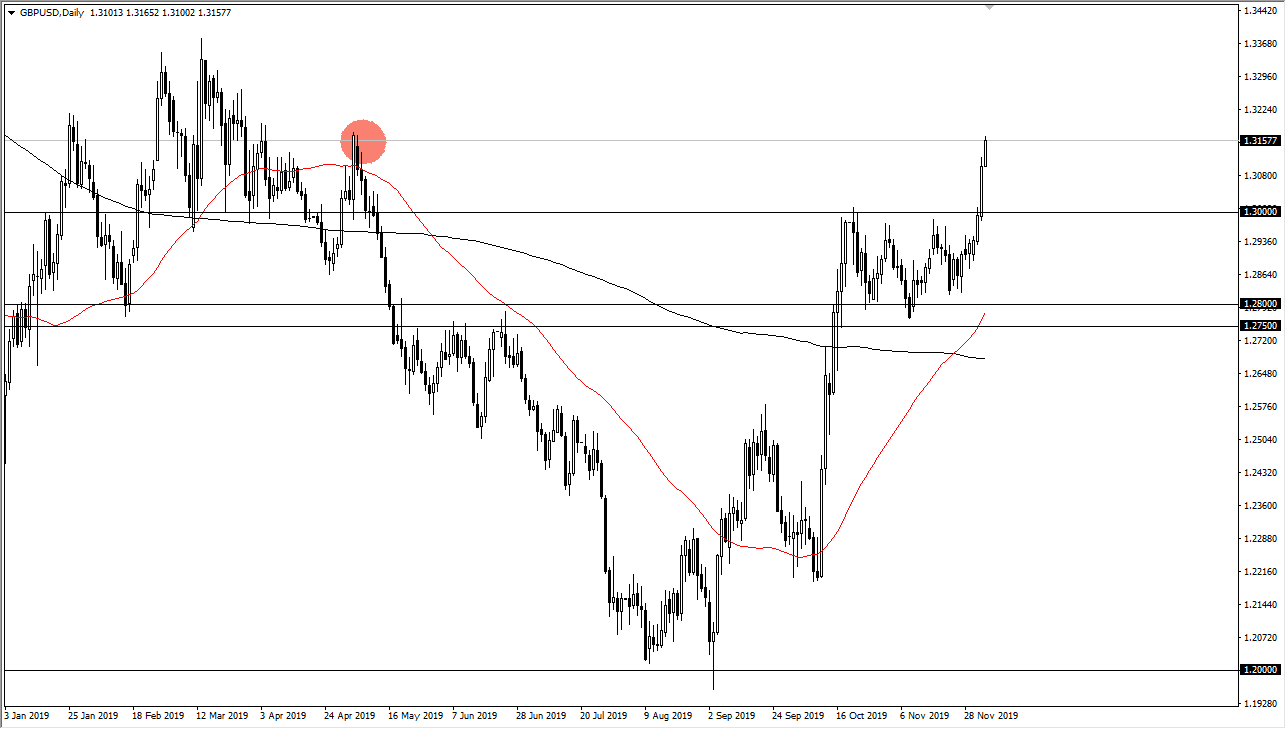

The British pound has initially fallen during the trading session on Friday but has turned around to show signs of strength yet again. The initial selloff probably was due to the jobs number in America being stronger than anticipated, so it suggests that the US dollar would strengthen a bit, but at the end of the day we are paying attention to Brexit more than anything else. It looks as if the conservatives will be in control of Parliament, and that of course is a huge boon to the British pound as it can help the Brexit move along. We need to see some type of certainly more than any type of particular outcome. At this point, the market is likely to do what it has done previously, simply going higher. We had broken above the 1.30 level, breaking above the top of the flag that ended up forming over the last couple of months. The market is likely to continue reaching towards the 1.33 handle above which is structurally resistive, but then after that it’s likely that we could go to the 1.35 level, and eventually the 1.38 level based upon the height of the flag.

All things being equal it’s likely that the 1.30 level will be massive support, but even if we were to break down below there, I think the true “floor” in the market is closer to the 1.28 handle. It’s likely that we will continue to see buyers interested in picking up value every time this market dips. Longer-term, I believe that the British pound is cheaper than it typically is historically, and therefore I think as soon as there is any type of stability in this market, it’s very likely to continue going higher. That being said, if the market gets what it needs, this pair could go as high as the 1.50 level given enough time. This is a market that could really take off to the upside, especially if we finally get signs of leaving the EU finally. Ultimately, the market should continue to offer plenty of buying opportunities on dips, and that’s how I plan on approaching this market as we have seen so much in the way of bullish pressure in momentum. I have no interest in shorting unless there is some type of shock election result.