Cautious wait-and-see mode characterizes GBP/USD price performance in recent trading sessions, while maintaining the upward momentum and indifference to important economic releases. As all the focus of the pound is on the results of the general elections that will be held in the United Kingdom next Thursday, which determines who will win the leadership of the country at a very sensitive time. The results of that election, which will be announced on Friday, will determine the fate of Brexit, and which has supported the gains of Sterling. Expectations are increasing for the Conservatives to have a higher chance of winning these elections, which means that the process of Brexit will be quick. Any results other than these expectations will negatively affect the Sterling's gains which reached the 1.3180 resistance, the highest level of in seven months, before settling around 1.3150 at the time of writing.

Recently two polls have shown gains for the Conservative Party and losses for the Labor Party, confirming expectations that Prime Minister Boris Johnson's party is still on track to secure the majority. A poll conducted by BMG Independent found that the Conservatives rose by two points to 41% and the Labor Party fell by one point to 32%. In the same context, a poll conducted by Survation for Good Morning Britain, affiliated with Survation, showed that the Conservatives rose by two points to 45%, and the Labor Party declined by two points to 31%.

According to recent opinion polls, the most likely scenario is the victory of the conservatives with a majority. Should this scenario persist and materialize, the GBP/USD might rise to a high of 1.3500 over the next few weeks because the UK will be on course to exit the European Union on a systematic basis on January 31, 2020.

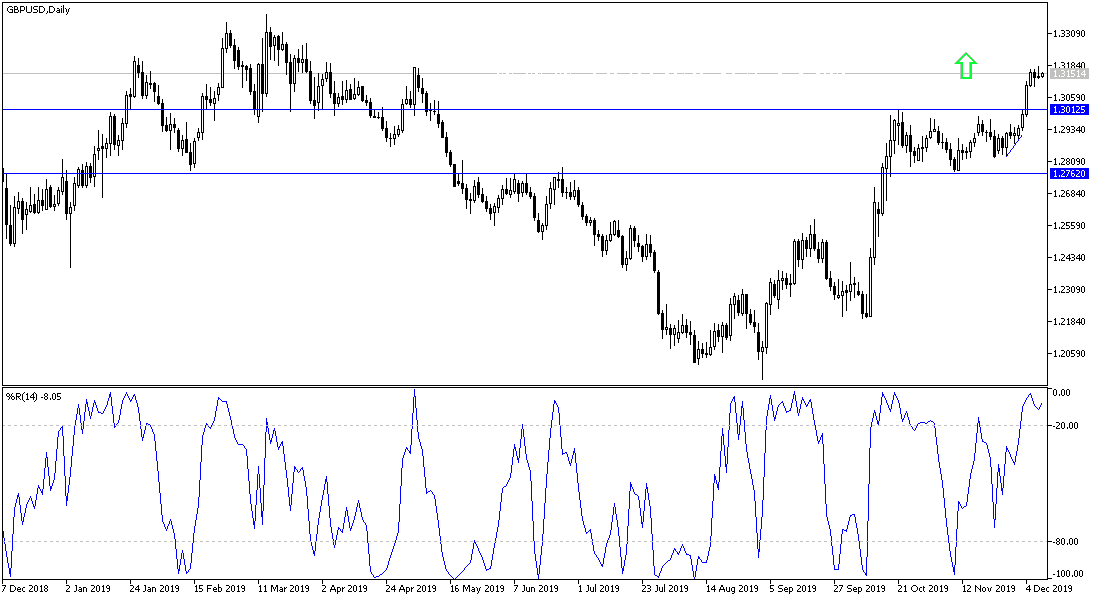

According to the technical analysis of the pair: Technical indicators are giving buy signals for the the GBP/USD pair after its recent gains, but the buying pressure will remain stronger with the increasing expectations of victory for the conservatives in the general elections, and in the event that happens, the closest resistance levels will be at 1.3220, 1.3300 and 1.3385 as a first stage. On the downside, if the winds were against the ships’ desire, and the conservatives did not obtain a majority, or there was a hanging parliament, the sterling would collapse quickly, and at the present time, the closest support levels for the pair are 1.3080, 1.3000 and 1.2920, respectively. I still prefer buying the pair from every downtrend.

As for the economic calendar data today: From Britain, a package of economic data will be announced, most notably the announcement of GDP growth, manufacturing production index, industrial production and the trade balance of goods. From the United States of America non-agricultural productivity and labor unit costs data will be released.