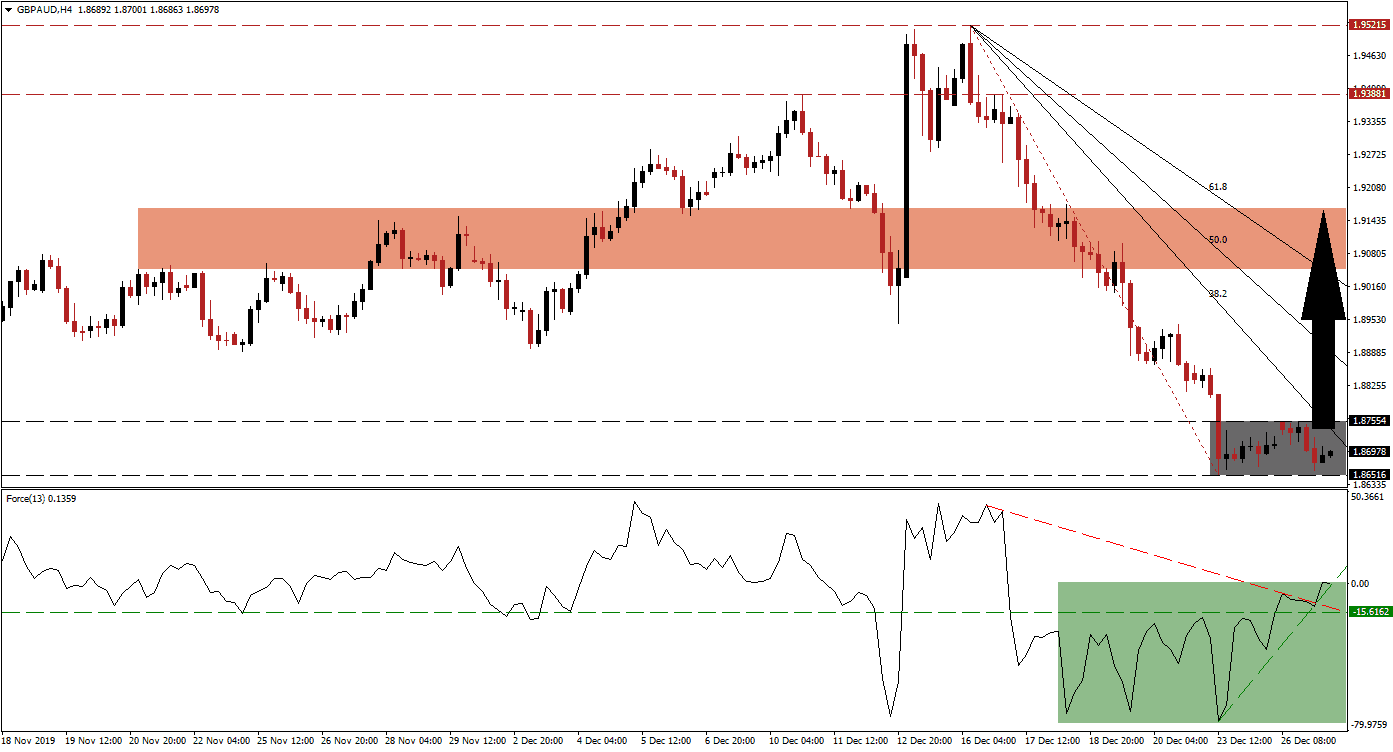

2020 is shaping up to be a turbulent year, and financial markets are not properly priced for it. January is expected to bring back volatility while portfolio managers make adjustments to positions. Brexit is scheduled for January 31st 2020, with the transition period extending until December 31st 2020. A no-deal Brexit remains an option as the EU noted more time is required for a trade deal, but the UK is expected to amend a bill making an extension illegal. This resulted in a severe corrective phase in the GBP/AUD, but bullish momentum is on the rise since this currency pair reached its support zone.

The Force Index, a next-generation technical indicator, descended to fresh lows in unison with price action. A recovery started to emerge with this currency pair entering a sideways trend inside its support zone. The Force Index quickly advanced above its horizontal resistance level, turning it back into support. A steep ascending support level formed, and this technical indicator eclipsed its descending resistance level, as marked by the green rectangle. The Force Index also moved into positive territory, placing bulls in control of the GBP/AUD.

Price action is now favored to attempt a breakout above its support zone located between 1.86516 and 1.87554, as marked by the grey rectangle. The magnitude of the sell-off resulted in a steep descending Fibonacci Retracement Fan sequence, with the 38.2 Fibonacci Retracement Fan Resistance Level inside the support zone. A confirmed double breakout in the GBP/AUD is anticipated to inspire a short-covering rally, off of extreme oversold conditions. The long-term fundamental outlook remains bullish. You can learn more about a short-covering rally here.

This would clear the path to the upside for the GBP/AUD and into its short-term resistance zone located between 1.90502 and 1.91685, as marked by the red rectangle. It would include a move above its 61.8 Fibonacci Retracement Fan Resistance Level, from where a breakout extension remains an option. The next long-term resistance zone awaits the GBP/AUD between 1.93881 and 1.95215, but a fresh fundamental catalyst would be required.

GBP/AUD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 1.87150

Take Profit @ 1.91650

Stop Loss @ 1.86150

Upside Potential: 450 pips

Downside Risk: 100 pips

Risk/Reward Ratio: 4.50

A breakdown in the Force Index below its descending resistance level, which acts as temporary support, may pressure the GBP/AUD into a breakdown attempt. Given the existing long-term fundamental scenario, together with the preceding corrective phase, the downside potential is limited to its next support zone. This zone is located between 1.83207 and 1.84278, which should be viewed as an outstanding buying opportunity.

GBP/AUD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.85900

Take Profit @ 1.84300

Stop Loss @ 1.86700

Downside Potential: 160 pips

Upside Risk: 80 pips

Risk/Reward Ratio: 2.00