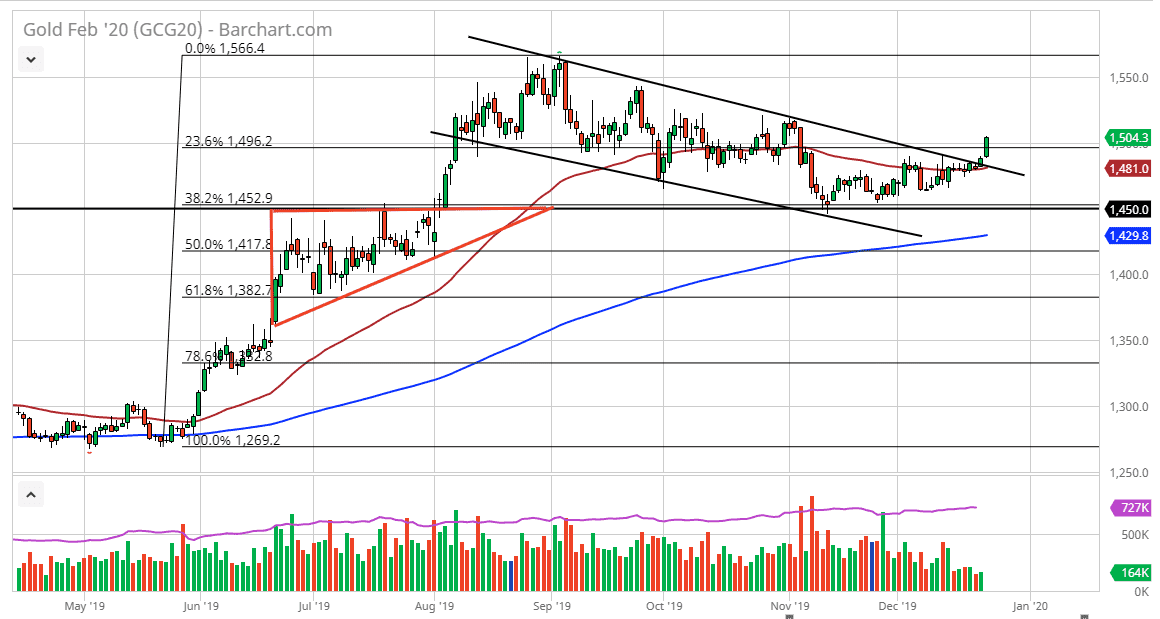

Gold markets have exploded to the upside during the trading session on Tuesday as traders continue to take advantage of the massive breakout. We are clearly above the $1500 level now so it’s likely that we will see a significant amount of buying pressure come into play. That being the case, this is a market that will continue to prefer the upside and go looking towards the $1520 level. That’s an area that features structural resistance, as it was a high from almost 2 months ago where we slaved into the down trending channel. At this point, we have broken out and it’s likely that gold will continue to attract a lot of attention. Nonetheless, I believe that there are some reasons why gold is getting a bit of a pickup.

Something that it has flown under the radar for a lot of traders is that the Federal Reserve continues to pump massive amounts of liquidity into the repo market. Something in the order of $3 trillion has been issued, and that’s not a good sign. Beyond that, economic numbers in the United States continue to soften, and that could have people betting on the Federal Reserve loosening monetary policy going into 2020. That being said, there are other issues out there along the lines of bank runs in China, and of course plenty of geopolitical issues that could come into play.

With all that being said, I believe that the fundamental reason for market to go higher is certainly strong, and on top of that we now have the technical analysis signaling the same thing. Now that we have had this massive breakout, I believe that it’s only a matter of time before we go much higher. With that in mind I recognize that the $1450 level now should be thought of as the “floor” in the market and the defender of the overall uptrend. It’s also the 38.2% Fibonacci retracement level so it suggests that we are going to go much higher. At this point, the market is likely to go looking towards the $1520, and then perhaps the $1550 level after that. Longer-term, this market probably goes much higher as there are a multitude of reasons for gold to continue to strengthen based upon fear, and of course cheap and easy money from around the world. Central banks around the world continue to loosen monetary policy, and as a general rule that does help gold quite significantly.