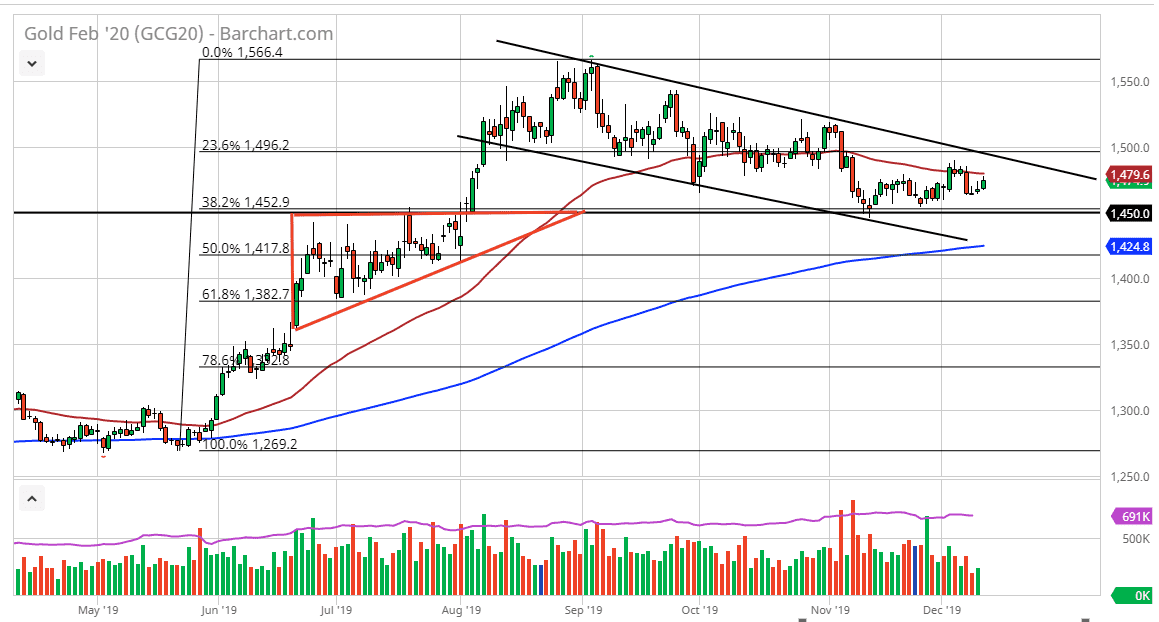

Gold markets will probably stick to consolidating as we await the trade tariff decision on December 15, which is this Sunday. If there is more of a “risk off” type of situation, then it’s likely that the gold markets could continue to go higher. The 50 day EMA above will be a bit of a resistance barrier though, and of course the $1500 level will be as we have been in a down trending channel. Ultimately, this is a market that has struggled to find its way lately, but the one thing that we have seen is massive support at the $1450 level.

At this point, gold simply moves due to risk appetite and most of the risk appetite out there is involving Chinese trade deal fiasco, so I think that headlines continue to make life very difficult for a lot of traders. Short-term trading is probably best, but if we were to break down below the $1450 level it probably opens up a bigger move down towards the 200 day EMA. That currently resides at the $1425 level, so don’t be too surprised if that would be the target. On the other hand, we could break to the upside and if we can clear the $1500 level it’s likely that the market will go much higher, perhaps starting a new uptrend. Gold needs a little bit of a boost, and at this point the US/China trade headlines will probably be the main driver.

All things being equal, this is a market that probably chops around over the next couple of days, but it has shown a bit of resiliency to the upside. Because of this, it’s very likely that the market participants will continue to see gold as being cheap, but it is difficult to hang on to this market right now as it has been so erratic. Ultimately, this is a market that the markets are trying to decide where to go next, and at this point I think you probably best leaving it alone but with those couple of levels mentioned previously, that gives you a bit of guidance going forward, and perhaps the ability to place a little bit bigger of a trade. Until then, the likelihood of being able to profit more than the occasional back-and-forth trading is very unlikely. If you are a short-term day trading type of trader, this might be a good range to play in.