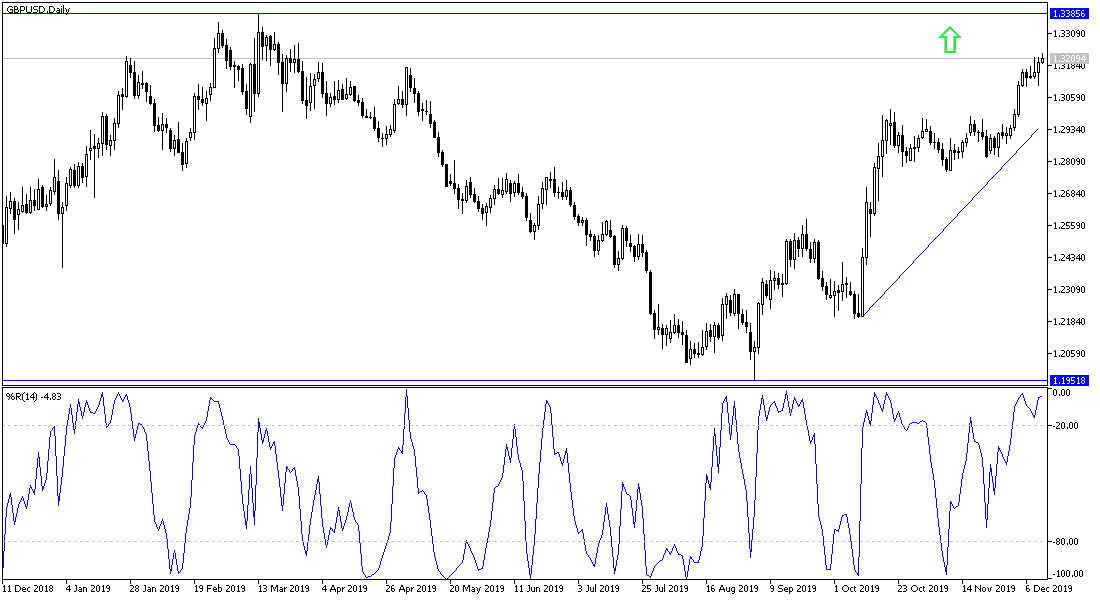

Voting will begin today to decide on who will lead Britain at a very sensitive stage, and determine the fate of the pound as well. Before the vote, the GBP/USD volatility increased, as it retreated to 1.3105 support after testing its highest levels in eight months, and soon returned quickly to the upward correction, until it stabilized around the 1.3228 resistance at the time of writing. Opinion polls indicate that Conservatives led by Prime Minister Boris Johnson are ahead of the main opposition; Jeremy Corbyn's Labor Party, ahead of today's elections. At the same time, all parties are concerned about the rule of the volatile voters who are tired after years of disagreement over Britain's exit from the European Union. Accordingly, we may witness severe tension in the performance of the pair until the announcement of the final results tomorrow morning.

Johnson focused tirelessly on Britain's exit from the European Union throughout the election campaign, reiterating its slogan, "ending Brexit." He said that if he won a majority of 650 seats in the House of Commons today, he would have an easy vote out of the block as scheduled on January 31, 2020. The Labor Party - which mysteriously supports the European Union - faces competition for voters opposed to Brexit from the Scottish and Welsh nationalist parties and the Greens.

Yesterday, the US Federal Reserve kept the US interest rate around 1.75% unchanged as expected. And the latest federal policy statement dropped a previously used phrase that refers to the "uncertainties" surrounding the economic outlook. This change indicates that the Fed is now less concerned about the economic risks from trade wars or the global economic slowdown.

Powell, the governor of the US central bank, has indicated that continuously low inflation allows the Fed to pursue low or “accommodative” interest rate policies to maintain economic growth that has been going on for 11 years and try to create conditions for more jobs. Powell also expressed optimism in the economy and relief that the Federal Reserve's interest rate cuts this year may have helped to prolong growth. He stated, "Both the economy and monetary policy are in a good place."

According to the technical analysis of the pair: The bullish correction still controls the performance of the GBP/USD pair since the beginning of the current month’s trading, and there will be no ceiling for gains if the conservatives ’victory is confirmed today. The 1.3500 psychological resistance will be the natural reaction in the case of the Conservatives majority, and the entire technical indicators will reach saturated buying area, from which the focus will be on the other side, which is the economic performance of the United Kingdom. On the downside, the closest support levels for the pair are 1.3135, 1.3050 and 1.2900, respectively. It is better to stay away from the Pound until the official results are announced.

Regarding the economic calendar data today: The performance of the pound carefully awaits the results of the general elections to be held in Britain today. The US dollar will be affected by the announcement of the producer price index and the claims of the unemployed.