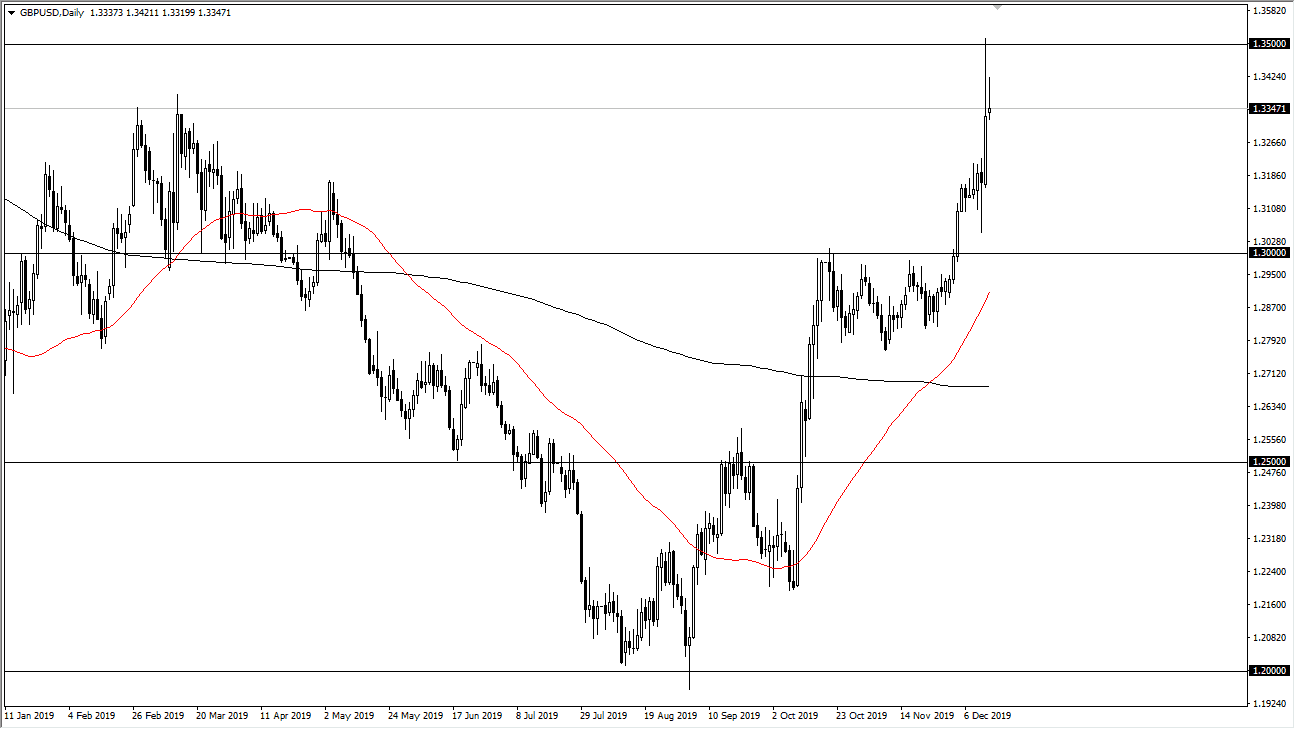

The British pound has rallied rather significantly during the trading session on Monday again, but could not keep the main bulk of the gains, and it looks as if the 1.35 level will continue to be a major barrier for the continuation of the uptrend. Now that we have gotten the elections out of the way, there isn’t much to drive the British pound in the short term. After all, we know that the Brits will be leaving the European Union now, but now we have to pay attention to the idea of trade negotiations between what is a very unified United Kingdom government, and a somewhat more fractured European Union. In other words, this is going to continue to be very messy and sloppy, but it will come from the other side of the English Channel now.

I believe that this point the market will probably pull back in order to find support, looking towards the 1.32 level, and then possibly even as low as the 1.30 level to find buyers. At this point, the market is likely to see a stand taken by the bullish traders, and I think that the top of the former flag, which is at the 1.30 level. Breaking down below there would be rather drastic, so at this point it’s only a matter of time before buyers take over again and start to try to take out the 1.35 handle. That is an area that is massive resistance, and you can see we have in fact pulled back during the bullish pressure to show signs of exhaustion. At this point, I think it’s only a matter of time before the buyers get involved again, especially if the Federal Reserve continues to stay on the sidelines. However, if we get good news out of the Brexit negotiations, then it’s very likely that it’s only a matter of time before the British pound breaks out. Looking at the bullish flag, we have a target of 1.38 based upon the measured move. The market as one you should be looking at through the prism of value, and therefore buying dips as they occur. I have no interest in trying to short the British pound, and in fact the stronger this pair looks, the more likely I am to short the EUR/GBP pair at the same time as the market rallies over here.