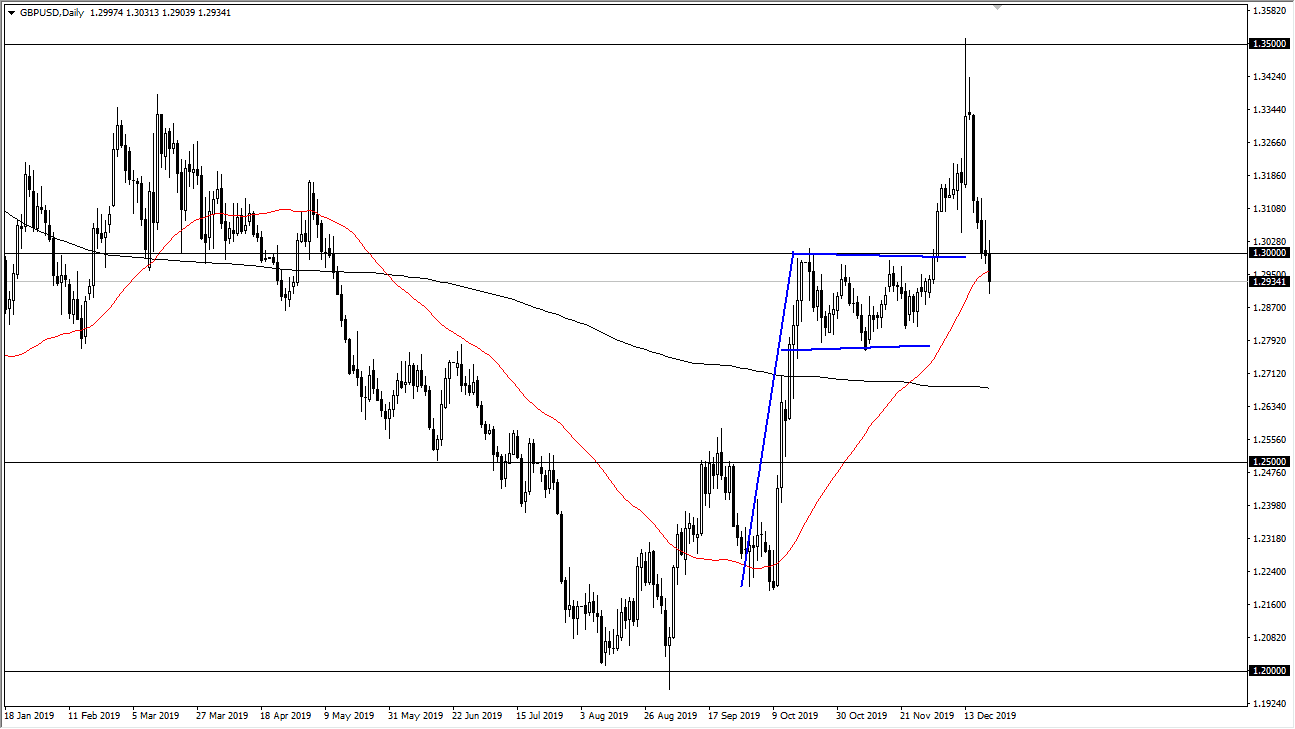

The British pound suffered again during the trading session on Monday after initially trying to rally but found the area above the 1.30 level to be far too expensive. We are now below the 50 day EMA which is a somewhat negative sign but more importantly we are basically in the middle of the bullish flag that had sent this market higher recently. The question now is whether or not there is any accumulation going on right here? It’s a bit difficult to tell, because we don’t have a centralized exchange in the Forex world, but the thought is that there could perhaps be buyers looking to pick up the British pound at this level.

With that being the case, you should look at this as a 200 point range that is offering potential support, extending down to the 1.28 handle. If we were to break down below there, then it’s likely that the market would break down significantly and perhaps down to the 200 day EMA or even the 1.25 handle. I suspect if we break through this flag though, it would be a very negative turn of events for the British pound it would make a rally very unlikely in the short term. That being said I believe that there are a lot of different things going on at the moment.

This pullback doesn’t surprise me as much, because now people of course are worried about a “hard Brexit”, which has been something that has caused a lot of drama for three years. Beyond that, it’s the end of the year and a lot of traders will be taking profit as it will be necessary for tax purposes and of course reporting returns to clients. Profit-taking and thin volume will of course be a major influence on what we are seeing right now so I wouldn’t read too much into the last couple of days. The question now is whether or not we will be able to recapture the 1.30 level and build up momentum from there? If we can, that would be a very bullish sign for the British pound, and we should continue to go much higher. I don’t know that it happens in the short term though, this is probably a story more for January than anything else as that will be when real volume comes back to the marketplace.