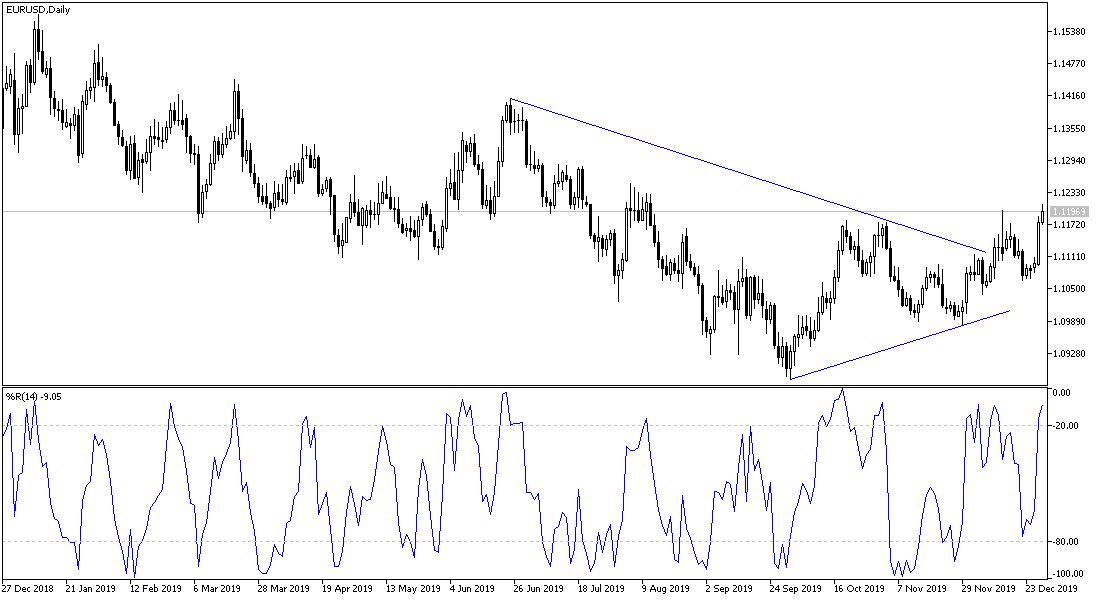

Throughout last week's trading, the price of the EUR/USD pair rose in an upward correction despite the market being on holidays for Christmas, and the lack of liquidity, but the decline in the US dollar gave the pair the impetus to move towards the 1.1188 resistance before closing the week's trading around 1.1176. The pair's success in overcoming the 1.1200 psychological resistance will support the reversal of the general trend to the upside.

In the beginning of this week’s trading, there will be no important economic data affecting the pair, and we will monitor the developments of the expected trade agreement between the United States of America and China. Details of the agreement, if were satisfactory to the markets, may see a continuation of the optimistic situation, and consequently an increase in the pair's gains. If the details of the agreement were not to the aspirations of the markets, the gains of the pair may be stopped. US President Donald Trump remained optimistic, saying that the negotiations were going "very well." Chinese officials have urged the United States to abandon the "cold war mentality". But they also expressed their hope for a major agreement with the United States to stop the tariff war between them, which negatively affects the global economy as a whole and not only their economies.

Investors are returning to focus on the economic performance of the Eurozone, which remains weak due to the prolonged global trade war. France, the continent's second largest economy, recorded a 0.4% increase in industrial output in October, beating forecasts. This positivity joins an increase in German exports and a Sentix investor confidence figure that increased unexpectedly for December. On the US side, US durable goods orders fell to their lowest in six months. The Fed is expected to refrain from cutting interest rates after three consecutive cuts in 2019. However, Fed Chairman Jerome Powell and his colleagues are likely to shake markets with decisions indicating monetary political changes in 2020. The minutes of the bank’s latest meeting, to be announced next Friday, may have a strong response to expectations for the New Year.

According to the technical analysis of the pair: EUR/USD bulls will try to push the price to breach the 1.1200 psychological resistance to confirm their control over the performance. On the downside, the pair's return to the 1.1075 and 1.1000 support levels will end the expectations of the current trend reversal and the trend remains bearish as it is in the long term.

For the economic calendar data: The Spanish Consumer Price Index will be announced. From the US there will be the Chicago PMI and Pending Home Sales data.