Brexit is thirty days away, but the UK will remain under EU rules and regulations until the transition period is concluded on December 31st 2020. Prime Minister Johnson will govern with a strong mandate due to an 80-seat majority in Parliament. The UK economy finishes 2019 on a soft spot, but expectations moving forward remain increasingly bullish. Bullish momentum in the GBP/CHF started to recover after price action entered a sideways trend inside its support zone. This recovery is favored to lead to a breakout and short-covering rally.

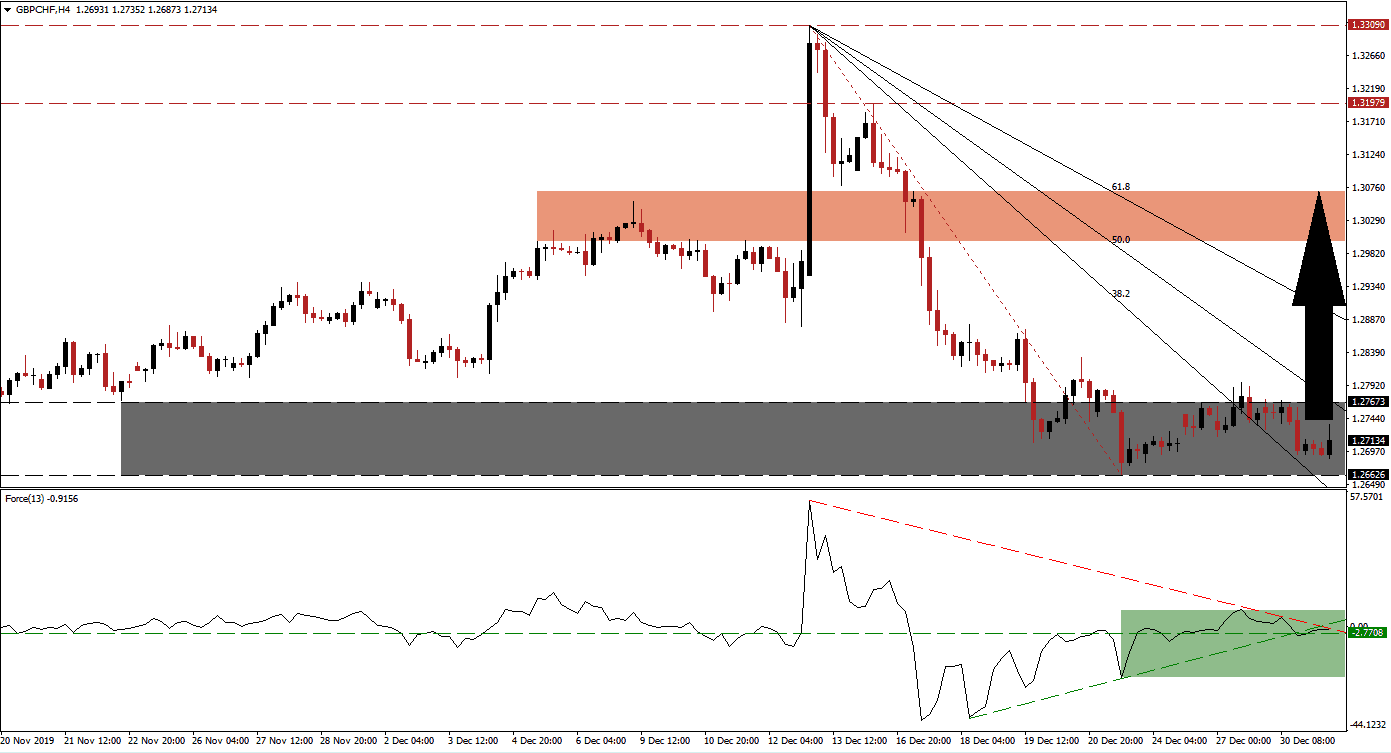

The Force Index, a next-generation technical indicator, confirms the build-up in bullish momentum which started before the GBP/CHF reached its support zone. A positive divergence formed, providing an early indicator that a price action reversal may be imminent. The Force Index converted its horizontal resistance level into support, but its descending resistance level has temporarily halted the advance. This technical indicator moved below its ascending support level, as marked by the green rectangle. A renewed push higher is favored to elevate the Force Index into positive territory, placing bulls in charge, and leading this currency pair higher.

Volatility is anticipated to increase as the Swiss Franc is likely to attract safe-haven demand as portfolio managers prepare accounts for a fresh trading year. A sustained breakdown below its support zone located between 1.26626 and 1.27673, as marked by the grey rectangle, remains unlikely due to the long-term fundamental outlook for this currency pair. Adding to bullish developments is the push by the GBP/CHF above its steep descending 38.2 Fibonacci Retracement Fan Resistance Level, turning it into support. A breakout above its 50.0 Fibonacci Retracement Fan Resistance Level is expected to follow and invalidate bearish pressures on this currency pair.

Price action is anticipated to enter a series of breakouts, which will take this currency pair above its entire Fibonacci Retracement Fan sequence and back into its short-term resistance zone. A breakout above this zone, located between 1.29991 and 1.30714 as marked by the red rectangle, remains a possibility. Trade negotiations between the EU and the UK will have an impact on the GBP/CHF throughout 2020. The next long-term resistance zone awaits this currency pair between 1.31979 and 1.33090. You can learn more about a resistance zone here.

GBP/CHF Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.27150

Take Profit @ 1.30700

Stop Loss @ 1.26300

Upside Potential: 355 pips

Downside Risk: 85 pips

Risk/Reward Ratio: 4.18

In the event of more downside pressure on the Force Index provided by its descending resistance level, the GBP/CHF may attempt a breakdown. While a temporary push lower cannot be ruled out, a sustained sell-off from current levels remains unlikely. Any breakdown attempt will provide forex traders with a good buying opportunity. The next support zone is located between 1.24626 and 1.25390.

GBP/CHF Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.26100

Take Profit @ 1.25100

Stop Loss @ 1.26500

Downside Potential: 100 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.50