The British pound has pulled back significantly during the trading session on Monday again, as we continue to see the British pound lose its value overall. That being said though, we are getting close to a major support level that should start to turn things around relatively soon. The biggest problem of course is that we are heading into the Christmas holiday, and therefore volumes will continue to decline. In low-volume markets, it’s quite often difficult to trust currency moves, as we have most traders out there focusing on other things. This move probably has something to do with profit-taking after the enormous surge higher that we had seen over the last couple of months. Money managers like to take profits towards the end of the year for tax purposes and of course reporting purposes when it comes to their clients.

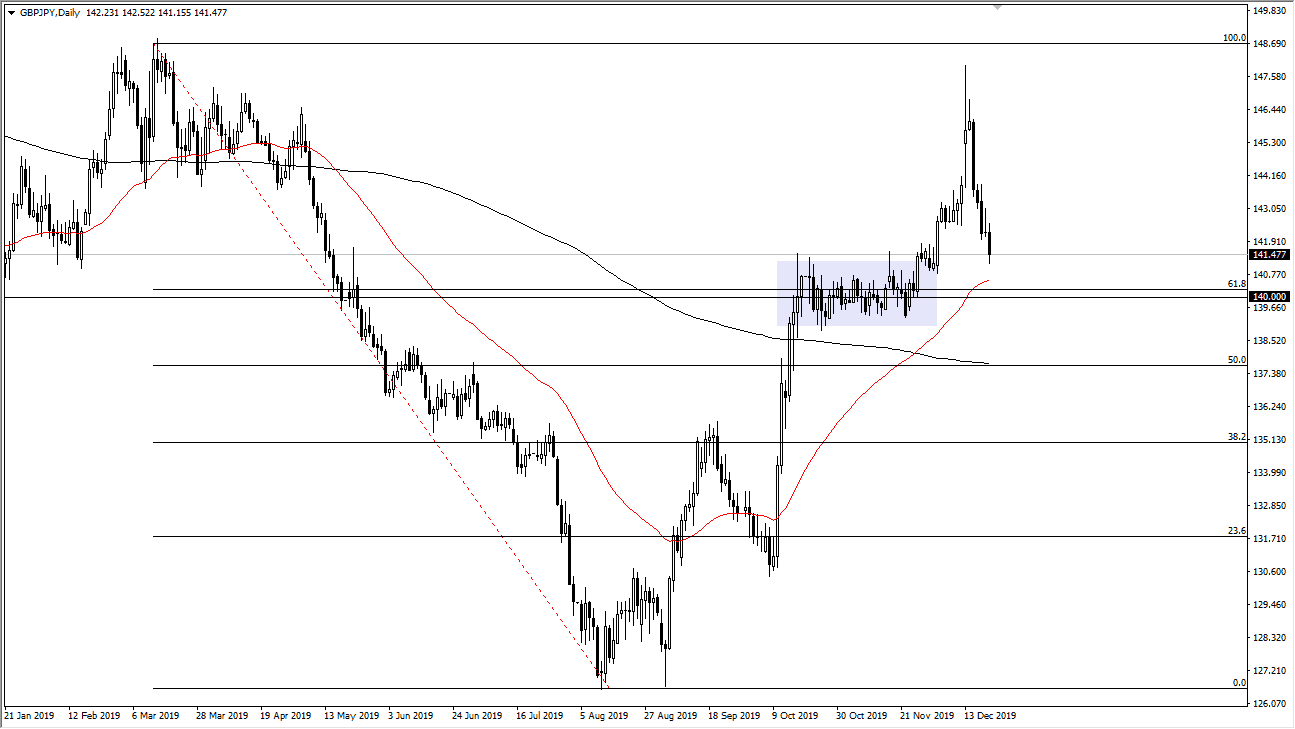

Underneath, I think that the 50 day EMA is going to offer support, just as the ¥140 level will be. You can see that I have a rectangle drawn, which is the flag part of the bullish flag that had sent this market much higher. After the elections though, we have given back all of the gains and more as people are starting to become very concerned about the possibility of a “hard Brexit”, as the British are now united in getting out of the European Union, regardless of what happens next.

Looking at this chart, the 50 day EMA is starting to reach towards the current price, and the market looks very likely to look at the flag and the 50 day EMA as potential support. All things being equal, it’s not until we break down below the ¥139 level that I would become very negative. At that point I think the market probably collapses back down to the ¥135 level, but I believe that’s going to be difficult to happen. I think that we need if you were negative headlines in order to have that kick off. That will be especially true this time of year, as the volume was our various slight. I think that the market will eventually find buyers in this general vicinity, and bounce towards the highs again. However, that’s probably a story for January so I would be very cautious about doing so right away. In fact, I will make these decisions based upon the daily candlestick’s closing more than anything else so I will keep you up-to-date here at Daily Forex.