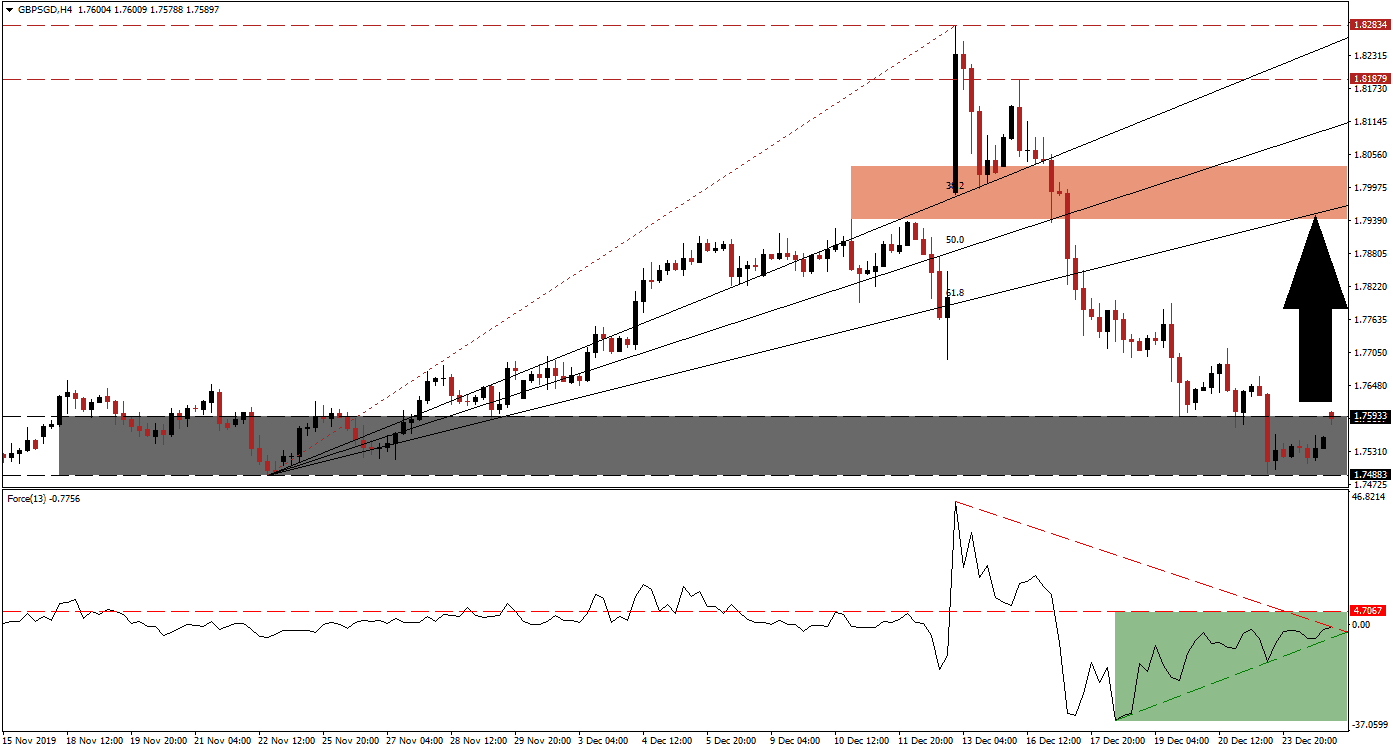

Selling pressure in the GBP/SGD faded after this currency pair descended into its support zone. The British Pound was faced with a severe corrective phase as Brexit uncertainty returned, many traders bought into the election victory of Prime Minister Johnson based on hopes for soft Brexit. Those hopes were countered after the Prime Minister announced an amendment to make an extension of the transition period illegal, reigniting the potential for a no-deal Brexit. Price action is now attempting to sustain a breakout above its support zone. You can learn more about a breakout here.

The Force Index, a next-generation technical indicator, shows its recovery began before this currency pair reached its support zone. This led to the emergence of a positive divergence and delivered an early indicator pointing towards the end of the downtrend. The Force Index advanced, guided higher by its ascending support level. It remains in negative territory with bears in charge of the GBP/SGD, as marked by the green rectangle. A breakout above its descending resistance level is anticipated to lead price action to the upside.

A confirmed breakout in this currency pair above its support zone located between 1.74883 and 1.75933, as marked by the grey rectangle, is likely to initiate a short-covering rally. This should close the gap between the GBP/SGD and its ascending 61.8 Fibonacci Retracement Fan Resistance Level. This morning’s economic data out of Singapore featured an unexpected fall in industrial production, confirming the global economy remains weaker than markets have priced in. You can learn more about the Fibonacci Retracement Fan here.

Economic data out of the UK has been weak, but the labor market started to recovery and is favored to lead the economy higher in 2020. Forex traders are advised to monitor the intra-day high of 1.77136, the peak of a reversed breakout attempt, as a move higher is anticipated to result in the addition of new net long positions in the GBP/SGD. This should clear an advance into its short-term resistance zone located between 1.79404 and 1.80345, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is passing through this zone and may pause the expected advance.

GBP/SGD Technical Trading Set-Up - Short-Covering Rally Scenario

Long Entry @ 1.75950

Take Profit @ 1.79450

Stop Loss @ 1.74800

Upside Potential: 350 pips

Downside Risk: 115 pips

Risk/Reward Ratio: 3.04

In the event of a breakdown in the Force Index below its ascending support level, mire downside in the GBP/SGD is possible. This is expected to remain a short-term development, as the long-term fundamental outlook is increasingly bullish. The next support zone awaits this currency pair between 1.73446 and 1.73803 from where more downside would require a major fracture in existing conditions. Any breakdown attempt will represent a sound buying opportunity, which should not be ignored.

GBP/SGD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.74600

Take Profit @ 1.73450

Stop Loss @ 1.75100

Downside Potential: 115 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 2.30