As is the case, the Pound ignored the results of the economic data and focuses more on the future of the general and crucial elections, which will be held in the United Kingdom tomorrow, Thursday, and will determine the fate of Brexit. After announcing the continued recession of the British economy, the GBP/USD pair continued the upward movement by moving towards the 1.3214 resistance, its highest level since last March, before settling around 1.3190 at the time of writing, and before the announcement of monetary policy decisions of the US Federal Reserve and the statements of its Governor Jerome Powell.

Expectations strongly indicate that the bank will keep the 1.75% interest rate unchanged, and the focus will be more on the statement of monetary policy, updating the bank’s economic forecasts about inflation and employment, and then statements from the bank’s governor Powell, half an hour after the announcement of the interest rate.

Powell and other policy makers, stated several times in recent weeks that the US economy and interest rates are in "good shape" and that it will take a "material reassessment" of expectations to change this view. The results of the US economic data have been mixed since the issuance of these comments, which seems unlikely to be a reason to reassess the current monetary policy settings.

Opinion polls still indicate a strong parliamentary majority for incumbent Prime Minister Boris Johnson, and it appears to be the most likely result from Thursday's general election. The final results are announced on Friday morning - and it must be borne in mind that polls were wrong in all three national elections that Conducted in the past five years. If the Conservatives win a majority, it will ensure the speedy exit of the UK from the European Union with ease, with trade agreements guaranteed to survive.

For world trade. Both Trump and Commerce Secretary Wilbur Ross said recently that without a "Phase 1" agreement as a first step to ending the trade war, these tariffs will go ahead, and will be imposed by December 15. That deal is still out of reach as no White House permission to delay implementation has been received. Going forward with increasing tariffs would do another blow to a truly turbulent global economy.

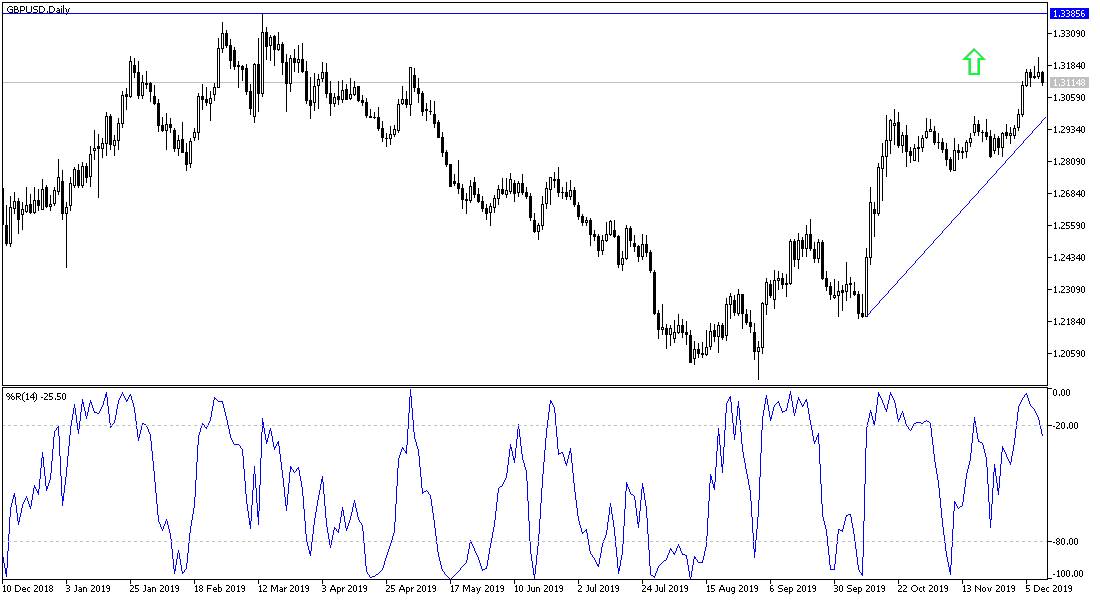

According to the technical analysis of the Pair: As we had expected previously, the stability of the GBP/USD pair above the 1.3000 resistance will remain supportive for the bullish trend and foreshadow a stronger bullish move especially with the continued momentum towards a big victory for the conservatives in the early general elections. The pair ignores the technical indicators' arrival in the overbought areas, with arrival to the highest level in eight months, and the pair will remain ready to achieve stronger gains in the event of election results meeting market expectations, and the purchases may increase to push the pair higher towards the 1.3500 resistance in a short time. On the other hand, the lack of a majority for the Conservatives, and the presence of a suspended parliament, will cause Sterling’s gains to collapse quickly. At the moment, the closest support levels for the pair are at 1.3125, 1.3050 and 1.2965, respectively.

As for the economic calendar data today: All focus will be on the US session data, with the announcement of US inflation figures, according to the consumer price index, and then US oil stocks. There will also be the decisions of the monetary policy of the US central bank, then the statements of its governor Jerome Powell.