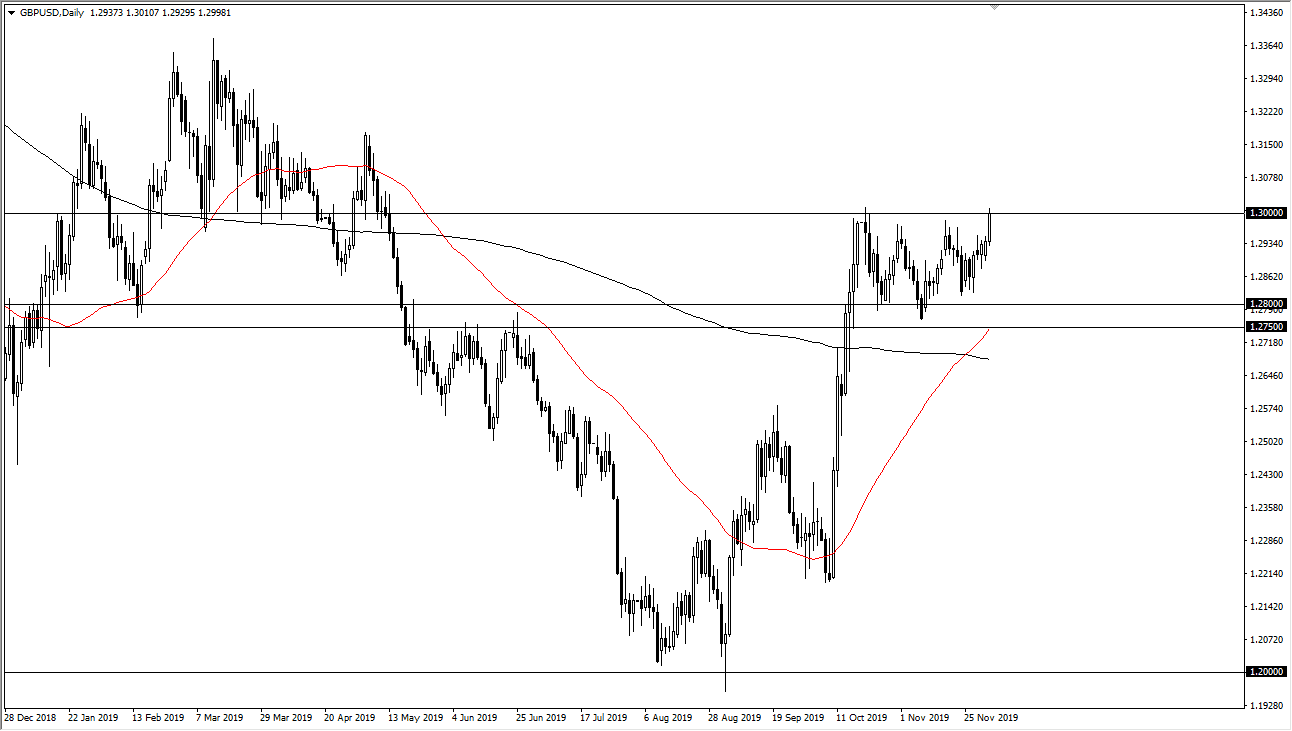

The British pound initially tried to rally above the crucial 1.30 level during the trading session on Tuesday, and although this was a strong move, once we got close to that area we failed again. At this point, it looks very likely to pull back from here, but that doesn’t necessarily mean that I would be comfortable selling. I think that buying some type of pullback makes sense because it is only a matter of time before the British pound does in fact break above this crucial level. Once it does, it’s likely to go looking towards the 1.33 level which is a significant resistance barrier above.

Underneath, the 1.28 level is massive support, and of course the bottom of the bullish flag that I have been talking about for a couple of months now. We also have the “golden cross” underneath, and that of course is a bullish sign as well. At this point, I do think it’s only a matter of time before we break out but quite frankly you are going to need to be very patient waiting for that move, and it could be something that does not happen until the election itself. If the conservatives can take over parliament, then it’s possible that Brexit becomes a reality, and then that brings in a bit of certainty or at least relief in the British pound in general.

If they cannot command some type of majority in parliament, expect chaos because then there will almost certainly be talk about a second referendum again. The second referendum is a dangerous proposition in the United Kingdom, because quite frankly it suggests that democracy doesn’t exist anymore. The trading world has been dealing with a headache known as Brexit for three years now, and quite frankly we are reaching a crucial level. With a little bit of luck, we might get some certainty and then start buying the British pound comfortably for a longer-term move again. Otherwise, this mass is only going to get worse and if for some reason Labour takes over parliament, that will probably send this pair down about 500 pips almost immediately. With this though, it’s very likely that we go higher eventually. If you can hang on to a small position for a longer-term trade, this might be a good play for you going forward. Between now and the election though, I wouldn’t hold my breath for much.