With the UK elections less than 48 hours away, the outcome remains uncertain. Prime Minister Johnson and his Tories are widely expected to win the election, but the majority required to implement Brexit is not guaranteed. The focus has shifted to healthcare, where the opposition Labour party is perceived as a better short-term choice. The British Pound has enjoyed a strong rally as the Tories have consistently polled ahead of opposition parties, but the GBP/JPY may be ripe for a short-term corrective phase. A breakdown below its resistance zone is expected to materialize as election-day arrives.

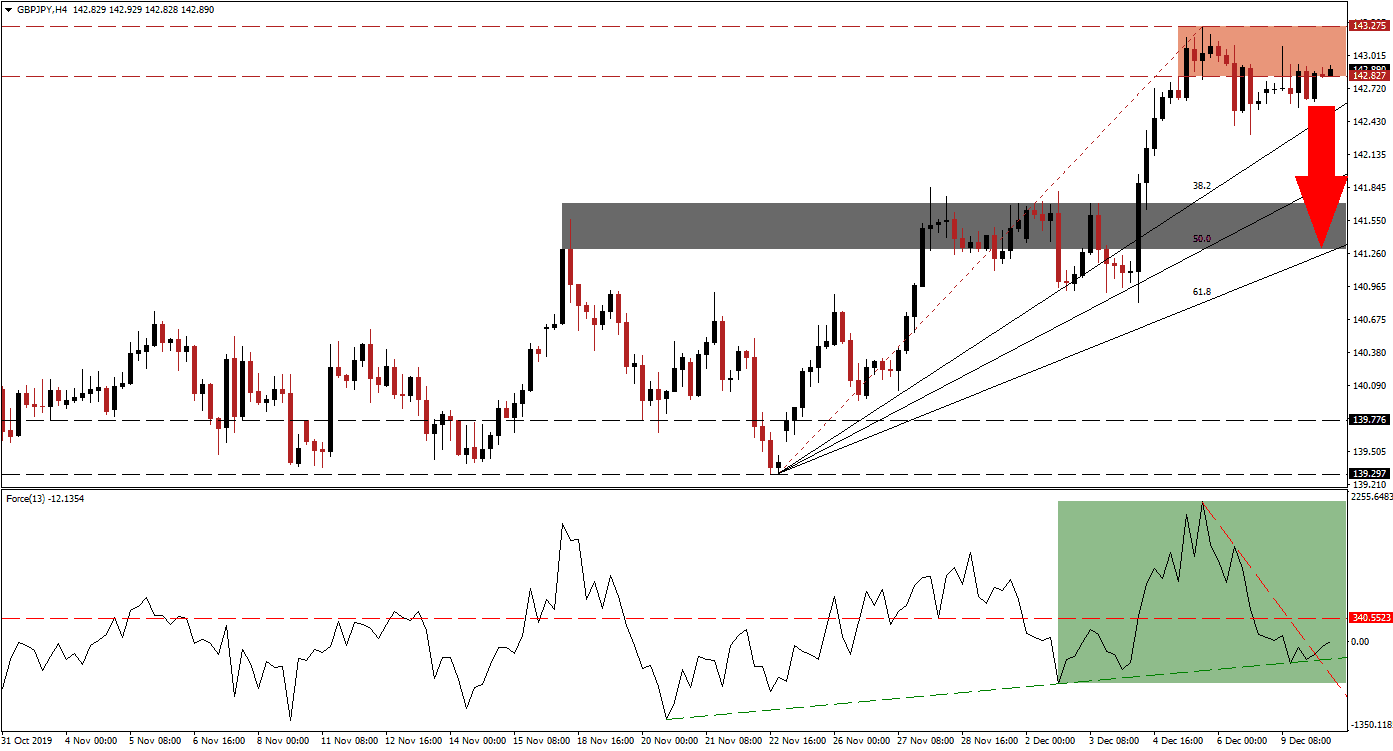

The Force Index, a next-generation technical indicator, plunged as the GBP/JPY approached its resistance zone; this led to a breakdown below its horizontal support level and turned it into resistance. The Force Index stabilized after reaching its ascending support level, as marked by the green rectangle; this resulted in a move above its steep descending resistance level. Bears remain in charge of price action as this technical indicator is located in negative conditions, and more downside is favored. You can learn more about the Force Index here.

This currency pair is expected to move below its resistance zone located between 142.827 and 143.275, as marked by the red rectangle. The GBP/JPY is already trading below its Fibonacci Retracement Fan trendline, a bearish development. Forex traders are recommended to monitor the intra-day low of 142.315, the low of the reversed breakdown in this currency pair. A breakdown below this level will take price action below its ascending 38.2 Fibonacci Retracement Fan Support Level; a profit-taking sell-off is additionally expected to follow.

Any potential correction is expected to conclude once price action reaches its next short-term support zone; this zone is located between 141.295 and 141.707, as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level has just entered this support zone, and a move into it will keep the long-term uptrend intact. A convincing electoral victory by Prime Minister Johnson should invalidate the anticipated corrective phase in the GBP/JPY, and result in a short-term spike in the British Pound; volatility is expected to remain elevated. You can learn more about a support zone here.

GBP/JPY Technical Trading Set-Up - Short-Term Corrective Phase Scenario

Short Entry @ 142.850

Take Profit @ 141.300

Stop Loss @ 143.300

Downside Potential: 155 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 3.44

A breakout in the Force Index above its horizontal resistance level, aided by its ascending support level, is expected to push the GBP/JPY through its resistance zone. The results of this week’s election need to deliver a majority in Parliament for Prime Minister Johnson for a breakout to be sustained. The next resistance zone is located between 144.043 and 144.401, but forex traders are urged to caution with price action over the remainder of this week.

GBP/JPY Technical Trading Set-Up - Breakout Scenario

Long Entry @ 143.500

Take Profit @ 144.400

Stop Loss @ 143.150

Upside Potential: 90 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.57