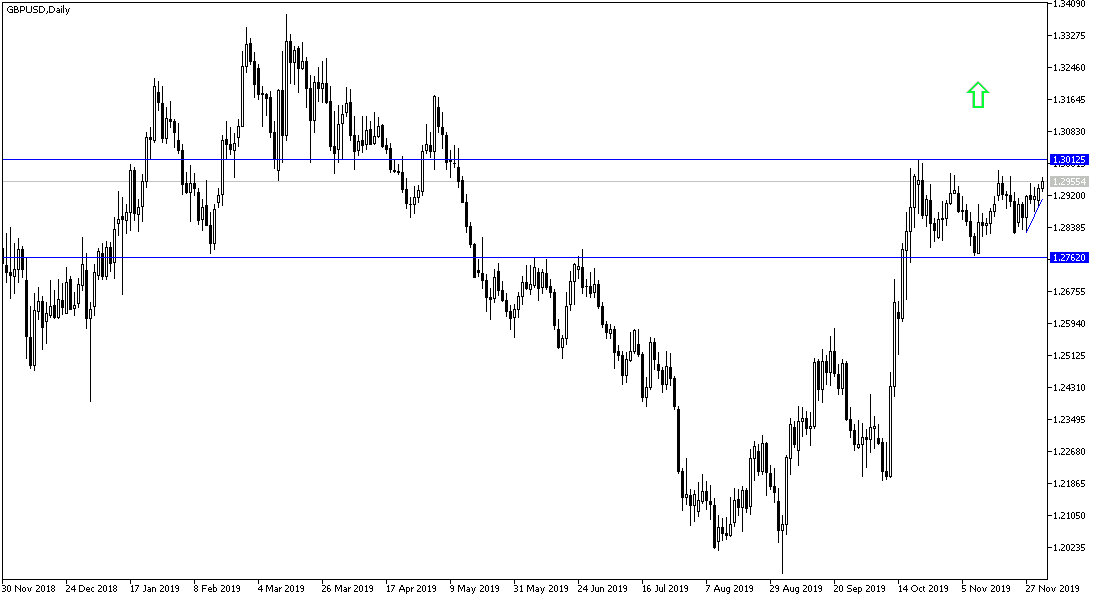

For four consecutive trading sessions, GBP/USD is attempting to breach through the 1.2950 resistance level to complete the upward correction. Overall, the polls still favor the Conservative- victory led by Boris Johnson, thus facilitating the task of passing the Brexit agreement. The Pound rose 0.7% last week, and was almost flat in November, and since mid-October, its price has remained stable between $1.28 and $1.30. This stability is due to the fact that many investors are confident that the Conservatives will win the December 12 elections and that the UK will leave the EU by the end of January. After the election, investors' attention may shift to the country's economic performance.

UK manufacturing continued to decline in November amid uncertainty from the upcoming general election and delays in Brexit. The manufacturing PMI fell to 48.9 from 49.6 in October, and the PMI remained below the neutral 50.0 level that separates growth from deflation for seven consecutive months.

“There is a strong sense of inevitability hanging around the sector in November as it continues to suffer the effects of a deadly combination of Brexit uncertainty, slowing global growth and an imminent general election,” said Duncan Brock, Group Director at CIPS. Brock added that the sector's performance is unlikely to change anytime soon, marking a grim start for the industry in 2020.

Difficult conditions in both domestic and foreign markets reflect a decline in new orders for the seventh consecutive month. The companies attributed this to the abolition of the supply of customers after the delay in Brexit and the continuing uncertainty surrounding the conditions of political, economic and global trade. The data showed that industrial employment declined for the eighth consecutive month with the pace of job losses steepest since September 2012.

According to the technical analysis of the pair: The performance of this pair has been characterized by cautious wait in the recent period. Overall, the bullish correction for the GBP/USD remains intact and awaits fresh momentum, and its success in moving above 1.3000 psychological resistance will stimulate the strength of the current trend and foreshadow a move towards higher highs. As we expected before, we now confirm that the 1.2800 support level is a strong threat to the future of the current correction. The results of the polls just 9 days before the election date will further fluctuate the Pound's performance against the major currencies in the coming trading sessions.

As for the economic calendar data today: From Britain, the Construction PMI will be released. There are no significant US economic releases today.