the yellow metal is the safe haven of choice for investors in times of uncertainty.

The gold price will react strongly to the announcement of the US inflation figures, the US Federal Reserve's monetary policy decisions and the content of the statements of its Governor Jerome Powell.