After UK Prime Minister Johnson swept to a landslide victory last Thursday, delivering the best election results since 1987, the British Pound extended its massive rally that began after the Brexit referendum. Brexit is now expected to be completed by January 31st 2020, and the long-term fundamental outlook for the UK and its currency remains bullish. A short-term profit-taking sell-off in the GBP/AUD is anticipated to precede an extension of the advance, Chinese economic data came in better than expected and should benefit the Australian Dollar in the short-term.

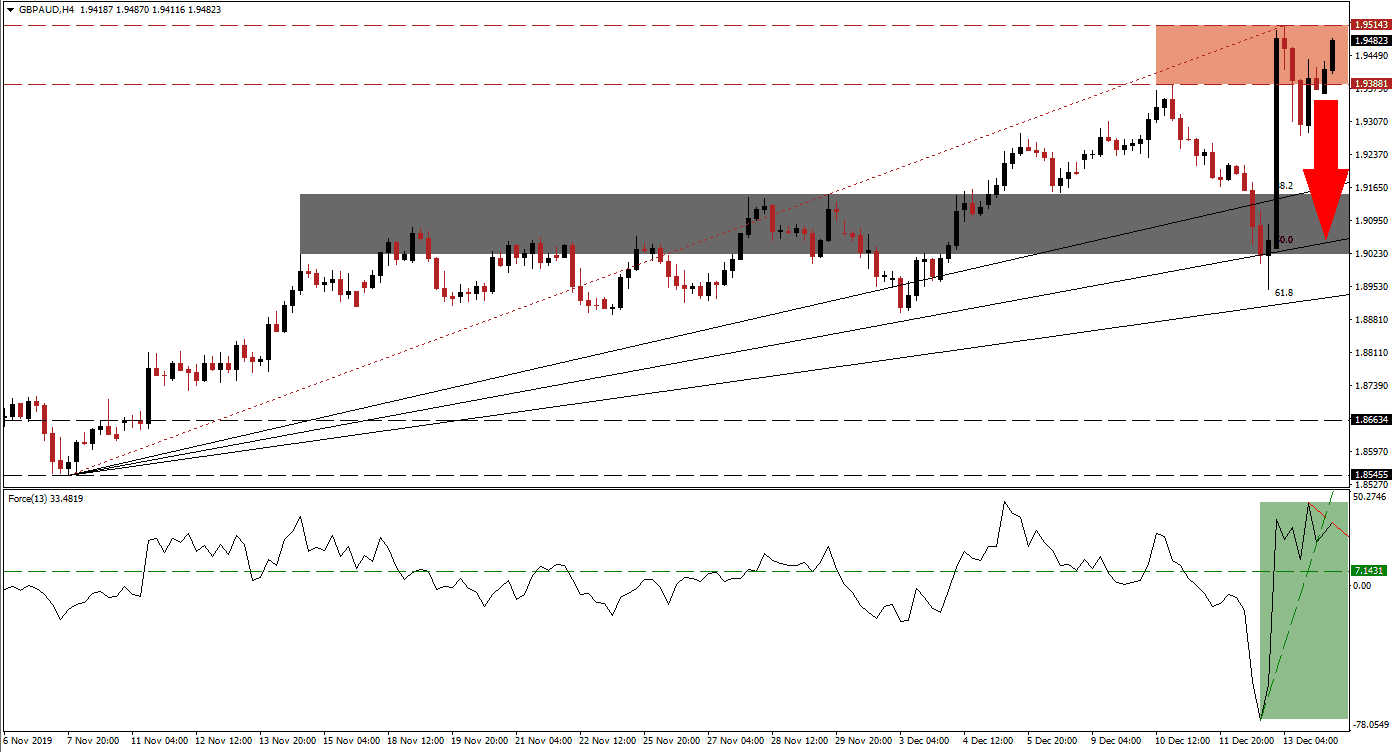

The Force Index, a next-generation technical indicator, confirmed the strong spike in this currency pair following the announcement of last Thursday’s election results out of the UK. It surged through its horizontal resistance level, converting it into support. The Force Index now shows signs of exhaustion and moved below its steep ascending support level, as marked by the green rectangle. A descending resistance level additionally formed, and this technical indicator is favored to re-test its horizontal support level which will keep it in positive conditions and bulls in charge of the GBP/AUD.

Weak Australian economic data reversed the breakdown in this currency pair, but short-term bearish developments are on the rise. Price action moved below its Fibonacci Retracement Fan trendline as bullish momentum is fading. The GBP/AUD may attempt a breakout above its resistance zone located between 1.93881 and 1.95143, as marked by the red rectangle, but it is unlikely to maintain it without a correction strengthening the uptrend. A breakdown will additionally close the gap between this currency pair and its ascending 38.2 Fibonacci Retracement Fan Support Level.

Due to the increasingly bullish long-term outlook for the GBP/AUD, the short-term profit-taking sell-off is expected to end once this currency pair descends into its next short-term support zone. This zone awaits the GBP/AUD between 1.90211 and 1.91514, as marked by the grey rectangle; the 50.0 Fibonacci Retracement Fan Support Level is passing through this zone. A breakdown below this zone remains unlikely unless a fresh fundamental catalyst will emerge. You can learn more about a breakdown here.

GBP/AUD Technical Trading Set-Up - Short-Term Profit-Taking Scenario

- Short Entry @ 1.94800

- Take Profit @ 1.90500

- Stop Loss @ 1.95800

- Downside Potential: 430 pips

- Upside Risk: 100 pips

- Risk/Reward Ratio: 4.30

In the event of a breakout in the Force Index above its descending resistance level, the GBP/AUD may attempt to extend its advance without a corrective phase. This would weaken the long-term structure of this currency pair, and make it vulnerable for a bigger sell-off. Despite the massive election victory, short-term uncertainty about Brexit and the UK economy remain in place. The next resistance zone is located between 1.98850 and 2.00007.

GBP/AUD Technical Trading Set-Up - Breakout Extension Scenario

- Long Entry @ 1.96850

- Take Profit @ 2.00000

- Stop Loss @ 1.95500

- Upside Potential: 315 pips

- Downside Risk: 135 pips

- Risk/Reward Ratio: 2.33