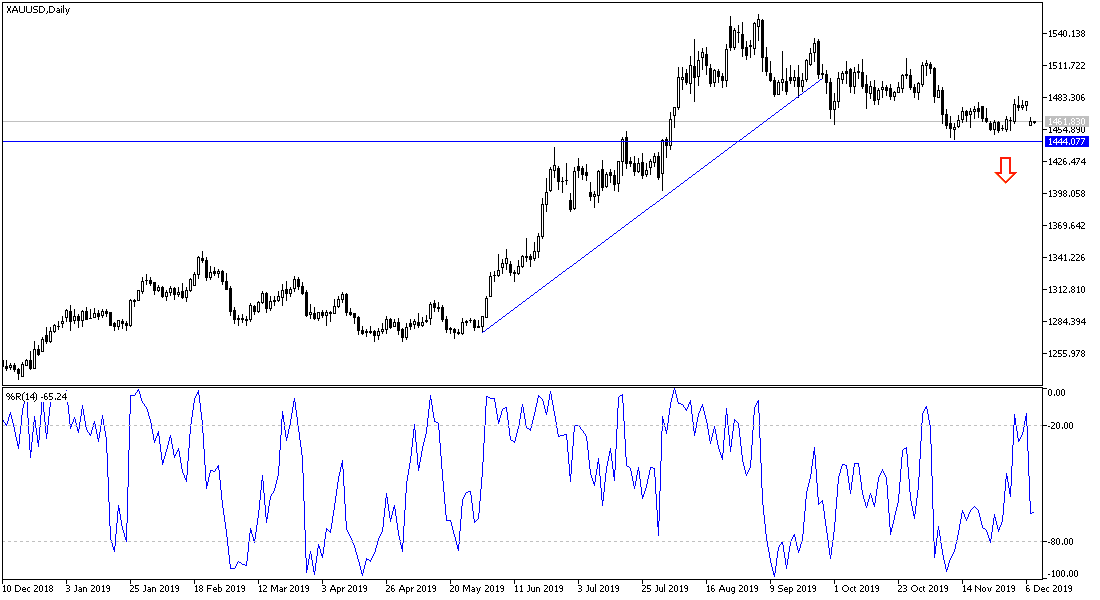

After the recent collapse gold prices to the $1458 level after the announcement of better-than-expected US jobs numbers by the end of last week, prices have been moving in a narrow, limited and stable range around $1463 at the time of writing, awaiting any developments. The yellow metal is expected from tomorrow to have important and influential events that will support a strong movement coming in one of two directions, according to the reaction of investors to what will be announced and what will happen. The most prominent among gold movers is the announcement of US inflation figures, the Federal Reserve's announcement of its monetary policy, and the general elections in Britain, the results of which will determine the future of the Brexit, and then there is the date for imposing more US tariffs on the rest of China's imports.

Since gold is one of the most important safe havens for investors in times of uncertainty, the reaction to the above mentioned data and events, in case they didn’t meet expectations, will be a rapid bounce higher in gold prices, and vice versa in the event of increased reassurance of investors and everything is going well.

In the House of Representatives, Democrats reached a tentative agreement with labor leaders and the White House over rewriting the trade deal between the United States, Mexico and Canada, which was a top priority for President Donald Trump. In Mexico City, Mexican Minister of External Relations Marcelo Ebrard said Monday evening that a meeting of the negotiating teams between the three countries will be held on Tuesday to "announce progress" on the trade agreement.

It is expected that American trade representative Robert Lightizer will travel to Mexico City to participate. Details are yet to be finalized, and the United States Trade Representative will need to submit executive legislation to the Congress.

The new trade agreement will replace the 25-years old North American Free Trade Agreement, which has removed most tariffs and other trade barriers, and which include the United States, Mexico, and Canada. Critics, including Trump, labor unions and many Democratic lawmakers, have described NAFTA as a job killer for America because it encouraged factories to move south of the border, take advantage of low-wage Mexican workers and ship the products back to the United States.

According to the technical analysis of gold: the downward correction of gold is still valid and will be strengthened if the price moves towards the support levels of 1449, 1438 and 1425, respectively. On the other hand, the return of the movement towards 1472, 1483 and 1490 resistance levels will support the strength of the bullish correction again, and from it the price may move towards the $1500 psychological resistance again. The return of trade and political tensions around the world will support the strength of gold.

Gold will react today with the announcement of British economic growth and the German ZEW index data.