The British pound has been all over the place during the trading session on Thursday, as we await the final election results. Obviously, the market had been pricing in a Tory victory, as the market could expect a Brexit at that point. After all, this point the only thing that anybody cares about when it comes to the British pound is whether or not there is going to be some certainty finally. The Labour Party winning control of Parliament would be disastrous for the British pound because at that point a referendum would be somewhat likely. At this point, the market has priced in quite a bit of the election victory possibilities, so the reaction will probably be somewhat muted to the upside. That isn’t to say that I would be looking to sell, but that quite a bit of this is already priced in.

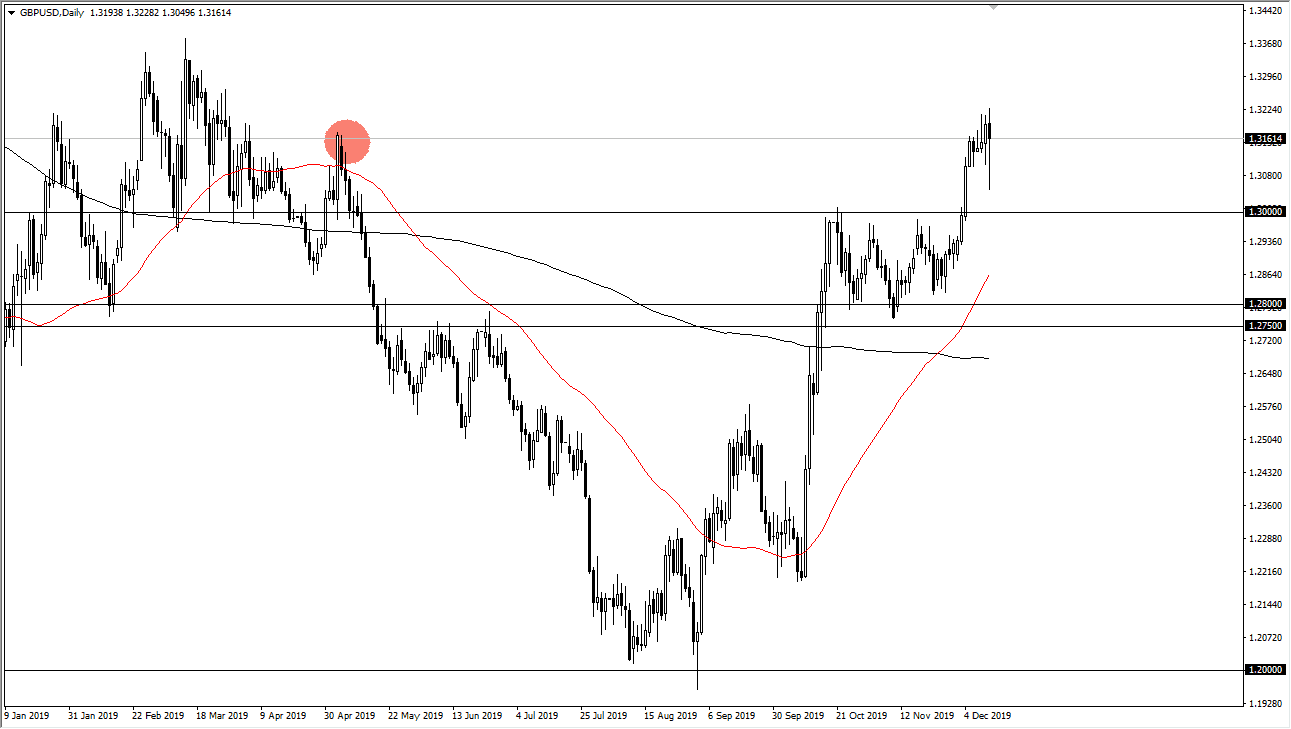

Looking at the chart, the 1.30 level underneath should offer support, and as a result we have even seen the market shy away from there after initially pulling back in the middle of the noise of the day. It shows that the British pound does want to go higher, but the reality is that the 1.33 level will cause quite a bit of resistance. Underneath, there is significant support extending all the way down to the 1.28 handle, and perhaps even further. That being said, we are in an uptrend and that should continue to be the case. The market measures for a move to the 1.38 handle and I do think that it’s only a matter of time before we get there. We had recently seen the so-called “golden cross”, and then broke out again. This has been a decent move, but we still have further to go not only from the structural standpoint but also from historical standpoint.

Underneath, it’s not until we break down below the 200 day EMA that I would be concerned about the overall trend. I do think that the British pound continues to attract a lot of value hunters on dips, as we have already seen in the middle of the trading session. That being said, I would prefer to see more value, i.e. pullbacks” in order to get involved. The market participants continue to see a lot of back and forth based upon the latest headline coming out of the parliamentary elections, but by the time we get to the end of the week, we should have a good idea as to where we are going next.