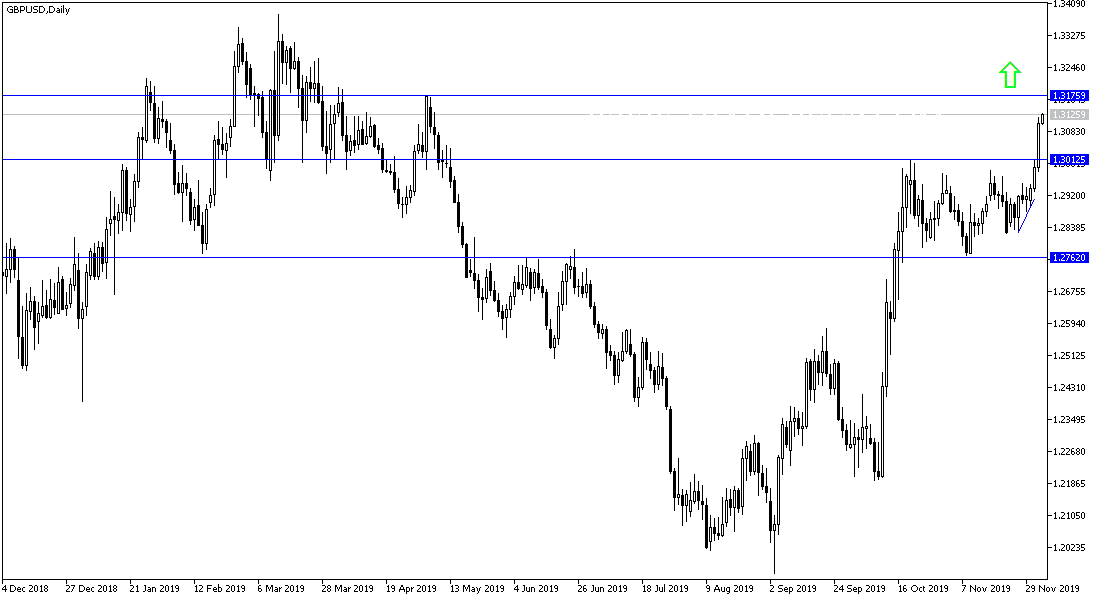

The catalysts for completing the GBP/USD bullish correction have increased with gains that hit the 1.3120 resistance, which has been at the highest level for almost seven months and is stable near that level at the time of writing. The gains were boosted by continued optimism that the Conservatives will win the general elections to be held in the United Kingdom on Dec. 12. The postponement of the trade agreement between the United States and China increased the chances of the pair to continue its gains. U.S. Commerce Secretary Wilbur Ross said the 2019 trade deal was unlikely now, while President Donald Trump warned that the deal might only be possible after next year's US elections. Speaking in London, where he is attending the NATO summit, Trump said he had "no deadline" to end the 16-month trade war between the world's two largest economies, which has caused economic damage to both sides. "Sometimes I like the idea of waiting until after the election," Trump said.

President Trump announced that trade negotiations with China were at a "critical stage."

On December 15, additional US tariffs are to be implemented on many Chinese-made items, including smartphones and games. The Trump administration already imposes tariffs on Chinese imports worth more than $ 360 billion. These tariffs are met by Chinese customs tariffs worth 120 billion dollars on US imports. Pressure is growing on both sides to complete what Trump called the limited "Phase 1" deal before the deadline. However, Trump may end up delaying tariffs, as he did in October, to allow more time for negotiations.

According to the technical analysis of the pair: The higher the expectations of the Conservative victory, the greater the chances for the GBP/USD to complete the move within the upward channel until the election is completed on December 12, and then investors will focus on the economic performance of the country. Having a hung parliament or the Conservatives not winning, means a rapid collapse of the GBP gains. The uptrend is supported by stability above 1.3000 psychological resistance. The nearest resistance levels are currently at 1.3165, 1.3220 and 1.3300 respectively. In case of a downward correction, the nearest support levels are currently at 1.3045, 1.2980 and 1.2880 respectively, and I still prefer to buy the pair from every bearish level.

As for the economic calendar data today: From the US, there will be the release of the trade balance, jobless claims and factory orders. There are no significant UK economic releases today.