The positive results of last Friday's US jobs report negatively affected the path of EUR/USD upward correction, as it returned to stability around 1.1055 support at the time of writing and the reaction pushed it to 1.1039. Resuming the move towards 1.1000 psychological support will support the return of the downside force again. The US Labor Department report said that non-farm payrolls increased by 266,000 in November, after rising by 156,000 in October. Economists had expected an increase of about 180,000 jobs compared to the addition of 128,000 jobs that were originally announced in the previous month.

Job growth was much stronger than expected due partially to a recovery in employment in the industrial sector, which rose by 54,000 in November after falling by 43,000 in October as striking GM workers returned. The Ministry of Labor also indicated significant gains in health care, professional and technical services. With jobs growing stronger than expected, the unemployment rate in the United States fell to 3.5 percent in November from 3.6 percent in October. The unemployment rate was expected to remain the same.

The unexpected drop brought the unemployment rate to its lowest level in nearly 50 years, which it hit in September. The Ministry of Labor said that the average hourly earnings of workers rose $0.07, or 0.2 percent, to $ 28.29 in November. Annual wage growth slowed to 3.1% in November from 3.2% revised in October.

Before the results were announced, German industrial production had been reported with a decline at the fastest pace in six months in October, driven by a sharp drop in capital goods production in October, according to data from the German statistics agency Destatis on Friday. Industrial production decreased by -1.7 percent on a monthly basis in October, which is much larger than a 0.6 percent decrease in September. Production fell at the fastest pace in six months, while economists expected 0.1% growth. In the third quarter, the Eurozone's largest economy had avoided recession. As the economy witnessed 0.1 percent growth driven by spending and investment in construction.

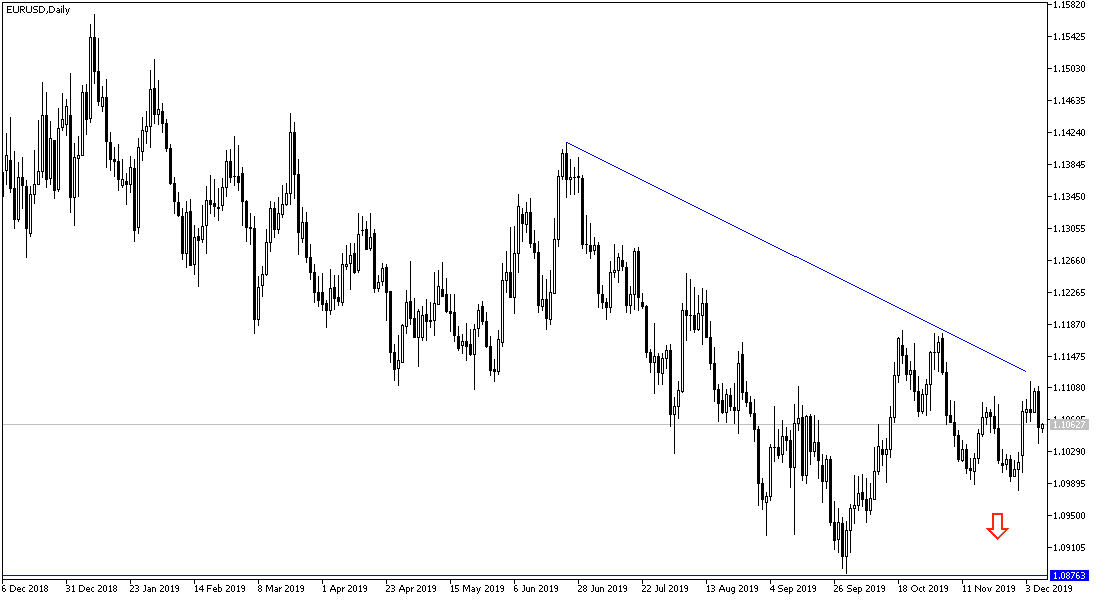

According to the technical analysis of the pair: The return of the EUR/USD price to the 1.1000 psychological support will end the hopes of completing the recent bullish correction that failed to overcome the 1.1120 resistance, which still represents the necessary momentum for the success of the correction. 1.1000 support will increase the selling operations on the pair again and the support levels 1.0985 and 1.0880 will be the following targets. The divergence of monetary policy between the Federal Reserve Bank and the European Central Bank and economic performance between the United States and the Eurozone are still causing strong pressure factors on the pair’s attempts to make gains.

As for today's economic calendar data: From the Eurozone the German Trade Balance and Sentix Investor Sentiment for the Eurozone will be announced. There are no significant US economic data releases today.