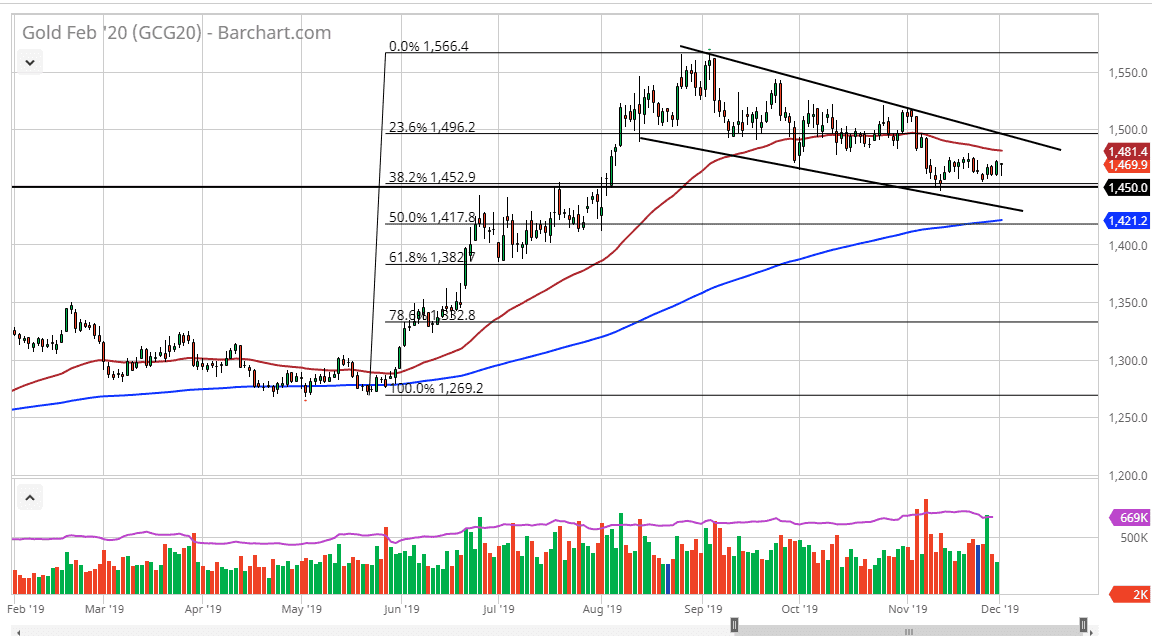

Gold markets have rolled over initially during the trading session on Monday but have continue to find support at the same levels again. The $1450 level underneath is significant support, as we have seen it cause buying pressure more than once. At this point in time it’s likely that the markets will continue to see a lot of volatility in the gold market, as it has been thrown around by international headlines, and of course interest-rate differentials as well as interest rate considerations.

All things being equal though, instead of trying to figure out the zoo that is the daily headline grind that we have in the markets, sometimes it’s more important to simply pay attention to where the market won’t go. Currently, it looks as if it will not go below the $1450 level. This is a crucial piece of information, because buyers continue to be attracted to this area. It also tells us that if the market were to break down below there, then we should start paying even more attention to the potential downtrend.

To the downside, the 200 day EMA is near the $1425 level, so a breakdown below the 200 day EMA probably kicks off a much more significant pullback. That would be an extraordinarily negative sign, and it could send this market much, much lower. That being said, I believe that there are enough headlines out there to cause issues for sellers anyway, because quite frankly the market has seen so much in the way of choppy behavior in this general vicinity. If the market was to break above the 50 day EMA at the $1480 area, then I believe the market probably continues to reach towards the $1500 level, possibly even the $1515 level. One thing that is going to continue to be a major issue is the fact that there are a lot of noisy headlines coming out of the US/China trade situation, and that of course the nonsense coming out of that situation will continue to cause a lot of problems. If we do break out to the upside, then it’s very likely that the market would go reaching towards the most recent highs. All things being equal though, we simply need to be very cautious about your position size more than anything else. I still favor the upside but recognize that there may be a lot of back and forth. Slowly building up a core position may be the best way to go.