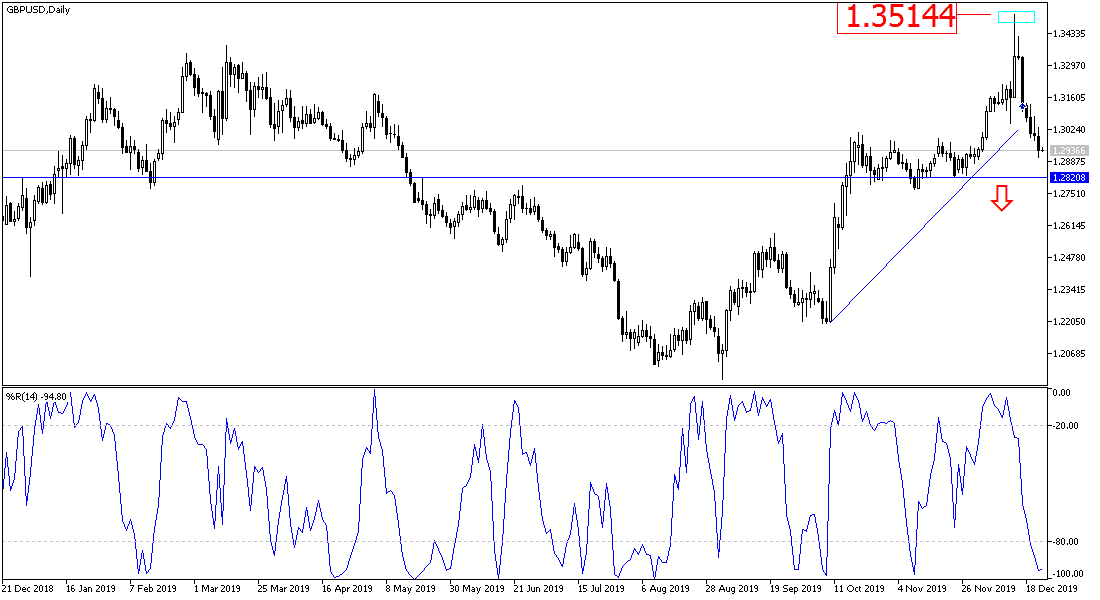

Despite the weak results of the US economic data, the GBP/USD continues its strong losses, which brought it back to the levels of before the general and early elections that took place in Britain, and in which the Conservatives won a landslide victory that allows them full control of Brexit track. The pair fell to the 1.2904 support level the lowest since December 2, before settling around 1.2940 at the time of writing. The recent Conservative victory pushed the pair to the 1.3514 resistance, the highest since May 2018. Gains collapsed amid renewed fears that Brexit could happen without a deal after Boris Johnson threatened to work not to extend the transition period beyond 2020.

And on the global trade front. China recently announced that it will reduce tariffs starting January 1 for more than 850 foreign products, and this announcement came after a temporary trade agreement with Washington in a customs war that rocked financial markets. The move is in addition to a series of tariff cuts over the past two years that Beijing says is aimed at improving consumer goods supplies and encouraging competition. Chinese officials say they should not be seen as concessions to US pressure.

As US manufacturing continued to be affected by the trade war with China, US durable goods orders fell to their lowest level in six months, and major commodity orders fell -2.0%, while expectations were for a 0.2% decline from 0.5% previously. Also, basic US durable goods orders, that exclude transportation, declined by 0.0%, and expectations were for a strong improvement of 1.5% from 0.5% previously.

Sales of new US homes also fell, recording 719,000 homes, and expectations were for 730,000 homes from 710,000 previously. In general, the US housing market remains strong and has not been affected much by the trade dispute with China.

According to the technical analysis of the pair: A strong break of the GBP/USD uptrend was confirmed by moving towards the 1.2900 support level, and the losses will not stop without reassuring the markets and investors by the conservative government that Brexit will not be hindered by anything, and that there will be no conflict with the European Union During the transitional period, which will begin after the official exit on January 31, 2020. Technically, the current best buying levels for the pair are 1.2880 and 1.2790 respectively. As we expected and confirm now, there will not be a strong opportunity for a bullish correction again without moving towards the 1.3300 resistance level. There are no significant economic releases that affect the pair during today's trading.