After UK Prime Minister announced plans to make an extension of the Brexit transition period past December 31st 2020 illegal, the British Pound entered a sharp sell-off. The GBP/NZD corrected almost 1,000 pips during eight trading sessions. This currency pair has now reached its support zone, and bullish momentum is quickly recovering. Economic data out of the UK since the December 12th 2019 election came in weaker than expected, adding to the magnitude of the plunge in price action.

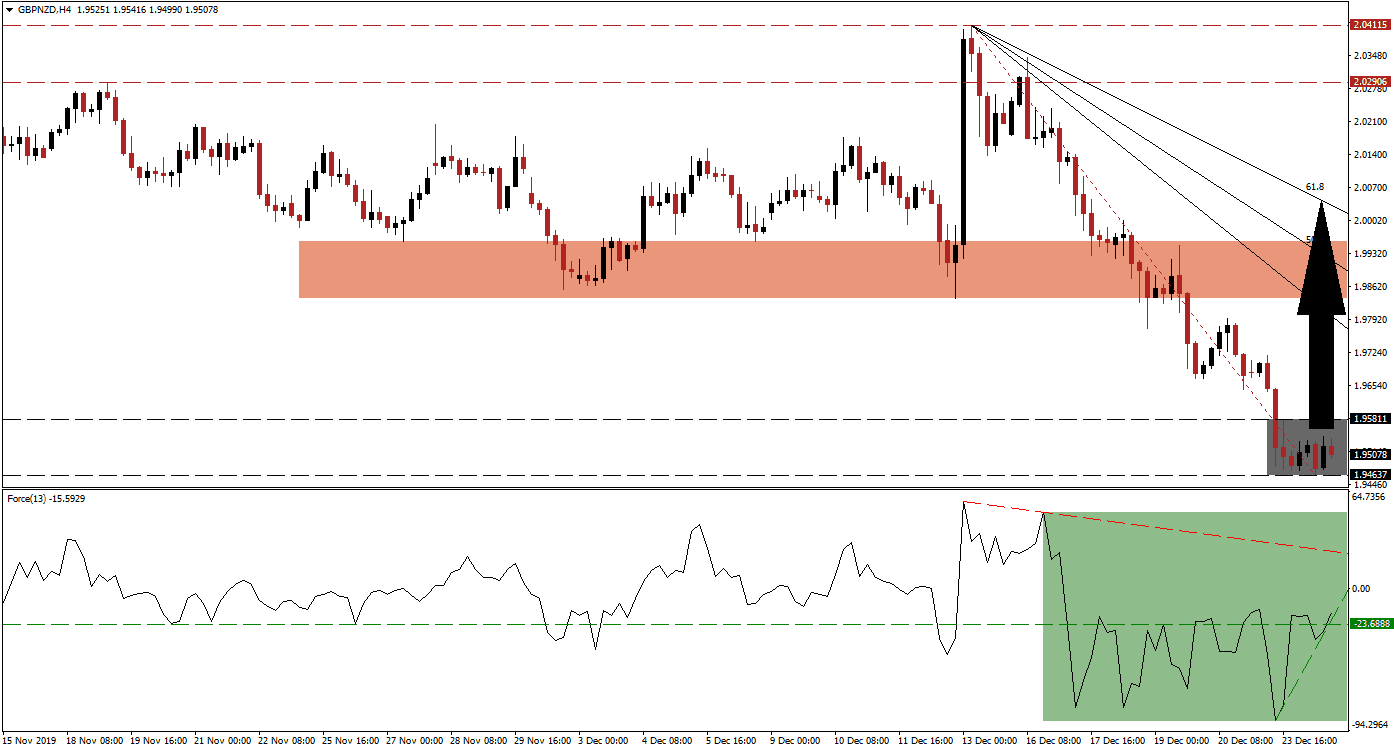

The Force Index, a next-generation technical indicator, spiked to the upside after the GBP/NZD reached its support zone. Before the recovery, it did record a marginally lower low. The sharp advance resulted in the formation of a steep ascending support level, prone to a breakdown. The Force Index was able to convert its horizontal resistance level into support, as marked by the green rectangle. This technical indicator remains in negative conditions with bears in control, but an advance into its descending resistance level is anticipated.

Another bullish development materialized after this currency pair moved above its Fibonacci Retracement Fan trendline inside its support zone. This zone is located between 1.94637 and 1.95811, as marked by the grey rectangle. A breakout is favored to spark a short-covering rally in the GBP/NZD, which is expected to close the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level. You can learn more about a short-covering rally here.

This currency pair will face its first test at its short-term resistance zone located between 1.98374 and 1.99560, as marked by the reds rectangle. The 50.0 Fibonacci Retracement Fan Resistance Level is crossing through this zone. Given the extreme sell-off in the GBP/NZD, a breakout is likely to elevate price action into its 61.8 Fibonacci Retracement Fan Resistance Level, which is approaching the top range near the psychological resistance level of 2.0000. A further breakout remains an option, but a fresh fundamental catalyst will be required

GBP/NZD Technical Trading Set-Up - Short-Covering Rally Scenario

Long Entry @ 1.95100

Take Profit @ 2.00000

Stop Loss @ 1.94000

Upside Potential: 490 pips

Downside Risk: 110 pips

Risk/Reward Ratio: 4.46

In the event of a breakdown in the Force Index below its ascending support level, leading to an acceleration to the downside, the GBP/NZD is likely to attempt a breakdown. The long-term fundamental outlook for this currency pair remains extremely bullish, and any breakdown should be considered an excellent buying opportunity. The next support zone is located between 1.91815 and 1.93075.

GBP/NZD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.93500

Take Profit @ 1.92000

Stop Loss @ 1.94150

Downside Potential: 150 pips

Upside Risk: 65 pips

Risk/Reward Ratio: 2.31