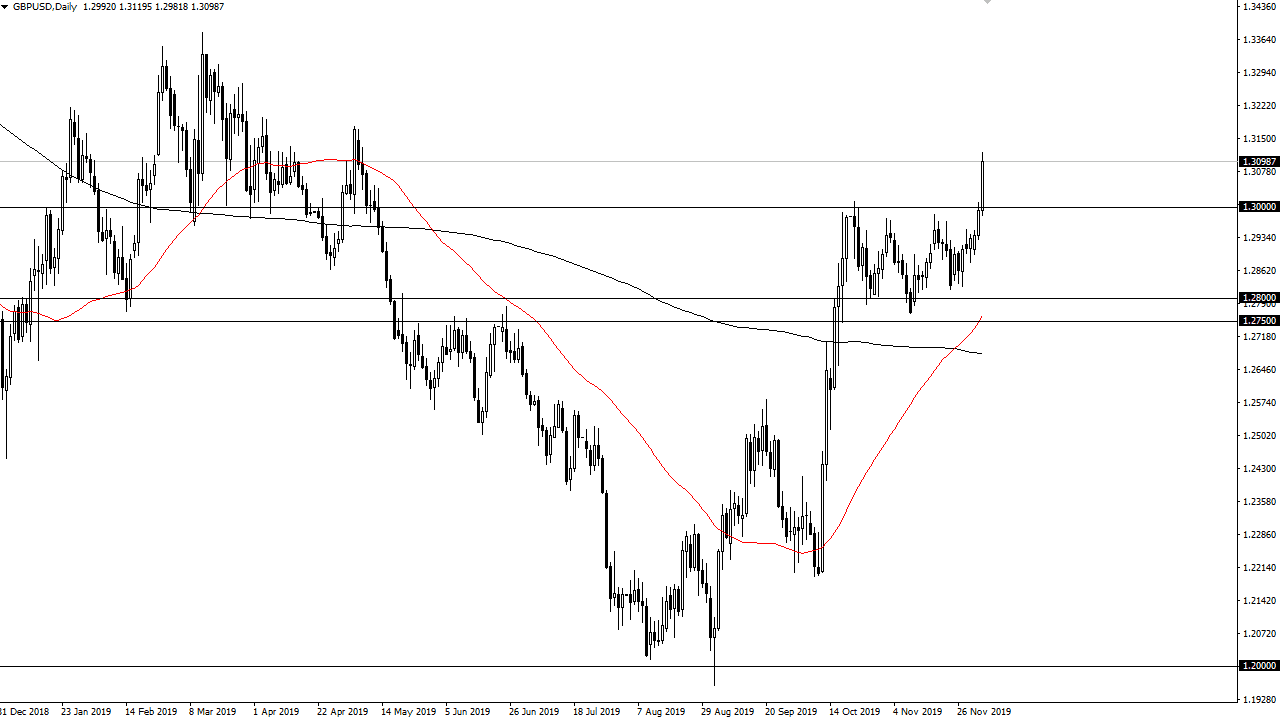

The British pound broke out during the trading session on Wednesday, slicing through the $1.30 level finally. This is an area that has been somewhat stubborn, and at this point it’s very likely that we are ready to see some type of major break out and continue towards the next major structural resistance barrier in the form of the $1.33 level. All things being equal, I believe that pullbacks should continue to offer plenty of support, especially near the $1.30 level which was so drastically resistive. Ultimately, this is a market that continues to see a lot of bullish pressure, mainly due to the fact that the UK elections look likely to offer a conservative Parliament. If that’s going to be the case, the market is likely to get some type of resolution to Brexit finally, which quite frankly that’s the only thing that people care about at this point.

The British pound is historically cheap, so therefore it makes sense that we would continue to go much higher, and with the idea of some type of certainly coming out of the United Kingdom is something new. The technical analysis is very bullish, we have had the “golden cross” recently, and then have just broken out of a major bullish flag. With that being the case, it makes quite a bit of sense that the market should continue to go higher based upon that as well. While the next major structural resistance barrier is the dollar 33 level, based upon the measurement of the bullish flag, the market is likely to go as high as $1.38 over the longer term.

Granted, as we get closer to the election, the pair is likely to get a bit volatile. Overall, this is a pair that every time it pulls back it’s likely to offer some type of buying opportunity over the next several weeks. This is a major breakout, and the fact that we even broke above the $1.31 level as well shows just how strong this could be. I see no situation whatsoever in trying to short this market, so therefore I am only buying on dips more than anything else. The trend has finally changed for the British pound over the last couple of months, and now it looks bullish longer term. This of course could change if Labour shows itself as leading the country, but right now that looks to be less and less likely.