Optimism about the British election to be held in a few days, along with the losses of the US dollar against other major currencies, pushed the GBP/USD pair to make more gains and break the 1.3000 psychological resistance with gains reaching 1.3011, near a six-month high. The pair was stable around 1.2990 in early trade on Wednesday ahead of the announcement of the services sectors’ data from Britain and the United States. Pressure on the dollar has increased after Trump's comments that the deal between the United States and China may have to wait until after the presidential election.

Financial markets have rejected the White House speech on US-China trade talks and the US decision to hit French exports with new tariffs, enabling the pound to test psychological resistance against the dollar again.

President Donald Trump said on Tuesday that the "Phase 1 of the deal" to end the US-China trade war could be delayed until after the November 2020 presidential election, and the markets neglected to recognize the recent change in the White House tone on trade talks with China, instead, they would prefer to continue betting on an end to the tariff battle and the resulting stability of the global economy.

Dec. 15 will see new tariffs imposed on all remaining annual trade volume between China and the United States, which have not yet been subject to punitive tariffs, unless President Trump decides otherwise. Markets had hoped to avoid tariffs through the "Phase 1” deal, but US Commerce Secretary Wilbur Ross said on Monday that if an agreement was not finalized before mid-month, the new tariffs would come into effect.

There has been speculation in recent months that China itself may want to wait until after the election before a deal is reached if Trump fails to get reelected. At the same time, investors also speculated that electoral considerations are likely to ease Trump's desire for more tariffs.

Eight days from now, we will be on schedule with the early general elections in Britain, which will determine who will lead the country at a very sensitive and fateful time. Conservatives have a greater chance of winning, so there will be a greater chance for the party to pass the Brexit agreement between Johnson and the EU, so Britain will leave the EU on the new date of Jan. 30, 2020. The actual election results will determine the GBP's fate in the exchange market.

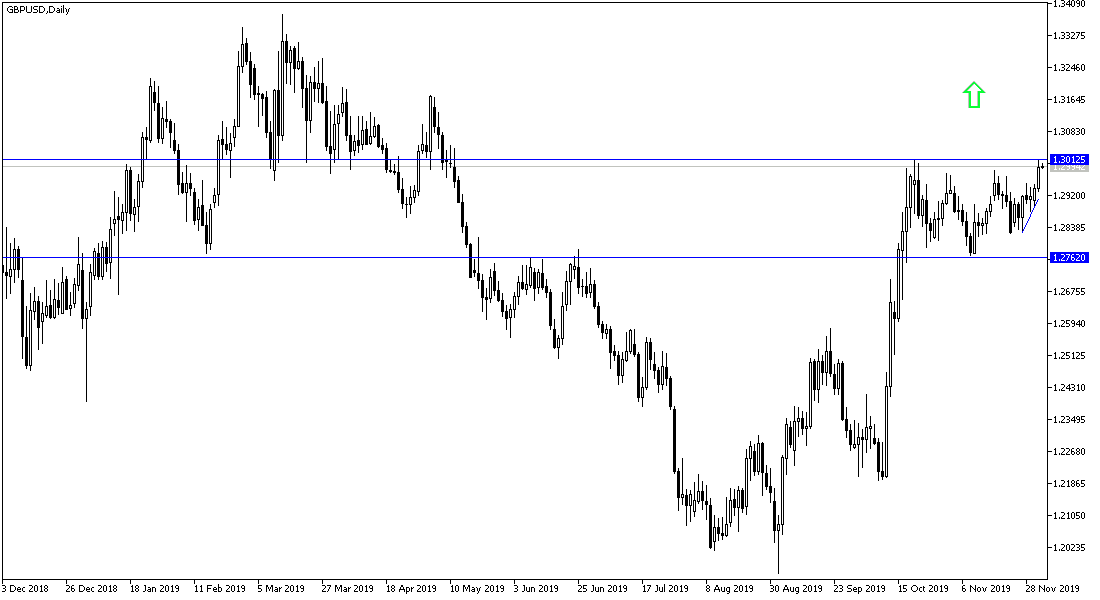

According to the technical analysis of the pair: The bullish trend of the GBP/USD is getting stronger by stabilizing above the 1.3000 psychological resistance as it is now. The continuation of the gains mentioned above means that the pair is poised to move towards higher peaks, and closest highs are currently at 1.3085, 1.3120 and 1.3200 respectively. On the downside, the closest support is currently at 1.2925, 1.2880 and 1.2800 respectively and I still prefer to buy the pair from every bearish level.

As for the economic calendar data today: From the UK, the Services PMI will be released. From the US, the ADP Non-Farm Payrolls Index will be released, followed by the ISM Services PMI and Crude Oil Inventories.