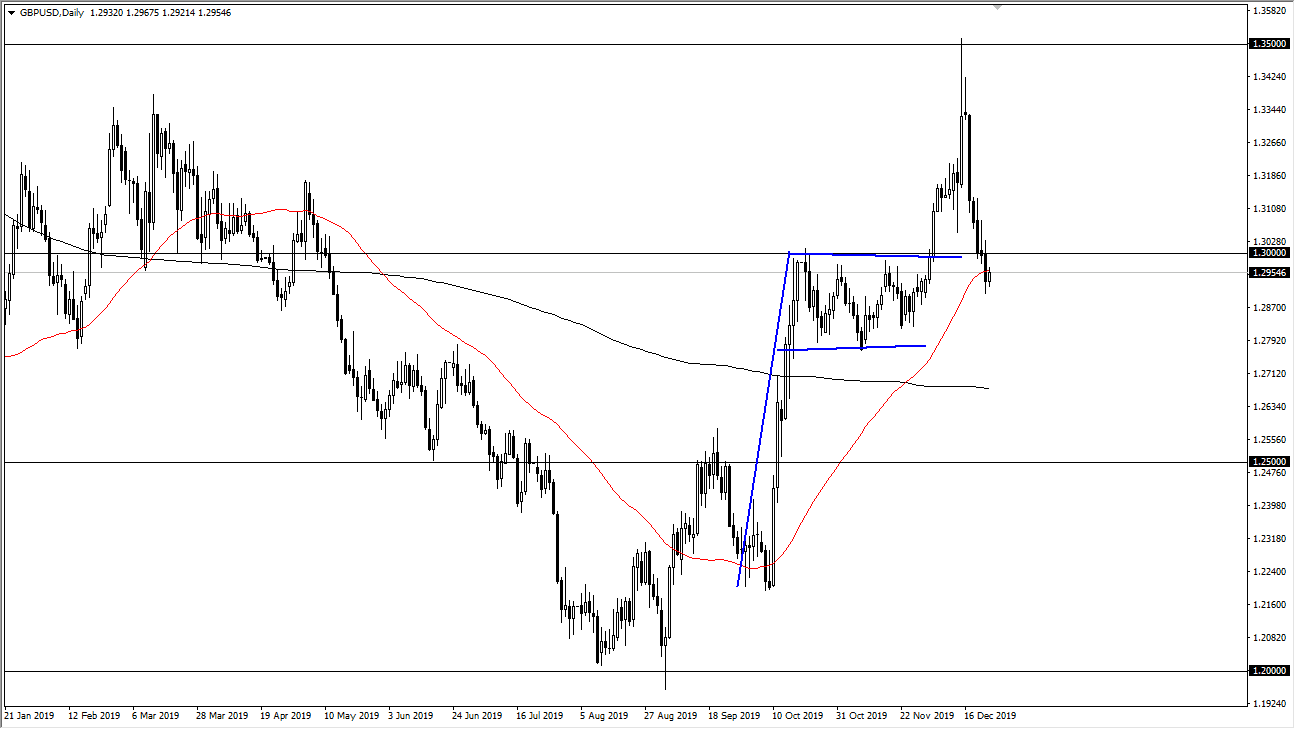

The British pound has bounced just a bit during the trading session on Christmas Eve, as we are testing the middle of a bullish flag. The bullish flag of course is one of the biggest patterns on the chart longer-term that we have seen, and now that we have retraced all of the explosive move higher, one would have to assume that there should be plenty of buyers in this area. A lot of this comes down to simple momentum, as we got well too far ahead of ourselves after the election. At this point, the market is finding the 1.35 level as resistance, and that we broke down significantly from there to slice through the 1.30 level.

At this point in time, we have collapse from that level and I think part of this is fear of a “hard Brexit”, but even beyond that we have the idea of the fact that simple profit-taking at the end of the year probably came into play. With this being the case, I am paying special attention to the 1.30 level again, because I think that if we break above there it shows signs of continued longer-term bullish pressure. After all, we are still very much in the throes of an intermediate uptrend that has quite a bit of strength attached to it.

Don’t be overly surprised that we have pulled back the way we have, because the time of year does have a lot of money managers trying to bring home profits for their clients before the new year. Ultimately, at the end of the day it has been a significant pullback, but not enough to change the overall attitude of the markets. If we break back above the 1.30 level, then it’s very likely that we are going to see buyers try to push towards the 1.3250 level, and then eventually the 1.35 level after that. If we can finally break above there, then the longer term uptrend will continue. Remember, the British pound is historically cheap at this point, so it’s not overly surprising to think that buyers would come in and pick things up. The enormous amount of damage that the Brexit boat and uncertainty has caused is all but over right now, at least from a longer-term standpoint. I remain bullish of the British pound regardless of what we have just seen.