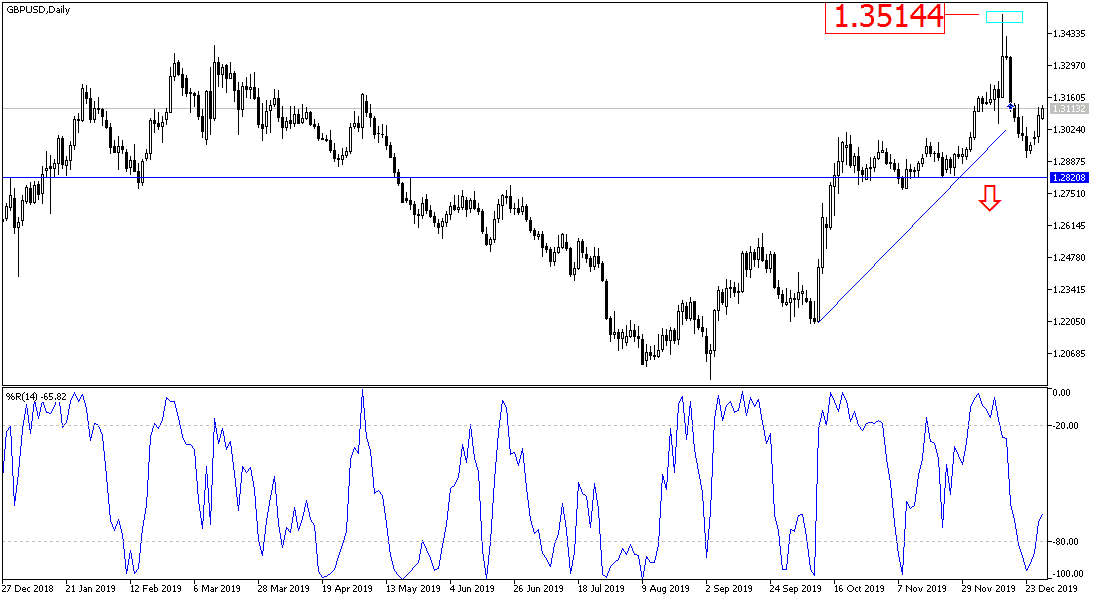

The GBP/USD pair was not able to celebrate its strong gains after the announcement of a landslide victory for the Conservative Party led by Boris Johnson, which pushed it towards the 1.3514 resistance, the highest since May 2018, and soon the pair lost all its gains and returned to its lowest levels before those fateful elections, as the pair fell to the 1.2904 support last week, the lowest for nearly a month. This is in light of renewed fears about the future of Brexit and that it might take place without a deal, with Johnson threatening not to extend the transition period for the agreement on relations between the United Kingdom and the European Union beyond the end of 2020. In the week of Christmas holidays, the dollar retreated, and the pair had a better chance to bounce higher, as a result, it rose to the 1.3117 resistance before closing the week’s trading around the 1.3085 level. Despite the rebound, the sterling is still waiting for a return of optimism from a positive response from the European Union to what was reported by the British government regarding the transitional period after Brexit, scheduled for January 31, 2020.

The hints from the bloc began that negotiations and agreements regarding future relations take a long time, as known, and that the year 2020 may not be sufficient to end everything, which is a strong threat to any gains for the British pound in the coming period.

We may witness a return to liquidity in the financial markets today and tomorrow before the New Year's holiday on Wednesday, with work returning to normal on Thursday and Friday. The exchange of statements by the two sides of the Brexit after the end of the holidays will be a strong reason for the volatility of the pound's performance against other major currencies. This is in addition to the future of the expected trade agreement between the United States of America and China.

According to the technical analysis of the pair: The stability of the GBP/USD price around and below the 1.3000 psychological support will remain a catalyst for the downward trend, and there will be no opportunity to reverse the trend without moving steadily above the 1.3300 resistance until now, and on the daily chart the pair is in the downward correction range.

For today's economic notebook data: Focus will be on US data for the Chicago PMI and Pending Home Sales. There are no major releases from Britain today.