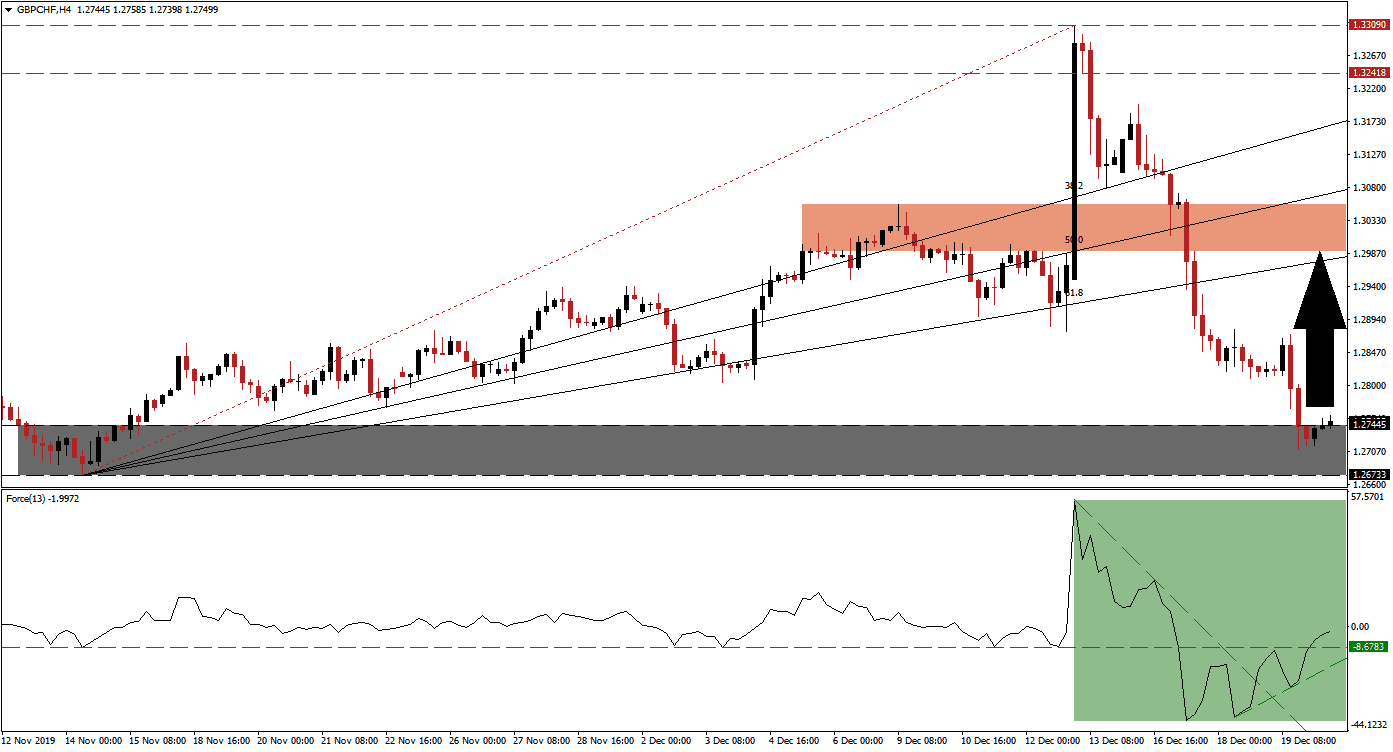

As the UK election results were announced last week, the British Pound extended its surge. Prime Minister Johnson secured an 80-seat majority in Parliament, and many market participants translated this into a softer Brexit. This notion was quickly dismantled, and the British Pound entered a sharp reversal, the GBP/CHF dropped into its support zone. The profit-taking sell-off was necessary to keep the long-term uptrend intact, and bullish momentum is now recovering. You can learn more about a support zone here.

The Force Index, a next-generation technical indicator, mirrored the volatility in price action and recorded a fresh high and low. After the Force Index moved below its horizontal support level, the recovery in bullish momentum took it back above it. This technical indicator additionally eclipsed its descending resistance level, as marked by the green rectangle. The ascending support level is now favored to pressure the Force Index into positive conditions and place bulls in control of the GBP/CHF.

Economic data out of the UK has been weaker than expected and assisted the corrective phase in this currency pair. The support zone located between 1.26733 and 1.27445, as marked by the grey rectangle, ended the sell-off. This currency pair is now pushing higher, and a short-covering rally is anticipated to emerge, adding more upside pressure to the GBP/CHF. Price action is expected to close the gap to its ascending 61.8 Fibonacci Retracement Fan Resistance Level. You can learn more about a short-covering rally here.

Forex traders are advised to monitor the intra-day high of 1.28020, the peak before price action descended into its support zone, a move above this level is likely to result in the addition of new net buy orders in the GBP/CHF. The 61.8 Fibonacci Retracement Fan Resistance Level is approaching the bottom range of its short-term support zone, and may temporarily pause the anticipated advance. The short-term resistance zone is located between 1.29892 and 1.30562, as marked by the red rectangle. A breakout may extend the advance, but a new fundamental catalyst will be required.

GBP/CHF Technical Trading Set-Up - Short-Covering Rally Scenario

Long Entry @ 1.27450

Take Profit @ 1.29900

Stop Loss @ 1.26700

Upside Potential: 245 pips

Downside Risk: 75 pips

Risk/Reward Ratio: 3.27

Should the Force Index reverse below its ascending support level, the GBP/CHF is anticipated to attempt a breakdown below its support zone. The long-term fundamental outlook for this currency pair remains increasingly bullish, and the downside potential of any breakdown is limited to its next support zone. Price action will face it between 1.24626 and 1.25173, and forex traders should consider this an excellent long-term buying opportunity.

GBP/CHF Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.26300

Take Profit @ 1.25150

Stop Loss @ 1.26800

Downside Potential: 115 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 2.30