Gold markets initially tried to rally during the trading session on Monday but as you can see gave back quite a bit of the gains. This makes sense because the stock market in the United States shot straight up in the air. In fact, the S&P 500 reached the 3200 level, showing a decidedly “risk on” attitude in New York. This is part of what has been plaguing gold lately, the obvious bullishness of traders.

At this point, the market is struggling with the 50 day EMA, and has a lot to think about. What I find interesting is that we got the US/China trade negotiation moving forward, yet the gold market didn’t exactly get crushed, so it’s as if people don’t necessarily trust this scenario. The gold markets have pulled back a little bit during the day on Monday but haven’t necessarily cratered like they would if the market was celebrating the United States and China coming together. This is because the trade war continues to be a lot of noise in general, and quite frankly we’ve seen a lot of the things that have been “agreed-upon” before. With that, we are starting to see that gold is just kind of hanging out in a very flat attitude.

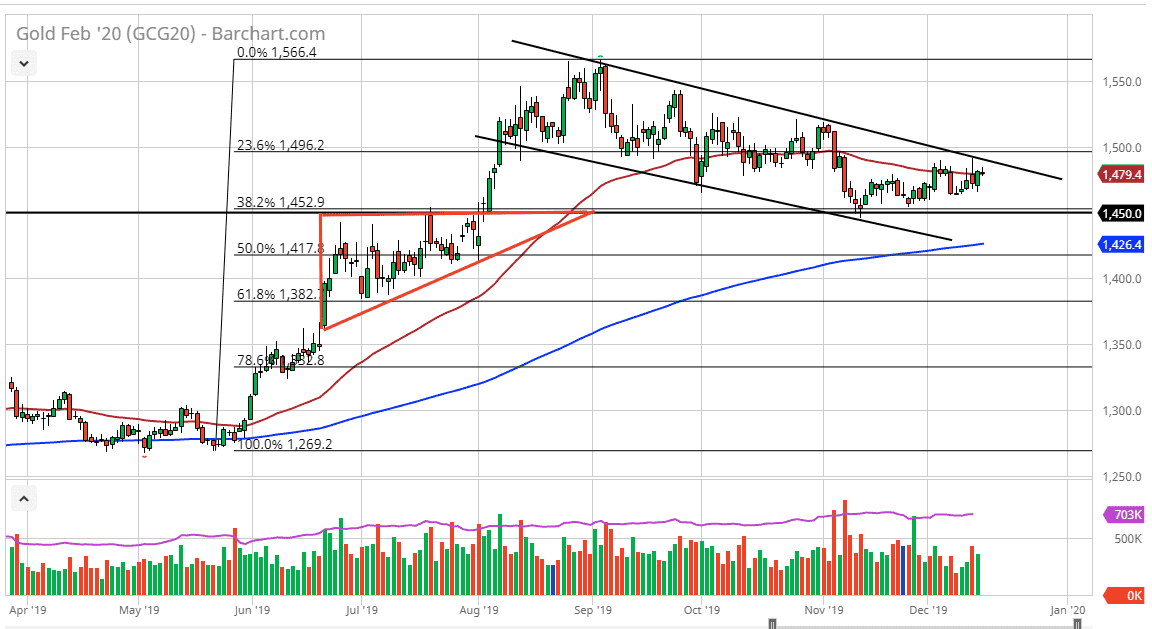

The descending channel is still very much in a fact, so at this point I think there is probably more downward pressure than up, but it doesn’t look as if the market is ready to fall apart either. I see a significant amount of support at the $1450 level, and as a result is very likely that we will see buyers just above there yet again. In other words, this is a market that will go back and forth and simply look for some type of reason to move. Right now, it doesn’t seem to have it so I anticipate that we will bounce around between $1460 on the bottom, and $1480 on the top. Short-term back-and-forth trading continues to be the case in the short term. If we break above the $1500 level though, that’s a sign that we are going to continue the longer term uptrend and the $1450 level has in fact held. If we were to turn around a break down below the $1450 level, then the 200 day EMA which is currently at the $1426 level is probably where we go to next.