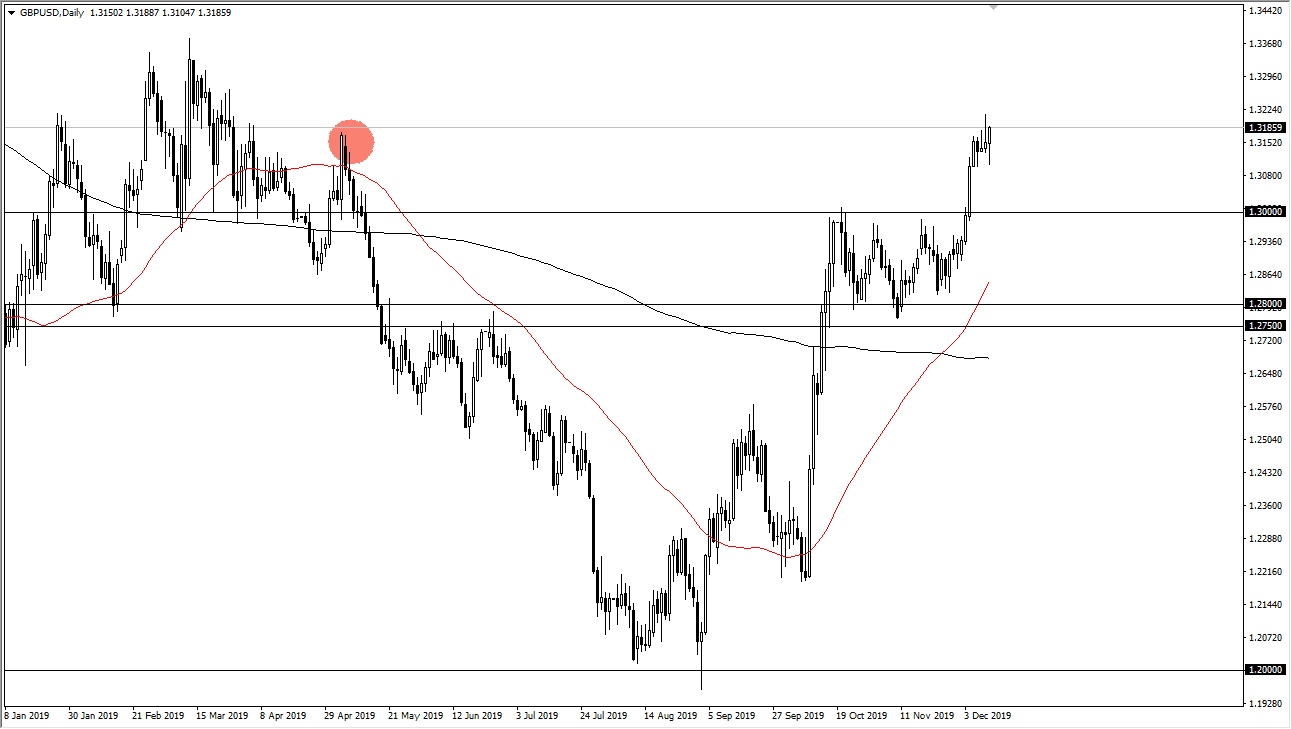

The British pound initially fell during the trading session on Wednesday, reaching down towards the 1.31 level before turning around and showing signs of strength. We crashed into the top of the shooting star from the previous session and it now looks as if we are ready to continue going higher. Perhaps it is a lead into the run-up ahead of the election results, which at this point look very likely to hand the conservatives Parliament control again. That suggests that we are going to have a Brexit finally, and this adds a little bit of certainty to the market.

Underneath, I still see the 1.30 level as a major support area, and if it does in fact hold up it’s very likely that we will see plenty of buyers down there on any type of “sell the news” event reaction. That is a real possibility, as traders will be willing to take profit after this enormous run higher. Having said that, there is still a lot of technical analysis suggesting that the market is more than likely going to go higher and not only reach the 1.33 level which is structurally resistive, perhaps even going as high as 1.38 level as it is based upon the measurement of the bullish flag. Ultimately, this is a market that continues to see a lot of bullish pressure, and with the Federal Reserve stating that they need to see significant inflation increase in order to raise rates, that wait upon the value of the greenback anyway. In that scenario it was a bit of a “perfect storm”, and now it looks as if the British pound is ready to go higher over the longer term. With that in mind, I like buying dips and I do recognize that any scenario in which we sell off for a day or two is probably going to be looked at as a fresh buying opportunity.

However, if Labour does in fact when control of Parliament buying is some fluke, that will be disastrous for the British pound and should send it much lower. At that point I would anticipate a move to the 1.28 level, perhaps even down to the 1.25 level depending on how bad the results are. Having said that, it would be a huge shock to the system and therefore could cause all kinds of havoc but doesn’t look very likely to happen.