With markets return to work again today after the Christmas holiday, the price of the GBP/USD pair rushed back up to the 1.2996 resistance, and it is stable around it at the time of writing, after the pair fell to the 1.2904 support in the beginning of trading this week. The sweeping victory of the Conservative Party in the recent British elections led them to dictate what they want to everyone. Before the Christmas holidays, they passed the Brexit deal through the British House of Commons, and the House of Lords would surely approve the matter. Boris Johnson has threatened not to extend the transition period with the European Union beyond 2020 and Britain will exit the bloc by January 31, 2020, which is a threat of the possibility of a no-deal Brexit, which was a valid reason for the collapse of the pound sterling against other major currencies to levels before that election.

The new majority government in the UK has reduced political uncertainty. However, Prime Minister Johnson continues to use the threat that there will be no-deal Brexit as a negotiating tactic in upcoming trade talks with the European Union. The British pound has risen 9% against the Euro and 10.7% against the dollar since early October, when Boris Johnson announced for the first time that he had agreed to the terms of the UK exit with the European Union.

The decisive election results led to an optimistic outlook for the British economy in the near term, but made it more likely that the UK would struggle to adapt to new terms of trade in 2021. Similarly, the Bank of England is looking to raise interest rates in order to keep inflation under Control, but they faltered in doing so because of the uncertainty over the outcome of Brexit. The performance of the Pound will largely depend on the performance of the economy in the coming months.

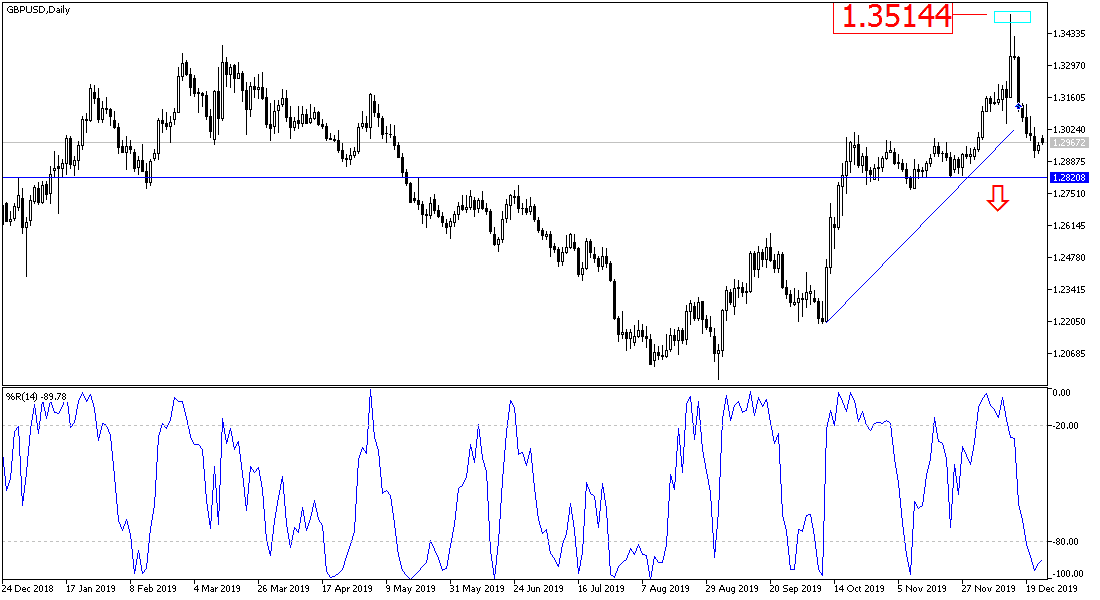

According to the technical analysis of the pair: The GBP/USD price is still in the range of reversing the general trend to the downside and stabilize below the 1.3000 support. The stronger support areas for the trend are currently at 1.2925 and 1.2800 respectively. As we expected before, we now confirm that there is no return to the upside strength of the pair without stabilizing above the 1.3300 resistance. There are no major economic or political releases from Britain today. From the United States of America, weekly jobless claims will be announced.