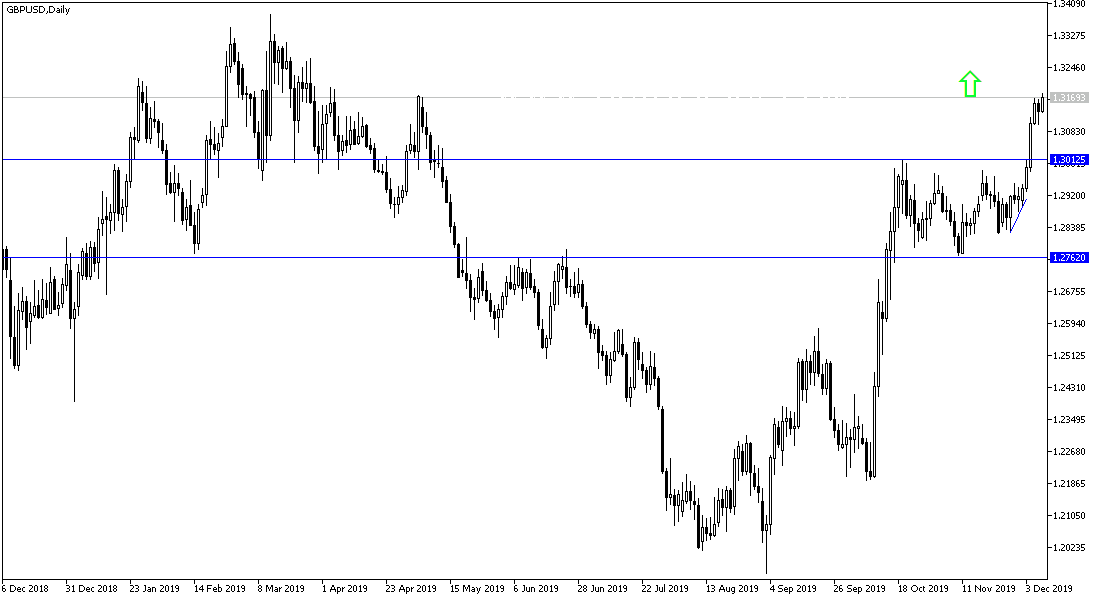

Next Thursday, the anticipated general elections will be held in the United Kingdom, the outcome of which will determine the fate of Brexit. With continues expectations a conservative victory, the price of the GBP/USD pair still maintains the bullish rebound despite the dollar's strength at the end of last week's trading, amid more positive expectations with better than expected US job numbers. Sterling was the second best performing major currency last week, and recorded the highest level in seven months at the 1.3166 resistance, before settling around 1.3140 at the time of writing.

Surveys have shown that the Conservative leadership stabilized at around 10% last week, enough to guarantee a small parliamentary majority, according to some polls. On this result, the implied possibilities of the conservative majority increased to 72% on the Betfair Exchange last week, the highest level recorded on the exchange since the start of the election campaign. With the vote soon, the bitter memories of how former Prime Minister Theresa May has turned a two-digit polls advance at the start of the 2017 campaign, to a suspended parliament more than two years ago, could constrain investor appetite for sterling in the coming days. Meanwhile, uncertainty about the possible outcome of the vote may drive some profit-taking for GBP deals.

The bottom line is that although investors, analysts and critics are happy to bet that Prime Minister Boris Johnson will win this week, the pound may be subject to a downward correction over the coming days.

On the US side, the US jobs report confirmed at the end of the week that the US economy is still strong and that the plans of the Federal Reserve are proceeding successfully as the bank stopped the pace of the rate cut after three times in 2019, until the reaction from its policy is measured. The US economy succeeded in creating 266,000 new jobs during the month of November. Expectations were for an increase of only 180,000, and the country’s unemployment rate fell to its lowest perimeter for 50 years and wages increased more than expected, too.

According to the technical analysis of the pair: The GBP/USD general trend is still bullish, and as shown on the daily chart, it appears that the price has reached overbought areas and investors will prefer to wait for the elections next Thursday and its result on Friday. The closest resistance levels are now at 1.3175, 1.3260 and 1.3320, respectively. On the other hand, there will be no chance for a downward correction without breaching the 1.3000 support, otherwise the pair will remain stronger. I still prefer buying the pair from every downtrend.

As for the economic calendar data today: It has no economic releases from Britain or the United States of America.